Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

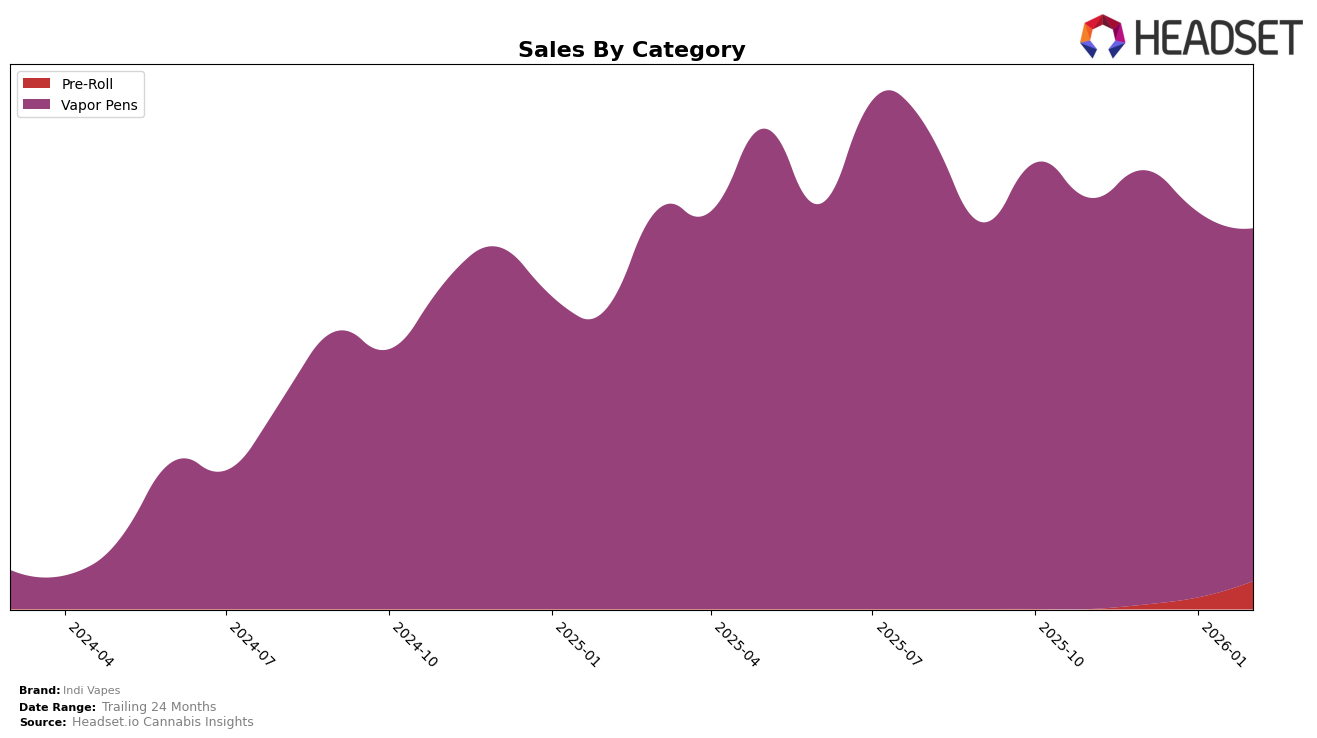

In the state of Missouri, Indi Vapes has shown varied performance across different cannabis categories. Notably, in the Vapor Pens category, the brand maintained a consistent presence within the top 10, ranking 8th in both November and December 2025, and slightly dropping to 10th in January and February 2026. This indicates a strong, albeit slightly fluctuating, position in the market, suggesting a stable consumer base for their vapor pen products. However, in the Pre-Roll category, Indi Vapes did not make it into the top 30 rankings until February 2026, where they secured the 39th position. This late entry into the rankings might suggest a developing interest in their pre-roll products, but also highlights the competitive nature of this category in Missouri.

Examining sales trends, Indi Vapes experienced a notable increase in Pre-Roll sales from January to February 2026, indicating potential growth and increased consumer interest in this category. Conversely, the Vapor Pens category saw a gradual decline in sales from December 2025 to February 2026, which might suggest market saturation or increased competition. This divergence in performance across categories could imply strategic areas for Indi Vapes to focus on, such as bolstering their pre-roll offerings while addressing the competitive challenges in the vapor pen market. The brand's ability to maintain a top 10 position in vapor pens despite sales fluctuations demonstrates resilience, but the evolving dynamics in pre-rolls warrant close attention.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Indi Vapes has experienced notable fluctuations in its market position from November 2025 to February 2026. Initially ranked 8th in November and December, Indi Vapes saw a dip to 10th place in January and maintained this position in February. This shift in rank can be attributed to the consistent performance of competitors such as Rove, which held a strong position, moving from 7th to 6th place before settling at 9th in February, and Elevate, which consistently ranked 9th but improved to 8th in February. Meanwhile, Kushy Punch and Ostara Cannabis also posed significant competition, with Kushy Punch peaking at 8th in January before dropping to 12th in February, and Ostara Cannabis maintaining a steady presence around the 11th and 13th positions. These dynamics indicate a competitive market where Indi Vapes must strategize to regain and enhance its standing amidst strong contenders.

Notable Products

In February 2026, the top-performing product for Indi Vapes was Strawberry Fields Distillate Disposable (1g) in the Vapor Pens category, maintaining its first-place position for the fourth consecutive month with sales of 4848. Fresh Lemon Distillate Disposable (1g) climbed back to the second rank after slipping to fifth in December 2025, showing a strong recovery. Pineapple Guava Distillate Disposable (1g) consistently held the third position, reflecting stable demand. Peaches & Creme Distillate Disposable (1g) entered the rankings at fourth place, indicating growing popularity. Polar Berry Distillate Disposable (1g) experienced a drop from second in January 2026 to fifth in February, suggesting a decline in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.