Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

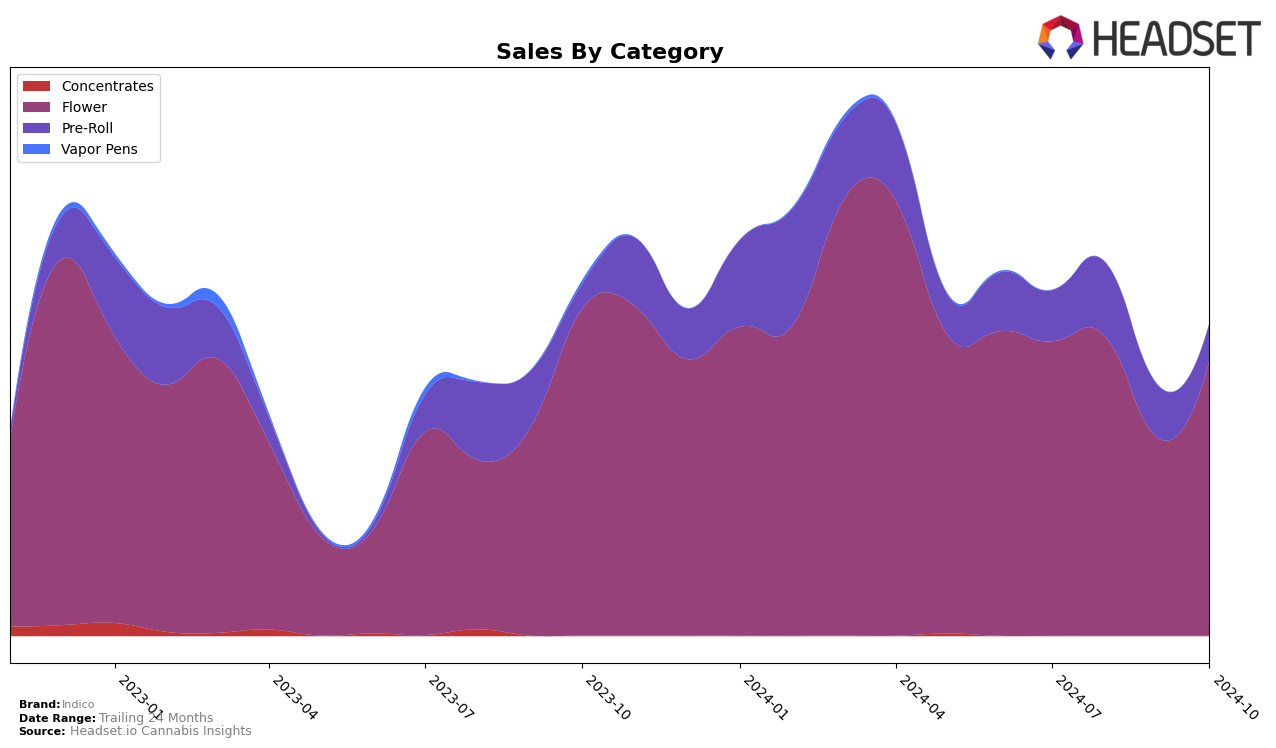

Indico has shown notable fluctuations in its performance across different categories and states, particularly in the Colorado market. In the Flower category, Indico has made a significant leap from being ranked 36th in September 2024 to 26th in October 2024, marking a positive trajectory and indicating a strong recovery after a dip in September. This upward movement suggests an effective strategy in place, possibly driven by changes in consumer preferences or promotional efforts. However, the brand's absence from the top 30 rankings in July and August highlights the competitive nature of the market and the challenges Indico faces to maintain its position among leading brands.

Conversely, in the Pre-Roll category, Indico's performance has been less consistent, with rankings fluctuating significantly. The brand was not within the top 30 in any of the months reviewed, indicating a struggle to capture a significant share in this category. The highest ranking achieved was 47th in August 2024, but this was followed by a decline to 53rd in October. This pattern suggests potential challenges in product differentiation or market saturation that Indico needs to address. The sales figures in this category also reflect a downward trend from August to October, which could be a focal point for strategic adjustments moving forward.

Competitive Landscape

In the competitive landscape of the Colorado Flower category, Indico has shown a notable improvement in its ranking from July to October 2024, climbing from 35th to 26th position. This upward trajectory suggests a positive shift in market perception and potential sales growth. Despite a dip in sales in September, Indico managed to recover in October, closing the gap with competitors like Freedom Road, which also improved its rank but maintained a higher sales volume. Meanwhile, Rocky Mountain High consistently outperformed Indico in both rank and sales, though their sales saw a decline in October. Higher Function made significant strides in rank, moving from 49th to 28th, indicating a potential emerging threat. Overall, Indico's strategic improvements in rank, despite fluctuating sales, highlight its resilience and potential for capturing more market share in the competitive Colorado Flower market.

Notable Products

In October 2024, the top-performing product for Indico was Ice Cream Cake Pre-Roll (1g) in the Pre-Roll category, achieving the highest rank with sales reaching 1063 units. The second spot was secured by Ice Cream Cake (Bulk) from the Flower category, followed by Stoney Bertz (Bulk) also in the Flower category. O Face Pre-Roll (1g) took the fourth position, maintaining a strong presence in the Pre-Roll category. Notably, Bubble Bath Pre-Roll (1g) slipped to the fifth rank from its consistent fourth position in the previous months, indicating a slight decline in its sales momentum compared to earlier performances.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.