Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

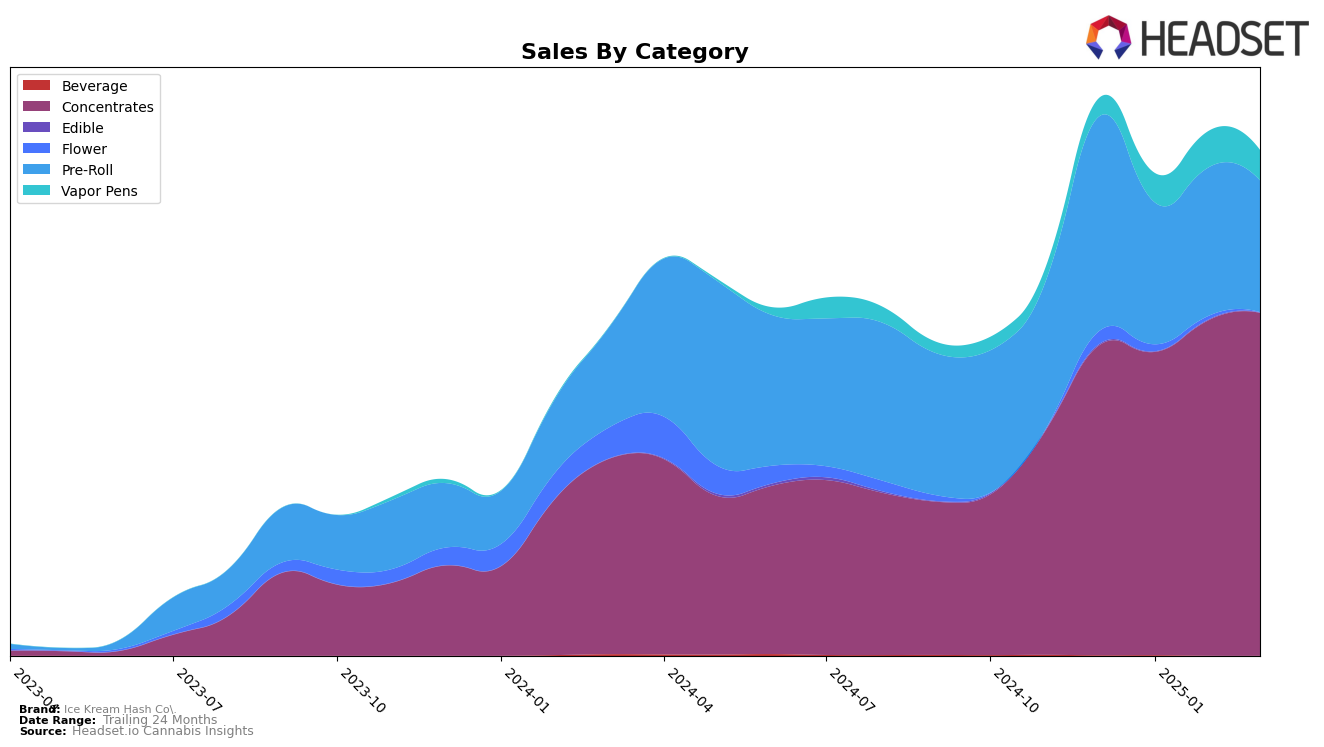

Ice Kream Hash Co. has shown a solid performance in the Michigan market, particularly in the Concentrates category. The brand maintained a strong presence with a consistent ranking, holding the 4th position in January and February 2025, before slightly dropping to 5th in March 2025. This stability in rankings, coupled with an upward trend in sales from $523,624 in January to $592,237 in March, indicates a robust demand for their products in this category. However, their performance in the Vapor Pens category reveals a different story, as they were not in the top 30 brands in December 2024, only breaking into the rankings in January 2025 at 98th place and showing some improvement to 84th in February, before slipping slightly to 90th in March.

In the Pre-Roll category, Ice Kream Hash Co. experienced a more volatile performance. They were ranked 20th in December 2024 but fell out of the top 30 in January 2025, landing at 34th place. The brand managed to recover slightly in February, reaching 29th, yet dropped again to 37th in March. This fluctuation in rankings, alongside a decrease in sales from $370,492 in December 2024 to $227,225 in March 2025, suggests challenges in maintaining a competitive edge in this category. The absence of a top 30 ranking for Vapor Pens in December 2024 further highlights areas for potential growth and focus for Ice Kream Hash Co. in the Michigan market.

Competitive Landscape

In the competitive landscape of Michigan's concentrates market, Ice Kream Hash Co. has shown a consistent performance, maintaining a strong presence in the top 5 rankings from December 2024 to March 2025. Despite a slight dip from 4th to 5th place in March 2025, Ice Kream Hash Co. remains a formidable player, with sales figures consistently above those of Cannalicious Labs, which held the 6th position for most of this period. However, Common Citizen has been a rising competitor, climbing from 9th place in December 2024 to 4th place by March 2025, with sales surging significantly, indicating a potential threat to Ice Kream Hash Co.'s market share. Meanwhile, Wojo Co has consistently outperformed Ice Kream Hash Co., maintaining a steady 3rd place ranking, suggesting that while Ice Kream Hash Co. is performing well, there is room for strategic growth to challenge the top competitors in the Michigan concentrates market.

Notable Products

In March 2025, Ice Kream Hash Co.'s top-performing product was Super Boof Live Rosin (1g) in the Concentrates category, maintaining its first-place rank from the previous months with a sales figure of 2187 units. White Truffle Live Rosin (1g) debuted at the second position, showing strong initial sales. Truffle Treats Live Rosin (1g) and Kush Mints Live Rosin (1g) secured the third and fourth ranks respectively, indicating their rising popularity. Double Baked Cake Live Rosin (1g) remained stable at the fifth rank, consistent since February 2025. Overall, the rankings saw new entries in March, highlighting a competitive shift within the top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.