Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

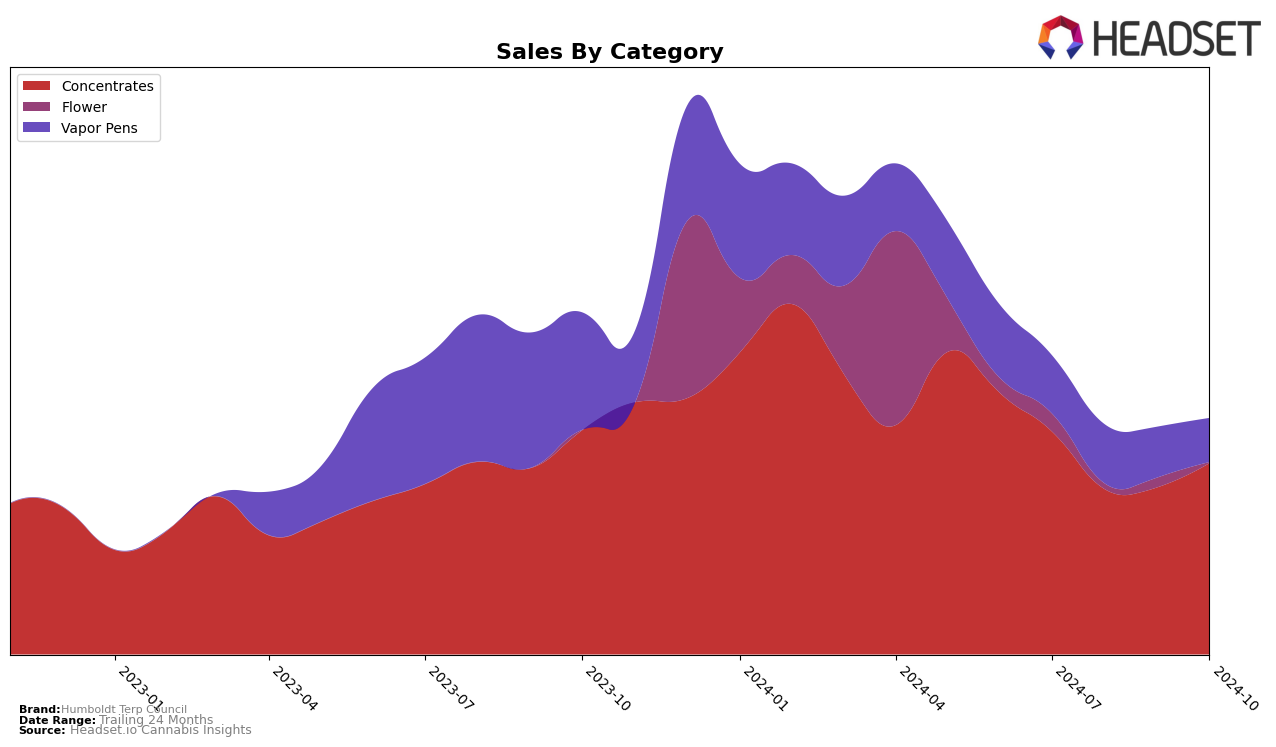

Humboldt Terp Council has shown fluctuating performance in the concentrates category across different months in California. In July 2024, the brand was ranked 29th, but it dropped out of the top 30 in August and September, ranking 35th and 33rd, respectively. This decline could indicate challenges in maintaining a consistent market presence. However, the brand made a comeback in October, regaining its position at 30th. This return to the top 30 suggests a potential recovery or strategic adjustment that allowed Humboldt Terp Council to regain some market traction in the state.

Despite the ranking fluctuations, the sales figures tell an interesting story. While there was a noticeable decrease in sales from July to August, with sales dropping from $139,209 to $103,024, the brand managed to stabilize and slightly increase sales in the subsequent months. By October, sales had risen to $119,354, reflecting a positive trend that could indicate successful efforts in recapturing consumer interest or improving product offerings. The absence of Humboldt Terp Council from the top 30 in August and September highlights the competitive nature of the concentrates category in California, suggesting that the brand may need to continue adapting to maintain or improve its market position.

Competitive Landscape

In the competitive landscape of California's concentrates category, Humboldt Terp Council has shown fluctuating performance in recent months. Despite a dip in rank from 29th in July 2024 to 35th in August, the brand rebounded to 30th by October. This recovery is notable given the competitive pressure from brands like Jetty Extracts, which improved its rank from 36th in July to 29th in October, and Greenline Organics, which also saw a significant rank improvement from 44th in July to 31st in October. Meanwhile, 5G (530 Grower) experienced a more volatile trajectory, dropping from 22nd in July to 44th in August, before climbing back to 28th in October. These shifts highlight the dynamic nature of the market and suggest that Humboldt Terp Council's ability to maintain a relatively stable position amidst these changes could be indicative of a resilient brand strategy. However, the brand's sales figures suggest a need for strategic adjustments to capitalize on market opportunities and improve its standing against competitors.

Notable Products

In October 2024, Rainbow Belts Live Resin (1g) from Humboldt Terp Council maintained its top position in the Concentrates category, achieving a notable sales figure of 743 units. Papaya Bomb Live Resin Cartridge (1g) made a significant leap in the Vapor Pens category, climbing from third to second place with a sales increase to 419 units. Original Glue Live Resin Sugar (1g) improved its ranking in Concentrates from fourth to third, with sales reaching 395 units. GMO Cookies Live Rosin (1g) re-entered the rankings in fourth place after being unranked in September, selling 332 units. Amarelo Live Resin (1g) also reappeared in the rankings, securing the fifth spot in Concentrates with 300 units sold, demonstrating a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.