May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

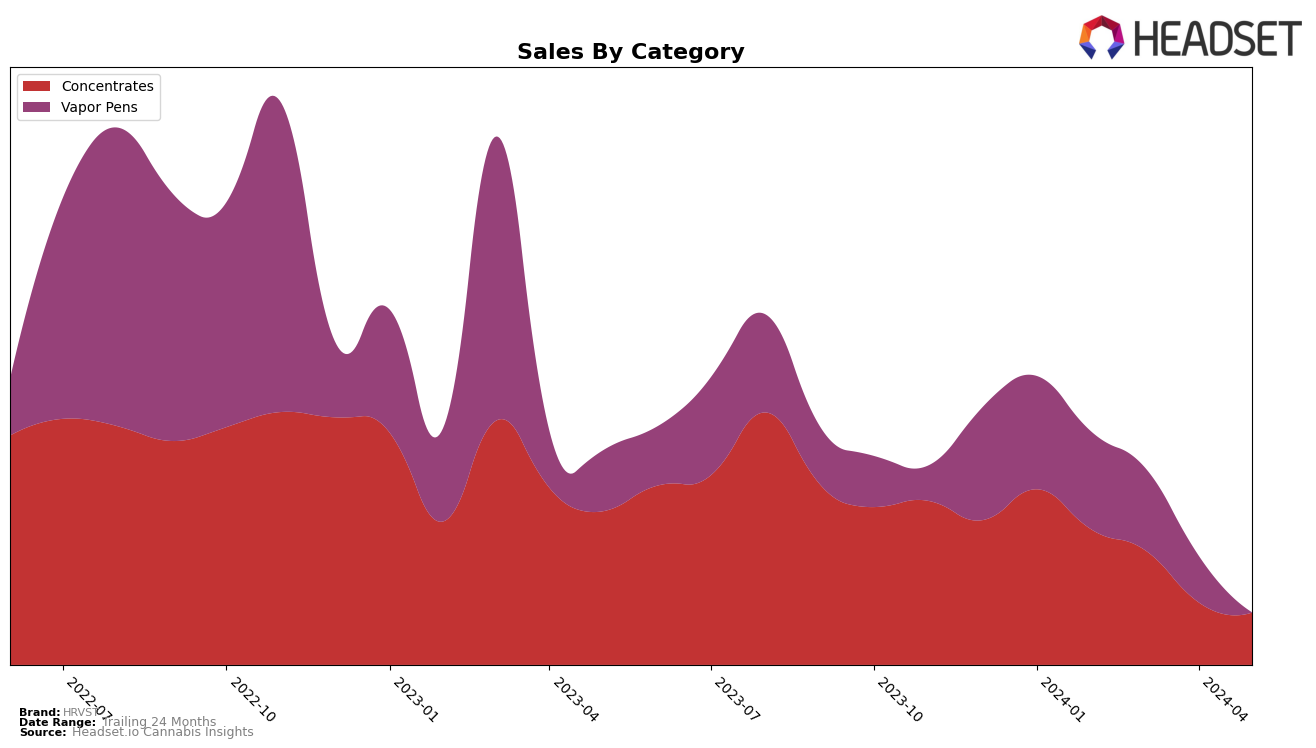

HRVST has shown varying performance across different categories and states in recent months. In Colorado, the brand's ranking in the Concentrates category has seen a decline from 15th place in February 2024 to 30th place by May 2024. This movement indicates a significant drop in their market position, suggesting either increased competition or a potential decrease in consumer preference for their concentrates. Despite this, HRVST managed to stay within the top 30 brands, which is a positive sign, although their sales figures have decreased over the months, reflecting a downward trend in this category.

In the Vapor Pens category, HRVST's performance in Colorado has been less promising. The brand was ranked 44th in February 2024 and fell to 76th by May 2024, indicating they were not in the top 30 brands for this category during this period. This significant drop suggests a major challenge in maintaining their market share within the vapor pens segment. The sales data for May 2024 also shows a sharp decline, which might be indicative of either a shift in consumer preferences or issues with product availability or appeal. Overall, while HRVST remains a recognizable name, their recent performance highlights the need for strategic adjustments to regain their standing in these competitive categories.

Competitive Landscape

In the competitive landscape of the Colorado concentrates market, HRVST has experienced notable fluctuations in its ranking and sales over recent months. In February 2024, HRVST held a strong position at rank 15, but by May 2024, it had dropped to rank 30. This decline is significant when compared to competitors like Apothecary Extracts, which started at rank 21 in February and fell to rank 28 by May, and 14er Gardens, which moved from rank 24 to 32 in the same period. Meanwhile, Billo showed a more stable performance, fluctuating between ranks 27 and 34. Despite these changes, HRVST's sales figures indicate a downward trend, with a significant drop from February to May. This suggests that while HRVST remains a recognizable brand, it faces stiff competition and needs to strategize effectively to regain its higher market position. For a deeper dive into these trends and more detailed data, consider exploring advanced analytics.

Notable Products

In May-2024, the top-performing product for HRVST was Gluebell Gold Wax (1g) in the Concentrates category, maintaining its first-place ranking from the previous months with notable sales of 757 units. MAC Wax (1g) secured the second position, making its debut in the rankings this month. Apple Fritter Pure Sugar Wax (1g) followed closely in third place, also appearing for the first time. Ice Box Pie Live Badder (1g) and East Coast Sour Diesel Wax (1g) rounded out the top five, ranking fourth and fifth respectively, both new entries for May-2024. This month's rankings saw a significant shake-up with several new products entering the top five, indicating a dynamic shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.