Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

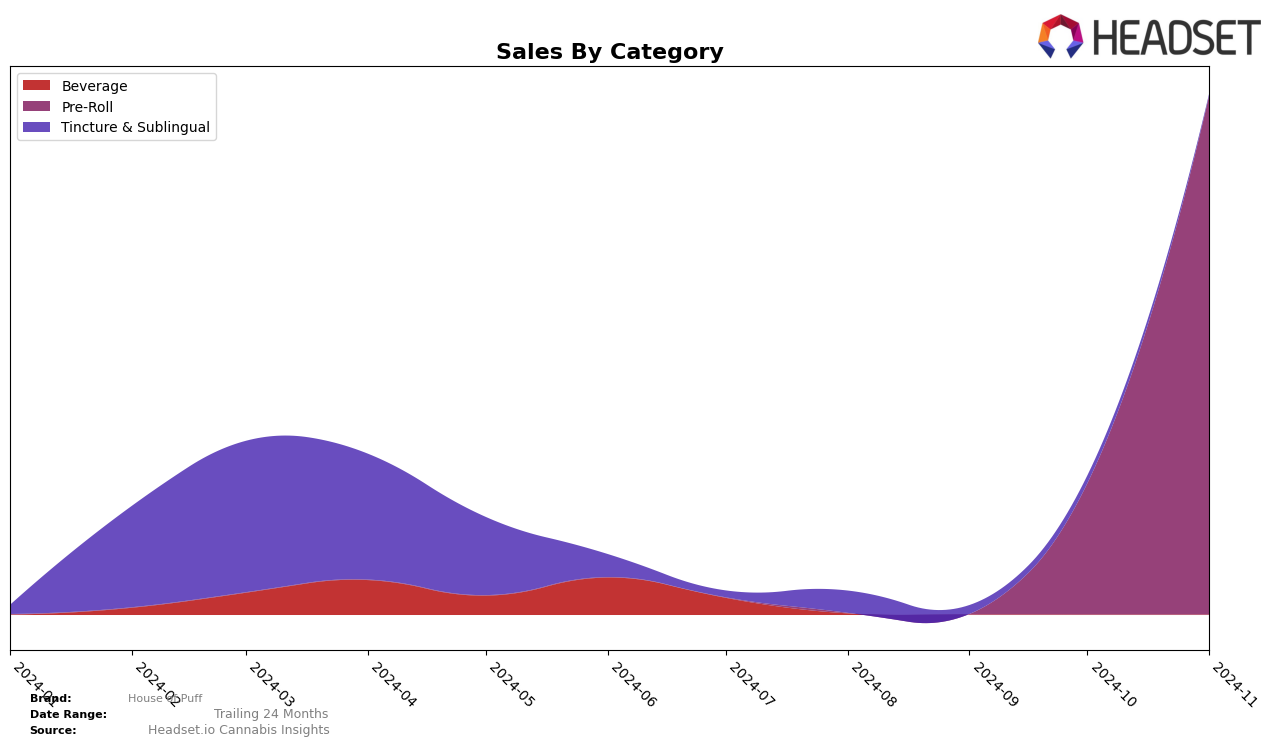

House of Puff's performance in the Pre-Roll category in New York has been notably absent from the top 30 rankings over the past few months. This absence indicates a potential area for improvement or increased competition within the state. Despite not making it into the top 30, the brand's sales in November 2024 were $26,977, suggesting that while they are not leading the pack in terms of rankings, there is still a consistent demand for their products. This could be an opportunity for House of Puff to strategize on how to break into the top tier by either expanding their product offerings or enhancing their marketing efforts within this category.

Across other states and categories, House of Puff's presence is less documented, as the data does not reflect any rankings or sales figures outside of New York's Pre-Roll category. This lack of visibility in other markets might imply that the brand is either in its early stages of expansion or is focusing its efforts primarily within New York. The absence from the top 30 rankings in other states could be seen as a challenge but also an opportunity for growth if the brand decides to diversify its reach. Observing movements in similar brands and categories could provide insights for House of Puff to capitalize on untapped markets and improve their standings in the future.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in New York, House of Puff has shown a notable entry into the rankings by November 2024, securing the 74th position. This is significant given that earlier months did not see House of Puff in the top 20, indicating a strategic push or market response that has improved its visibility. In contrast, High Peaks experienced a decline in rank from 58th in September to 70th by November, with sales reflecting a downward trend. Meanwhile, Honest Pharm Co saw fluctuating ranks, peaking at 62nd in October before dropping to 71st in November, suggesting volatility in their market performance. Eaton Botanicals re-entered the rankings at 85th in November after missing out in October, while Cannabals appeared in the rankings for the first time in November at 77th. These shifts highlight a dynamic market where House of Puff's recent entry could capitalize on the instability of its competitors to gain further ground.

Notable Products

In November 2024, the top-performing product for House of Puff was the Social Puff Pre-Roll 2-Pack (1g), which claimed the number one spot with a sales figure of 638 units. The Personality Puff Pre-Roll 2-Pack (1g) shifted from first place in October to second place in November, indicating a competitive sales environment. Serenity Puff Pre-Roll 2-Pack (1g) maintained its third-place ranking from the previous month, showing consistent demand. Meanwhile, the Serenity Puff Pre-Roll 5-Pack (2.5g) improved its position, moving up from fifth to fourth place. The Social Puff Pre-Roll 5-Pack (2.5g) entered the rankings in fifth place, suggesting a growing interest in larger pack sizes.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.