Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

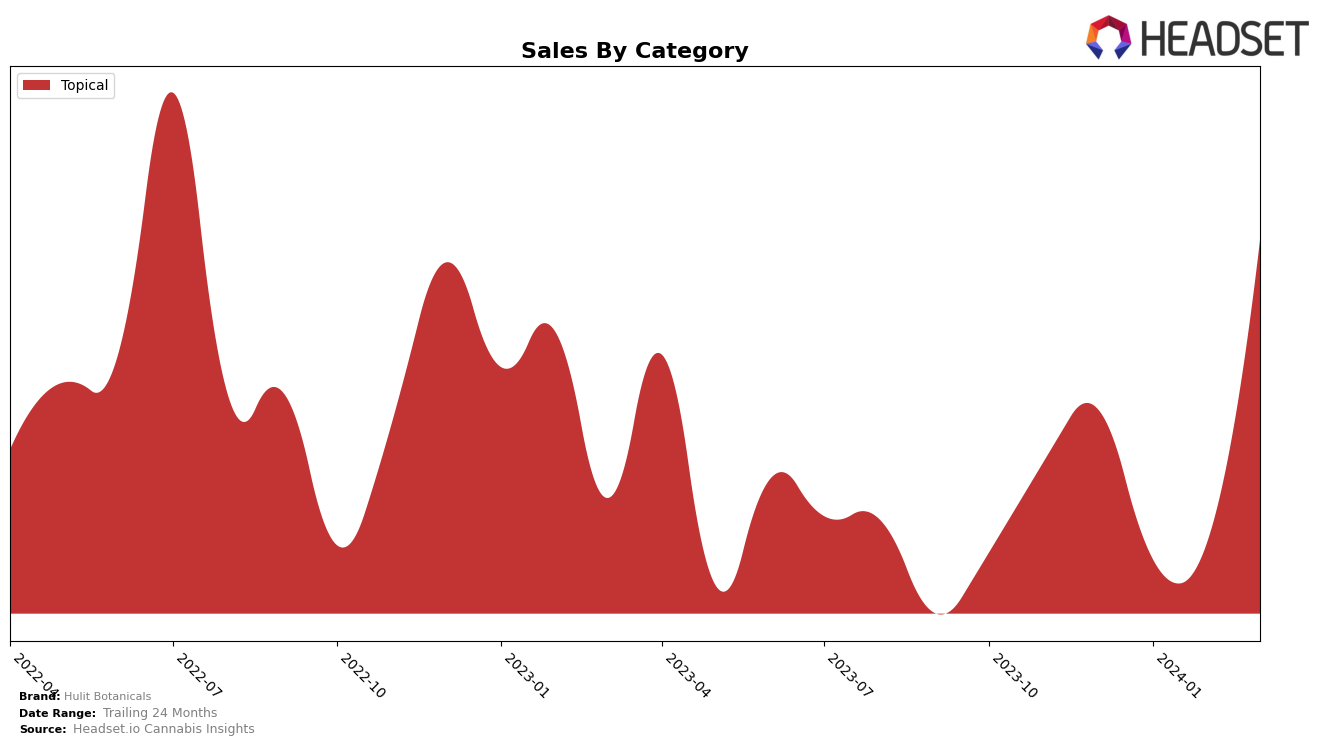

In British Columbia, Hulit Botanicals has shown a notable performance within the Topical category, as observed through their rankings and sales data over recent months. Starting from December 2023, the brand was ranked 10th, with a slight decline in the following two months, moving to 11th and 12th respectively. This downward trend in rankings could initially be perceived as a setback. However, March 2024 marked a significant turnaround for Hulit Botanicals, with the brand jumping to the 7th position. This improvement is particularly impressive, considering the competitive nature of the cannabis market in British Columbia. The sales figures further illuminate this story, with a notable increase from 780 units sold in February to 3198 units in March 2024, highlighting a strong recovery and growing consumer interest in their Topical products.

Despite the initial fluctuation in rankings within the Topical category, Hulit Botanicals' performance in British Columbia is a testament to the brand's resilience and potential for growth. The absence from the top 30 brands in earlier months might have been a cause for concern, but the subsequent rise in both rankings and sales indicates a positive trajectory. This upward movement, especially the leap in March 2024, suggests that Hulit Botanicals has effectively navigated the challenges of the competitive cannabis market. While specific sales figures for December 2023 to February 2024 are not disclosed in detail, the substantial increase in March sales provides a glimpse into the brand's improving market position and consumer acceptance. Such performance dynamics offer valuable insights but also hint at underlying strategies and market responses that could be shaping Hulit Botanicals' journey in the cannabis industry.

Competitive Landscape

In the competitive landscape of the topical cannabis category in British Columbia, Hulit Botanicals has shown a notable upward trajectory in rank over the recent months, moving from 10th in December 2023 to 7th in March 2024. This rise in rank is particularly impressive when considering the sales growth from 618 in January 2024 to 3198 in March 2024, indicating a significant increase in market demand for their products. Competitors such as LivRelief have maintained a steady position at 5th rank, showcasing strong and consistent sales. Meanwhile, 18twelve has experienced fluctuations in rank but saw a substantial increase in sales in March 2024, positioning them as a strong competitor. Even Cannabis Company and First Choice Cannabis have also shown changes in their rankings, with Even Cannabis Company experiencing a gradual decline and First Choice Cannabis moving closely behind Hulit Botanicals. The competitive dynamics suggest that while Hulit Botanicals is gaining momentum, the market remains highly competitive with significant movements in both rank and sales among the top brands.

Notable Products

In March 2024, Hulit Botanicals saw the CBD Weekend Clay Face Mask (400mg CBD, 50g) from the Topical category reclaim its position as the top-selling product, with notable sales figures reaching 83 units. Following closely was the CBD Glow Daily Facial Cream (400mg CBD) also from the Topical category, securing the second rank with a significant sales volume. Notably, both products have consistently performed well over the past months, with the CBD Glow Daily Facial Cream maintaining a leading position in January and February before slipping to second place in March. The shift in rankings indicates a competitive edge between these two products, reflecting changing consumer preferences or possibly promotional activities. Overall, Hulit Botanicals' Topical category demonstrates robust sales performance, highlighting consumer interest in skincare infused with CBD.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.