Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

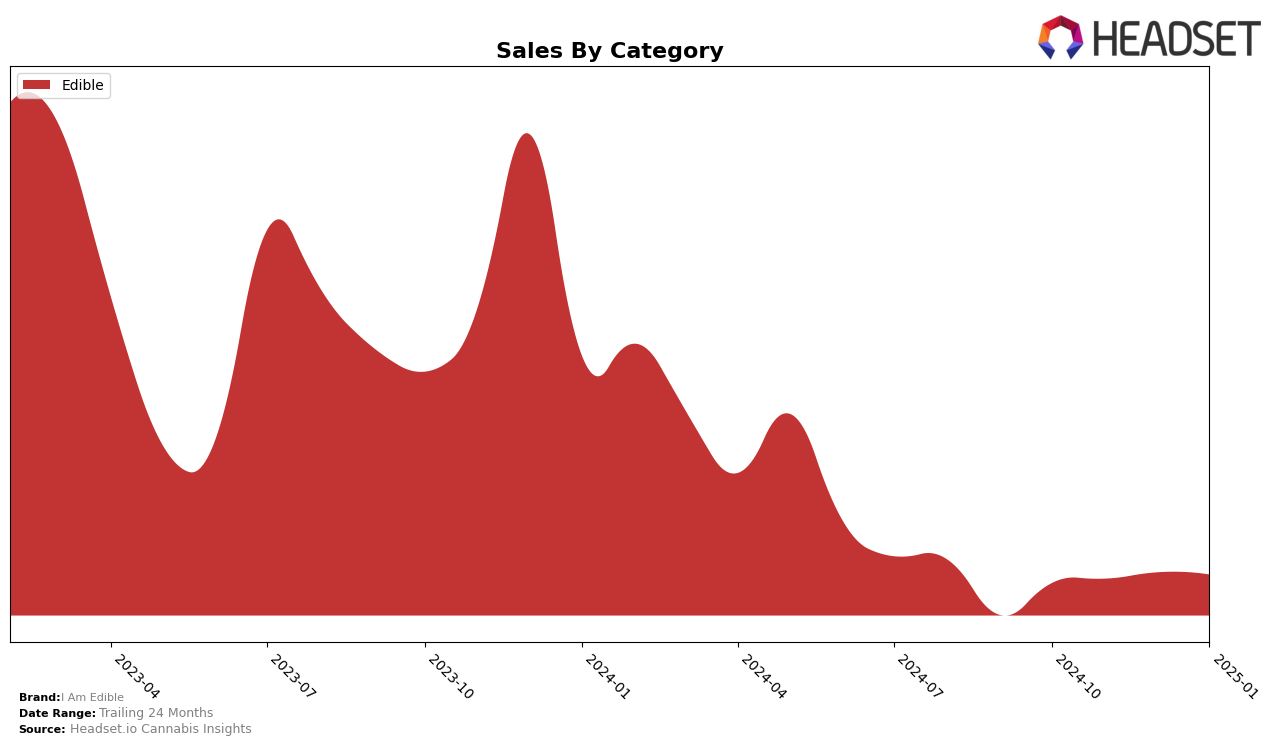

I Am Edible has shown consistent performance in the Massachusetts market, particularly within the Edible category. The brand maintained a steady presence, ranking 25th in October and November 2024, slightly dropping to 26th in December, before regaining the 25th spot in January 2025. This stability in ranking suggests a solid consumer base and effective market strategies, even amidst minor fluctuations. The steady sales figures, with a slight increase from October to December, indicate a growing demand for their products, although the January sales showed a slight dip, implying potential seasonal factors or market competition dynamics at play.

Interestingly, I Am Edible's absence from the top 30 brands in other states or provinces could be interpreted as a potential area for growth or a strategic decision to focus efforts primarily in Massachusetts. This focus may allow them to consolidate resources and strengthen their market position in a state where they have already established a foothold. However, the lack of presence in other regions might also suggest untapped opportunities that could be explored to diversify and expand their market reach. The brand's consistent ranking within Massachusetts's edible category highlights its competitive edge, although expanding its footprint could further enhance its overall market presence.

Competitive Landscape

In the Massachusetts edible market, I Am Edible has maintained a consistent rank around the 25th position from October 2024 to January 2025, with a slight dip to 26th in December 2024. This stability in rank suggests a steady performance in a competitive landscape. Notably, Happy Valley and Muncheas have shown stronger sales figures, consistently ranking higher than I Am Edible, though both experienced a decline in January 2025. Meanwhile, Freshly Baked has been climbing the ranks, moving from 34th in October 2024 to 27th by January 2025, indicating a potential threat if this upward trend continues. Sparq Cannabis Company has fluctuated in rank but remains close to I Am Edible, suggesting a competitive peer in terms of market position. These dynamics highlight the importance for I Am Edible to innovate and differentiate to maintain and improve its market standing.

Notable Products

In January 2025, Blue Raspberry Fruit Chews 20-Pack (100mg) maintained its position as the top-performing product for I Am Edible, with impressive sales figures reaching 3145 units. Peach Mango Fruit Chews 20-Pack (100mg) saw a notable rise, climbing from fourth place in December 2024 to third place, reflecting a significant increase in popularity. The CBD/THC 20:1 Blackberry Fruit Chews 20-Pack (400mg CBD, 20mg THC) consistently held the second position throughout the previous months, though its sales slightly declined in January. Meanwhile, the CBD/THC 2:1 Watermelon Cucumber Fruit Chews 20-Pack (200mg CBD, 100mg THC) remained steady in fourth place, showing a minor decrease in sales compared to December. Mixed Berry Fruit Chews 20-Pack (100mg) rounded out the top five, despite a continued decline in sales since October 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.