Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

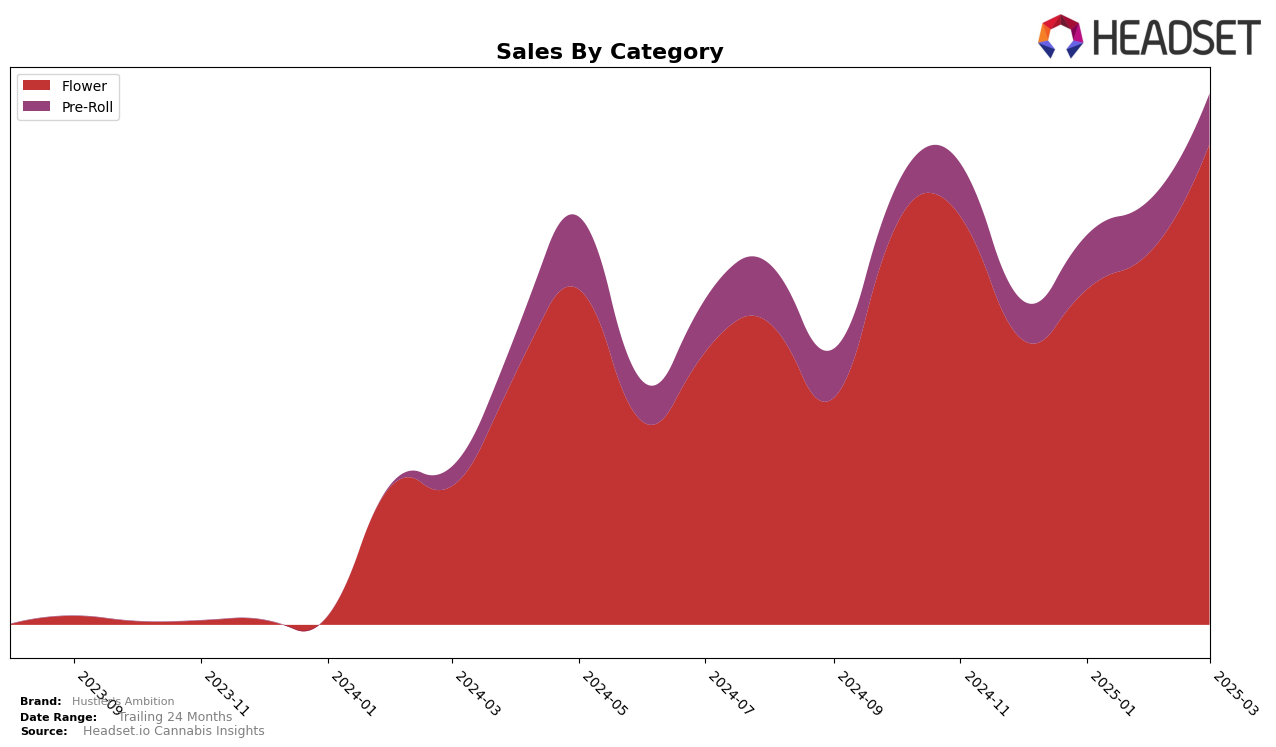

Hustler's Ambition has shown a notable performance in the Nevada market, particularly in the Flower category. Over the span from December 2024 to March 2025, the brand has climbed from the 10th position to a high of 6th in February before slightly dropping to 7th in March. This upward trend is highlighted by a significant increase in sales, suggesting growing consumer preference and market strength in this category. Such a trajectory indicates a robust strategy in place, potentially driven by product quality or effective market penetration tactics. However, it is essential to observe future movements to determine if this growth is sustainable.

In contrast, the performance of Hustler's Ambition in the Pre-Roll category in Nevada presents a more fluctuating picture. Starting at the 26th position in December, the brand improved to 17th in January and reached 14th by February, only to fall back to 19th in March. Although the brand did not break into the top 10, the initial upward trend followed by a slight decline might indicate competitive pressures or shifts in consumer preferences within this segment. The absence from the top 30 in other states or provinces suggests that Hustler's Ambition's presence is currently concentrated in Nevada, with potential opportunities for expansion or increased focus needed in other regions to enhance their market footprint.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Hustler's Ambition has demonstrated a notable upward trajectory in rank and sales over the past few months. Starting from a rank of 10 in December 2024, Hustler's Ambition improved to rank 8 in January 2025, ascended further to rank 6 in February, before slightly dipping to rank 7 in March. This positive trend in rank is mirrored by their sales performance, which saw a consistent increase, peaking at 795,088 in March 2025. In comparison, Lavi maintained a steady rank of 5 throughout the same period, consistently outperforming Hustler's Ambition in sales. Meanwhile, Nature's Chemistry experienced fluctuations, ending March at rank 6, just ahead of Hustler's Ambition, but with a significant sales boost. Green Life Productions and Ghost Town Cannabis showed more volatility, with Green Life Productions dropping out of the top 10 in January before recovering, and Ghost Town Cannabis remaining mostly behind Hustler's Ambition in both rank and sales. These dynamics suggest that while Hustler's Ambition is gaining ground, it faces stiff competition from established brands like Lavi and Nature's Chemistry, necessitating strategic efforts to maintain and enhance its market position.

Notable Products

In March 2025, Mochi Gelato Pre-Roll (1g) maintained its top position as the best-selling product for Hustler's Ambition, with sales reaching 4043 units. Sticky Fingers (14g) also held steady in second place, showing a significant increase in sales compared to previous months. Mochi Gelato (3.5g) climbed to third place, marking its return to the top ranks since December 2024. Zootiez Pre-Roll (1g) experienced a slight decline, moving to fourth place from third in January 2025. Wedding Mints (3.5g) made its debut in the rankings at fifth place, contributing to the diverse product offerings in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.