Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

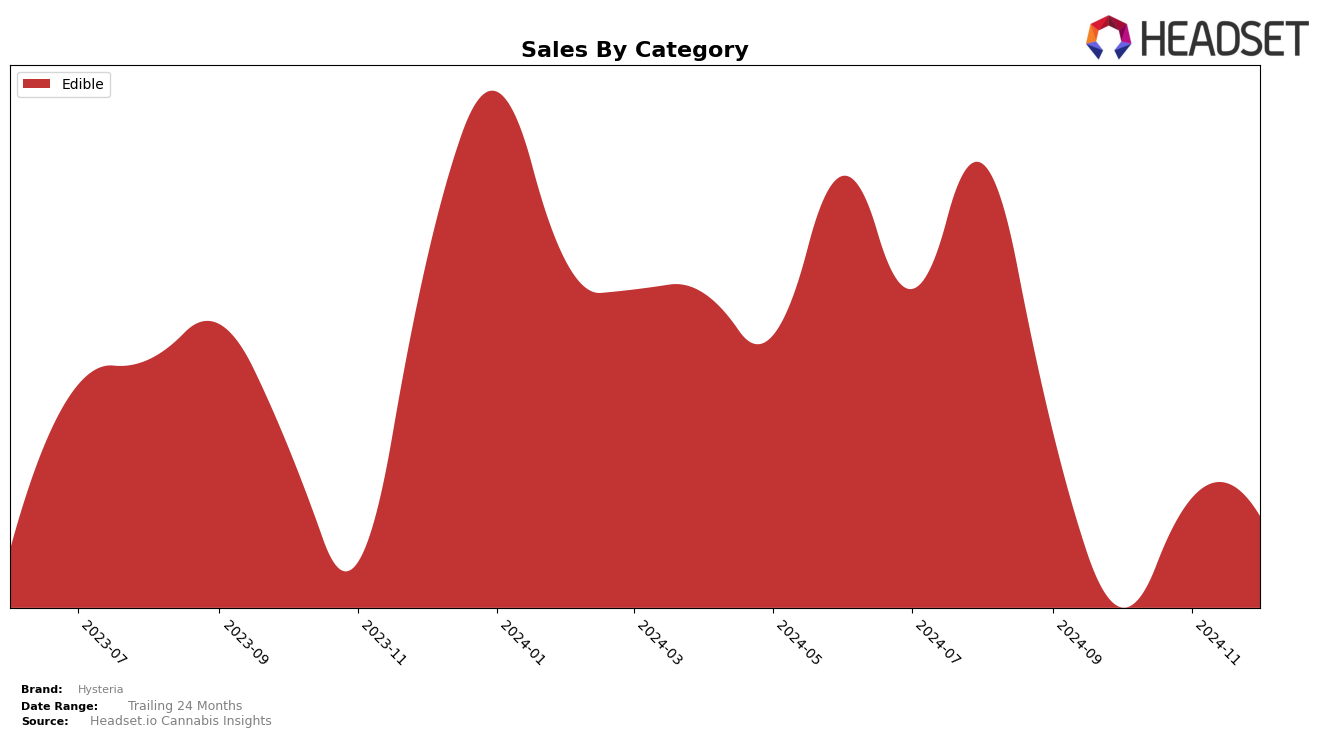

Hysteria's performance in the Edible category across the state of New York shows a fluctuating trend over the final months of 2024. In September, the brand was ranked 22nd, which marked its peak position within the last four months of the year. However, by October, Hysteria's rank slipped to 31st, indicating a significant drop and falling out of the top 30. The brand made a slight recovery in November, climbing back to 29th place, and managed to maintain a presence in the top 30 by December, albeit at the 30th position. This movement suggests some volatility in Hysteria's performance, which could be attributed to various market dynamics or competitive pressures within the New York edible market.

Despite the ranking fluctuations, Hysteria's sales figures reveal interesting trends. The brand experienced a notable dip in sales from September to October, with sales dropping significantly, reflecting their fall in rankings. However, the subsequent months saw a recovery in sales, with November witnessing an increase and a slight decrease in December, which might indicate some stabilization. This pattern suggests that while Hysteria faced challenges in maintaining its ranking, it still managed to capture consumer interest towards the year-end, albeit not enough to climb back significantly in the rankings. The data from New York provides a snapshot of Hysteria's market dynamics, but a comprehensive analysis across other states and categories would offer a fuller picture of its overall performance.

Competitive Landscape

In the competitive landscape of the Edible category in New York, Hysteria has experienced fluctuating rankings over the last few months, indicating a dynamic market presence. Hysteria started at rank 22 in September 2024 but slipped to rank 31 by October, showing a decline as competitors like Tyson 2.0 and Love Oui'd improved their standings. Despite this, Hysteria managed to recover slightly, reaching rank 29 in November and maintaining a close position at rank 30 in December. This recovery was supported by a notable increase in sales from October to November, although not enough to surpass The Green Lady Dispensary, which consistently held a rank around 29. The competitive pressure from brands like To The Moon, which also saw fluctuations, highlights the need for Hysteria to innovate and capture more market share to improve its rank and sales trajectory in this evolving market.

Notable Products

In December 2024, Hysteria's top-performing product was the Cookies & Cream Chocolate Bar 10-Pack (100mg) from the Edible category, maintaining its number one rank for four consecutive months with December sales of 1062 units. The Milk Chocolate Bar 10-Pack (100mg) also held steady in the second position, showing a significant sales increase to 605 units compared to previous months. The Dark Chocolate Bar 10-Pack (100mg) consistently ranked third, while the Milk Chocolate Bar 10-Pack (70mg) remained in fourth place. Notably, the Dark Chocolate Bar 10-Pack (70mg) experienced a drop in sales, settling at the fifth rank in December. Overall, the rankings for these top products have shown stability, with only minor shifts in sales figures over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.