Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

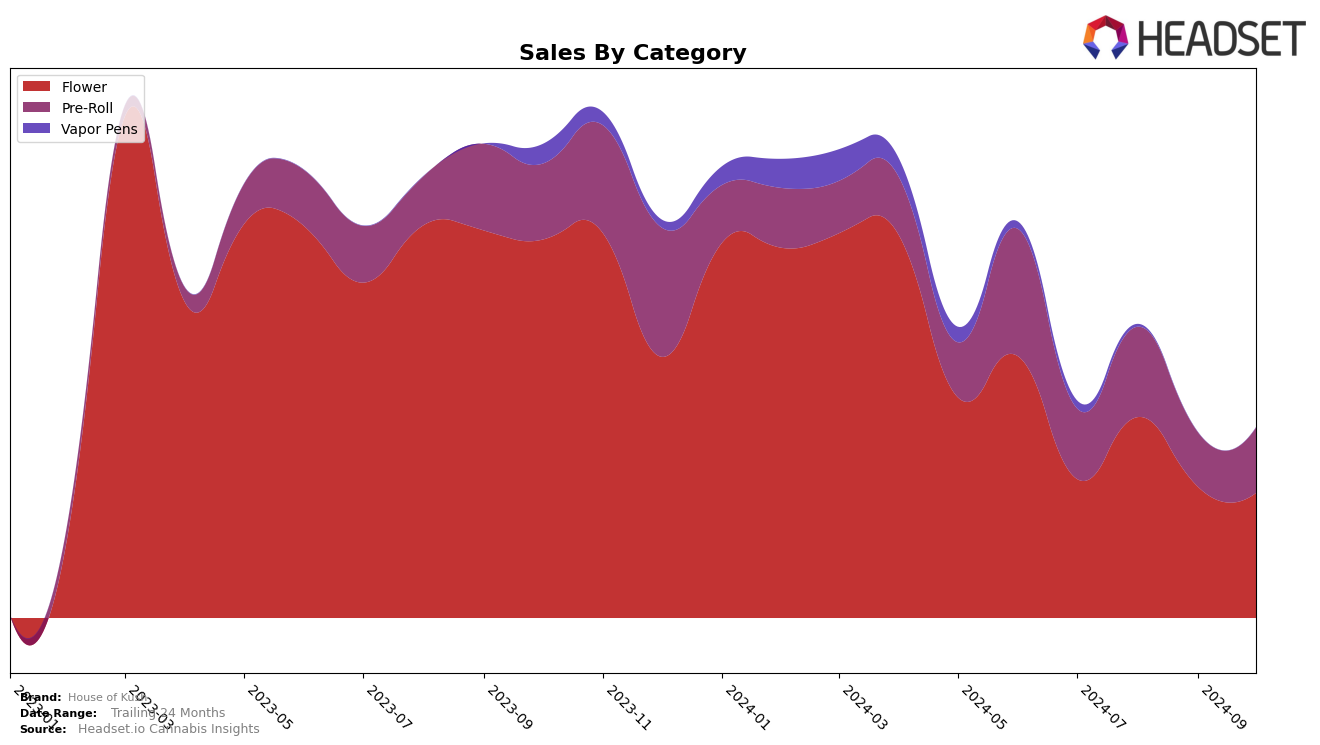

In examining House of Kush's performance in the Maryland market, the brand showed a consistent presence in the Flower category, although it did not break into the top 30 ranks over the observed months. In October 2024, it held the 40th position, a slight improvement from July's 41st, indicating some stability despite fluctuations in sales figures. In contrast, the Pre-Roll category saw more dynamic movement, with the brand achieving a top 30 rank in October, marking a notable improvement from September's 34th position. This suggests a growing consumer interest in their Pre-Roll offerings, perhaps hinting at a strategic focus or successful marketing efforts in this category.

Moving over to Missouri, House of Kush's performance in the Flower category remained outside the top 30 rankings throughout the period, with the highest position being 50th in both July and August. This consistency in ranking, despite varying sales volumes, may point to a challenging competitive landscape or a need for differentiation in this particular state. The sales numbers, while not detailed here, suggest potential room for growth if the brand can leverage its strengths or adapt its strategy to better meet local consumer preferences. The data highlights the importance of regional strategies in the cannabis industry, as market dynamics can vary significantly from one state to another.

Competitive Landscape

In the competitive landscape of the Flower category in Maryland, House of Kush has shown a dynamic performance over the past few months. Starting from a rank of 41 in July 2024, House of Kush improved to 36 in August, but then experienced fluctuations, dropping back to 41 in September and slightly recovering to 40 in October. This indicates a volatile position in the market, with sales peaking in August but declining thereafter. In comparison, Verano consistently maintained a stronger presence, ranking between 35 and 38, and showcasing relatively stable sales figures. Meanwhile, In House also demonstrated competitive strength, although it was absent from the top 20 in August, it ranked closely with House of Kush in other months. Grass, while consistently ranking lower, showed a notable sales increase in September, indicating potential growth. These insights suggest that while House of Kush has potential, it faces stiff competition and must strategize to stabilize and improve its market position.

Notable Products

In October 2024, Red Velvet Kush (3.5g) from House of Kush emerged as the top-performing product, climbing back to the first rank after being second in September, with notable sales of 1,300 units. The GMO BK Pre-Roll 2-Pack (1g) made a strong debut, securing the second rank in its first recorded month. Katsu Bubba Pre-Roll 2-Pack (1g) maintained a steady position at third place, consistent with its ranking in September. Red Velvet Kush Pre-Roll 2-Pack (1g) held the fourth rank, slightly down from its debut. Bubba/Chemdawg Pre-Roll 2-Pack (1g) saw a drop to the fifth position, after leading the category in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.