Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

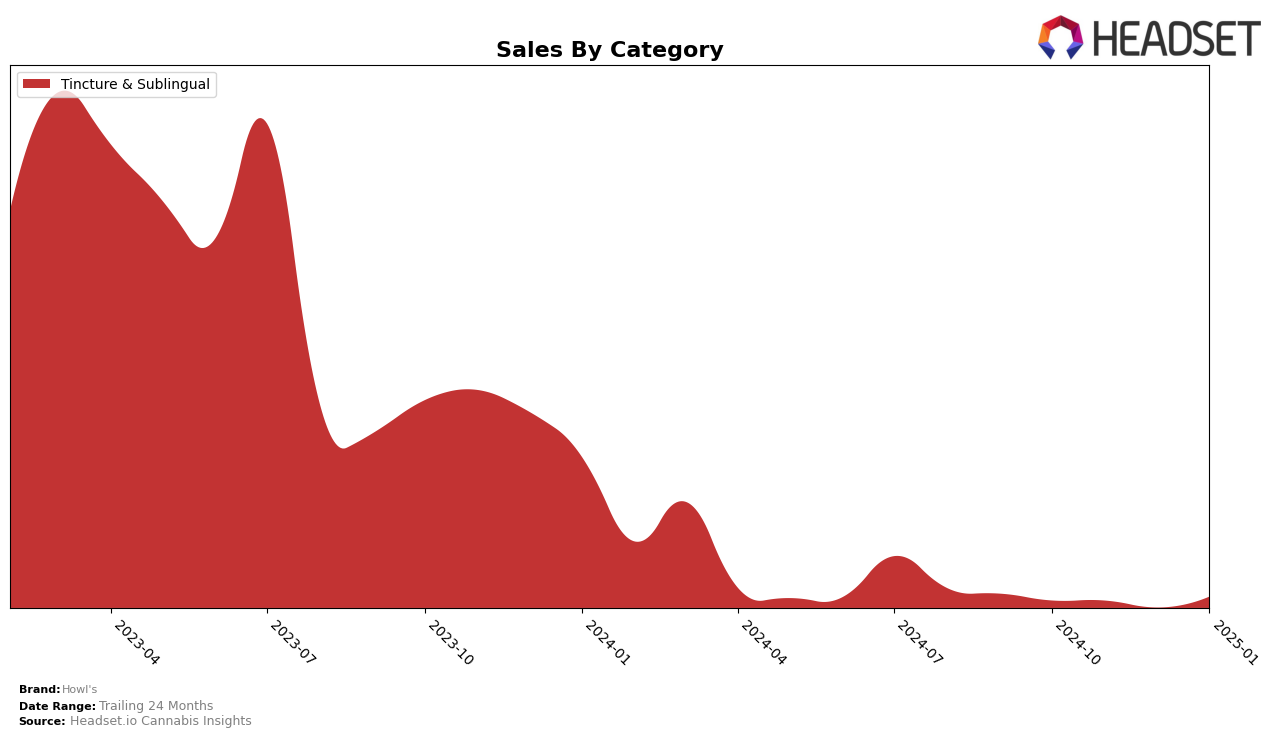

Howl's has demonstrated a consistent performance in the Massachusetts market within the Tincture & Sublingual category. Over the months from October 2024 to January 2025, Howl's maintained a steady rank, moving from 5th to 4th position, and holding that rank consistently through December and January. This stability in ranking suggests a strong brand presence and consumer loyalty in this category. Despite a slight dip in sales from November to December, Howl's rebounded in January, indicating a positive growth trajectory as the new year commenced.

While Howl's has shown resilience in Massachusetts, it is noteworthy that the brand does not appear in the top 30 rankings for other states or provinces in the Tincture & Sublingual category. This absence could be seen as a potential area for growth or a strategic decision to focus on specific markets. The consistent ranking within Massachusetts could provide a model for expansion into other regions, suggesting that Howl's might leverage its strengths and successful strategies in this state to explore new opportunities elsewhere. However, without further data from other states, the brand's overall market penetration remains an area to watch for future developments.

Competitive Landscape

In the Massachusetts Tincture & Sublingual category, Howl's has shown a consistent performance, maintaining the 4th rank from November 2024 through January 2025, after an initial rise from 5th place in October 2024. This stability in ranking suggests a solid market presence, although Howl's sales figures have seen some fluctuations, with a notable dip in December 2024 before rebounding in January 2025. In contrast, Levia has held a steady 3rd position throughout the same period, with a significant sales lead over Howl's, indicating strong consumer preference or brand loyalty. Meanwhile, Treeworks dominates the category, consistently ranking 2nd with sales figures that far surpass those of Howl's, highlighting a competitive challenge for Howl's to increase its market share. Additionally, Happy Valley experienced a decline from 4th to 5th place, providing Howl's an opportunity to solidify its position above this competitor. The absence of Doctor Solomon's from the rankings in November 2024 suggests a temporary market exit or significant sales drop, which could have contributed to Howl's improved rank during that month.

Notable Products

In January 2025, Howl's top-performing product was Daytime Max Tincture (500mg), maintaining its consistent rank of first place since October 2024, with a notable sales increase to 209 units. Nighttime Tincture (500mg) climbed to the second position, showing an improvement from the previous months where it ranked third. Anytime Tincture (500mg THC, 1/3oz) slipped to third place after holding the second spot in November and December 2024. The CBD/THC 1:1 Tincture (250mg CBD, 250mg THC, 1/3oz) remained stable at fourth place across all four months. Additionally, the CBD/THC 10:1 High CBD Tincture (500mg CBD, 50mg THC, 1/3oz) reappeared in the rankings at fifth place after being absent in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.