Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

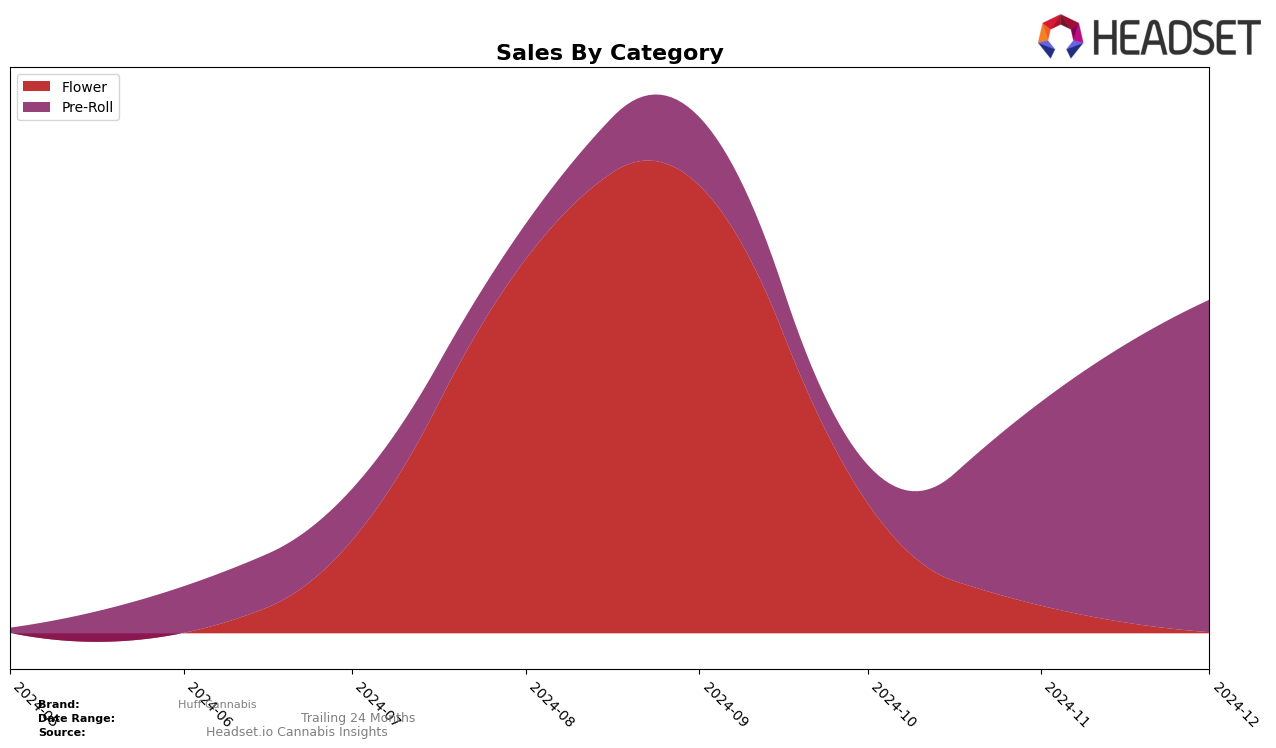

In the Michigan market, Huff Cannabis has shown a notable trajectory within the Pre-Roll category. Starting from a position outside the top 30 in September 2024, the brand made a significant leap to rank 43rd in November, and further advanced to 27th by December. This upward movement highlights a strengthening presence and increasing consumer preference for their pre-roll products. In contrast, their performance in the Flower category remained outside the top 30 throughout the final quarter of 2024, indicating potential challenges or areas for growth within this segment.

While Huff Cannabis has made strides in the Pre-Roll category in Michigan, it is important to note the absence of top 30 rankings in other states or categories during the same period. This suggests that the brand's influence is currently more localized, with significant room for expansion and improvement in other markets. The lack of ranking in the Flower category, despite achieving substantial sales in September, points to a competitive landscape where Huff Cannabis may need to differentiate itself further to capture a larger market share. Such insights can guide strategic decisions to enhance their market positioning in the coming months.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll category, Huff Cannabis has demonstrated a notable upward trajectory in brand ranking and sales. After not being in the top 20 in October 2024, Huff Cannabis made a significant leap to rank 43rd in November and further improved to 27th in December. This upward movement is indicative of a strong growth trend, contrasting with competitors like Pro Gro, which saw a decline from 13th in September to 30th in December, and Redemption, whose ranking fluctuated but ultimately did not break into the top 20 by December. Meanwhile, Seed Junky Genetics and Rare Michigan Genetics showed inconsistent rankings, with Seed Junky Genetics falling out of the top 20 by December. Huff Cannabis's ability to climb the ranks amidst such competition suggests a robust market presence and potential for continued growth in the Michigan pre-roll market.

Notable Products

In December 2024, the top-performing product for Huff Cannabis was Donny Oreo Burger Pre-Roll (1g), securing the first rank with impressive sales of 37,231 units. Hot Date Pre-Roll (1g) followed closely in second place. Papa Smurf Pre-Roll (1g) climbed from fourth place in November to third in December, showcasing a significant boost in popularity. Punch Bomb Pre-Roll (1g) saw a slight decline, moving from first in November to fourth in December. Red Velvet Gelato Pre-Roll (1g) maintained its fifth-place position from the previous month, indicating consistent performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.