Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

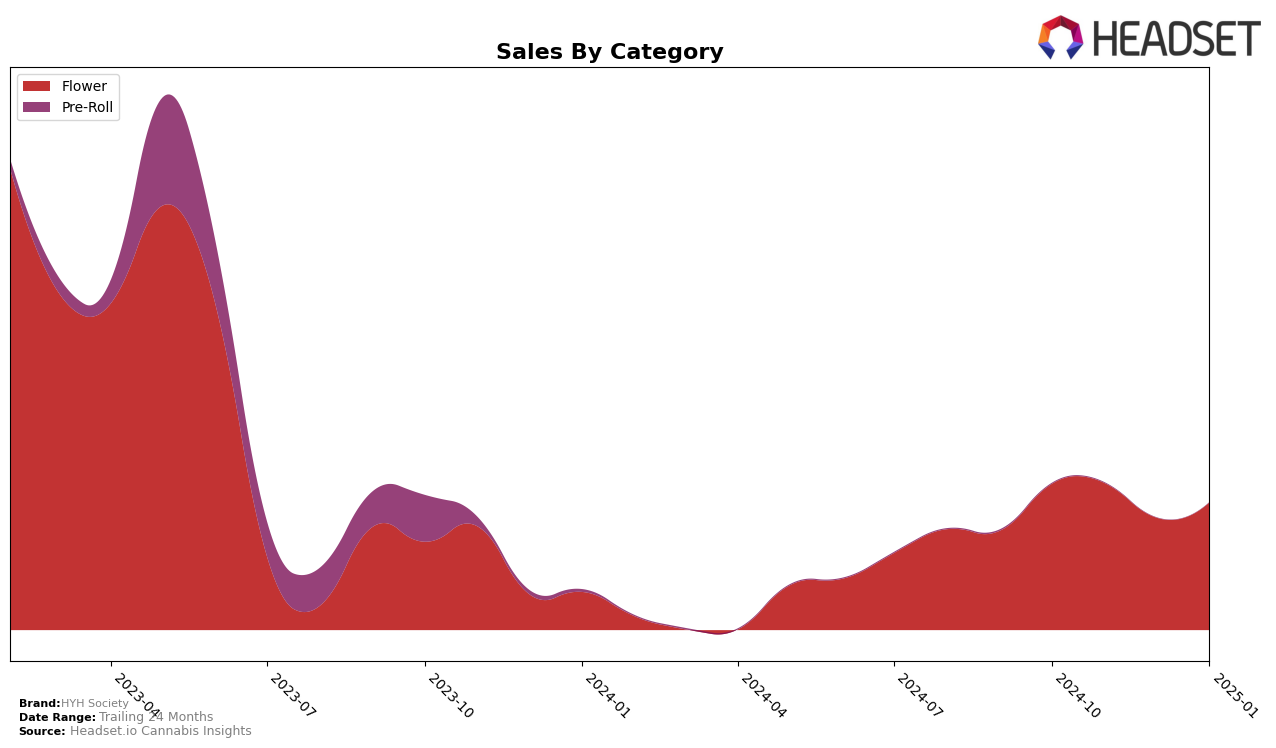

In Arizona, HYH Society has shown a steady presence in the Flower category, consistently ranking within the top 30 brands over the past few months. Starting from the 30th position in October 2024, the brand improved its rank to 25th in November, although it experienced a slight dip to 28th in December. By January 2025, HYH Society had climbed back to the 26th position. This movement suggests a resilience in maintaining market presence despite fluctuations in sales, which saw a notable decrease in December before recovering in January.

Across other states and categories, the absence of HYH Society from the top 30 rankings indicates areas where the brand could potentially expand its market influence. The consistent ranking in Arizona's Flower category highlights a particular strength or focus that could be leveraged in other regions. The brand's ability to rebound in January after a December dip is a positive indicator of its potential to adapt and optimize strategies for maintaining or improving its market position. The data suggests that while HYH Society has a foothold in Arizona, there is room for growth in other states and categories, which could be explored in further analysis.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, HYH Society has shown a fluctuating performance in terms of rank and sales over the past few months. Starting from October 2024, HYH Society was ranked 30th, improving to 25th in November, but then dropping to 28th in December before climbing slightly to 26th in January 2025. This indicates a volatile market position, with sales peaking in November before experiencing a dip in December and a slight recovery in January. In comparison, TRIP demonstrated a strong performance, jumping from 29th in October to 15th in November and maintaining that rank in December, though it fell to 24th in January. Meanwhile, FENO consistently outperformed HYH Society, maintaining a higher rank throughout the period, with a notable sales increase in January. These dynamics suggest that while HYH Society is making strides, it faces stiff competition from brands like TRIP and FENO, which have shown more stable or upward trends in both rank and sales.

Notable Products

In January 2025, the top-performing product for HYH Society was Exotic V2 (3.5g) in the Flower category, achieving the number one rank with notable sales of 797 units. Following closely, Apple Banana Gelato (3.5g) secured the second position, while Silver Project (14g) claimed the third spot. Hot Lava (28g) and WB (14g) rounded out the top five rankings at fourth and fifth, respectively. Compared to previous months, Exotic V2 (3.5g) and Apple Banana Gelato (3.5g) maintained strong performances, consistently appearing at the top. The rankings of these products indicate a stable preference among consumers for these particular offerings from HYH Society.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.