Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

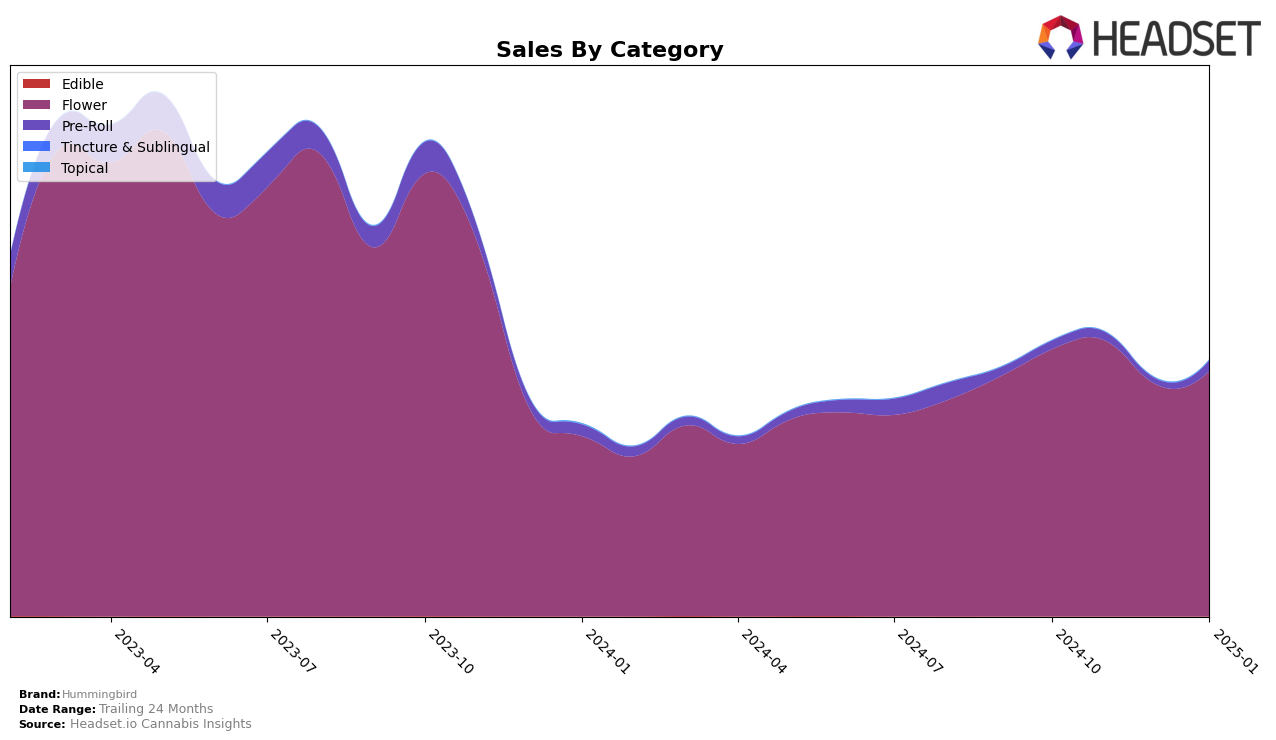

Hummingbird has shown a steady performance in the Colorado market, particularly in the Flower category. Over the four-month period from October 2024 to January 2025, the brand has improved its ranking from 25th to 23rd. This upward movement suggests a positive reception and growing popularity among consumers in the state. However, it's worth noting that while there was an increase in sales from October to November, there was a subsequent decline in December before a slight recovery in January. This fluctuation indicates potential challenges in maintaining consistent sales momentum, which could be an area for strategic focus.

In contrast, Hummingbird's presence in the Pre-Roll category in Colorado is less prominent, as they did not rank in the top 30 brands until January 2025, when they entered at 61st. This late entry into the rankings could be seen as a positive development, signaling the brand's potential to capture market share in this growing segment. However, the absence from the top 30 in previous months indicates that there is significant room for improvement. The brand may need to explore innovative strategies or product offerings to strengthen its position in the Pre-Roll category and achieve similar success as seen in the Flower market.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Hummingbird has shown a steady presence, maintaining a rank within the top 25 from October 2024 to January 2025. Despite facing competition from brands like Silver Lake, which consistently ranked higher, peaking at 13th in December 2024, Hummingbird has managed to improve its rank slightly from 25th in October and November to 23rd by January 2025. This improvement in rank, despite a competitive market, suggests a resilience in maintaining market share. Meanwhile, Dro experienced a significant rise, moving from 44th in October to 9th in December, indicating a potential shift in consumer preferences or successful marketing strategies that Hummingbird might need to address. Additionally, LEIFFA and Bonsai Cultivation have demonstrated fluctuating ranks, with LEIFFA peaking at 14th in December, which could pose a threat if their upward trend continues. Overall, while Hummingbird's sales have seen a slight increase from November to January, the brand must remain vigilant and adaptive to maintain its competitive edge in this dynamic market.

Notable Products

In January 2025, the top-performing product from Hummingbird was Alpha Blue Bulk in the Flower category, securing the number 1 rank with notable sales of 2,853 units. Lost Tribe Bulk, also in the Flower category, climbed to the 2nd position from its previous 4th rank in November 2024, showing significant growth. Durban Kush Pre-Roll 1g moved up to the 3rd spot from 5th in December 2024, indicating a rising preference for pre-rolls. Super Lemon Haze 3.5g entered the top 5, taking the 4th position, while Alpha Blue 3.5g dropped slightly to 5th place after being ranked 2nd in December 2024. Overall, the rankings reveal a strong demand for bulk Flower products, with pre-rolls gaining popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.