Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

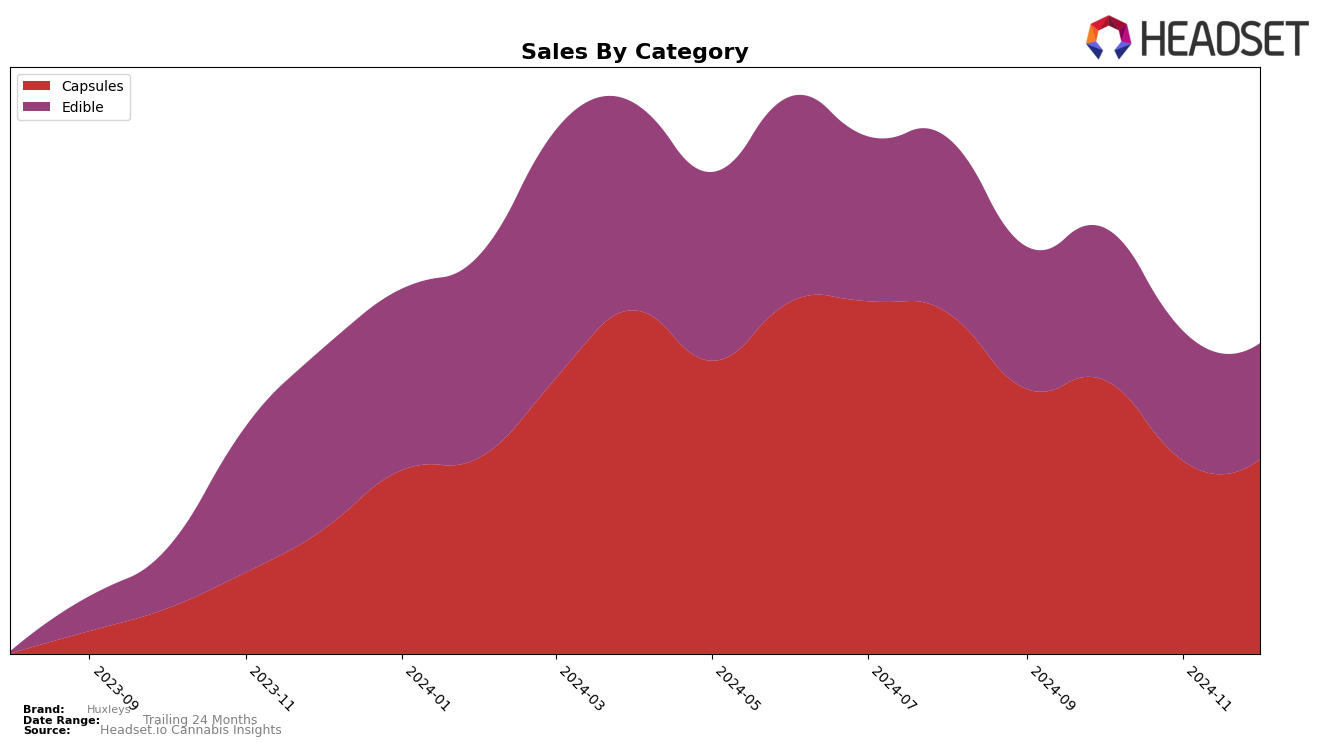

Huxleys' performance in the California market, particularly in the Capsules category, has shown a consistent presence within the top 10 rankings over the last few months of 2024. Despite a slight dip in sales from October to November, the brand maintained its position at rank 8, indicating a stable demand for their capsules. This stability suggests that Huxleys has managed to carve out a loyal customer base in this category. However, the Edible category tells a different story. Huxleys did not make it into the top 30 brands in California, with rankings slipping from 32 in September to 37 by December. This downward trend suggests potential challenges in market penetration or competition within the edibles space.

It's noteworthy that while Huxleys has managed to sustain a strong foothold in the Capsules category, their performance in the Edible category requires attention. The absence from the top 30 list in California for edibles highlights a gap that might be worth exploring further for potential market opportunities or strategic adjustments. The contrasting performance across categories underscores the importance of category-specific strategies and consumer engagement. While the sales figures provide a snapshot, the underlying trends and consumer preferences are crucial for understanding the brand's market dynamics and potential future directions.

Competitive Landscape

In the competitive landscape of the California cannabis capsules market, Huxleys has experienced some fluctuations in its rankings over the last few months, maintaining a steady position at 7th place in September and October 2024, before slipping to 8th place in November and December. This slight decline in rank coincides with a noticeable drop in sales from October to November, suggesting potential challenges in maintaining market share. In contrast, Kikoko consistently held the 5th position, though it experienced a significant sales decline by December, potentially opening opportunities for Huxleys to regain ground. Meanwhile, Buddies improved its rank from 6th to 5th, indicating a competitive edge that Huxleys might need to address. Despite these challenges, Huxleys remains ahead of Papa & Barkley and Proof, both of which have maintained stable but lower rankings, suggesting that Huxleys still holds a competitive advantage over these brands. As the market evolves, strategic adjustments could help Huxleys capitalize on the shifting dynamics and enhance its position in the California capsules category.

Notable Products

In December 2024, the top-performing product for Huxleys was the THC/CBD/CBN 10:5:5 Sleep Mixed Berry Gummies 10-Pack, maintaining its number one rank for four consecutive months despite a sales decrease to 1848 units. The Happy Lemonade Gummies 10-Pack secured the second position, climbing from third place in the previous months, with a notable increase in sales to 1599 units. The THC/CBG/CBD 10:5:3 Sex Passion Fruit Gummies dropped to third place, although its sales remained strong at 1541 units. The THC:THCV 5:1 Apple Energy Gummies held steady at fourth place, showing resilience with an increase in sales to 1435 units. Notably, the Happy Lemonade Capsules made an appearance in the top five for the first time, indicating a growing interest in this category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.