Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

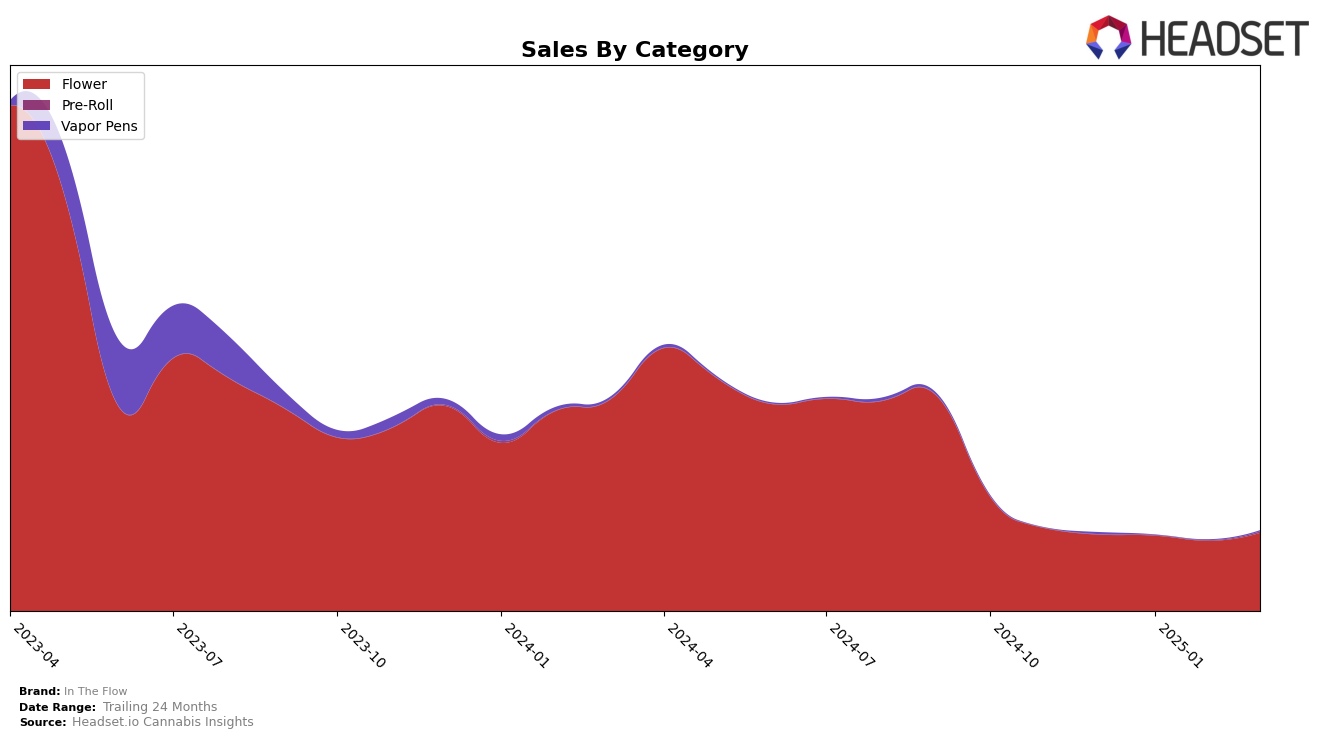

In The Flow has shown a consistent upward trajectory in the Colorado market within the Flower category. Starting from a rank of 20 in December 2024, the brand improved its position to 16 by March 2025. This steady climb is indicative of a positive reception in the market, despite a slight dip in sales in January and February. Interestingly, March saw a rebound in sales, surpassing the December figures. The brand's ability to maintain and improve its ranking amidst fluctuating sales suggests effective strategies in place to capture consumer interest in Colorado's competitive landscape.

While In The Flow has made significant strides in Colorado, their absence from the top 30 in other states or categories highlights potential areas for growth or market entry. This limited presence outside of Colorado could be seen as a missed opportunity or a strategic focus on strengthening their position within a familiar market. The data underscores the importance of regional strategies and the potential benefits of exploring new markets or product categories. The brand's performance in the Flower category in Colorado could serve as a benchmark for potential expansion efforts.

Competitive Landscape

In the competitive landscape of the Colorado flower market, In The Flow has shown a consistent upward trajectory in rankings from December 2024 to March 2025, moving from 20th to 16th place. This positive trend is noteworthy, especially when compared to competitors such as The Health Center, which experienced fluctuating ranks, dropping to 23rd in February 2025 before rebounding to 17th in March. Meanwhile, Green Farms made a significant leap from being unranked in December to 12th in January, although they slightly declined to 14th by March. Artsy Cannabis Co also saw a dip in February but managed to recover to 15th place by March. Despite these fluctuations among competitors, In The Flow's steady improvement in rank, coupled with a notable increase in sales in March, suggests a strengthening market position and a growing consumer base, potentially driven by strategic marketing and product quality enhancements.

Notable Products

In March 2025, Chemmy Jones Bulk maintained its top position for In The Flow, with sales reaching 10,380 units, demonstrating consistent dominance since December 2024. Lemon Skunk Bulk emerged as the second best-selling product, making its debut in the rankings this month. Blue Dream 1g followed closely in third place, showing strong market entry. Chemmy Jones 3.5g held steady at fourth, slightly improving from its fifth position in February 2025. Point Break Bulk rounded out the top five, highlighting a notable entry into the rankings this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.