Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

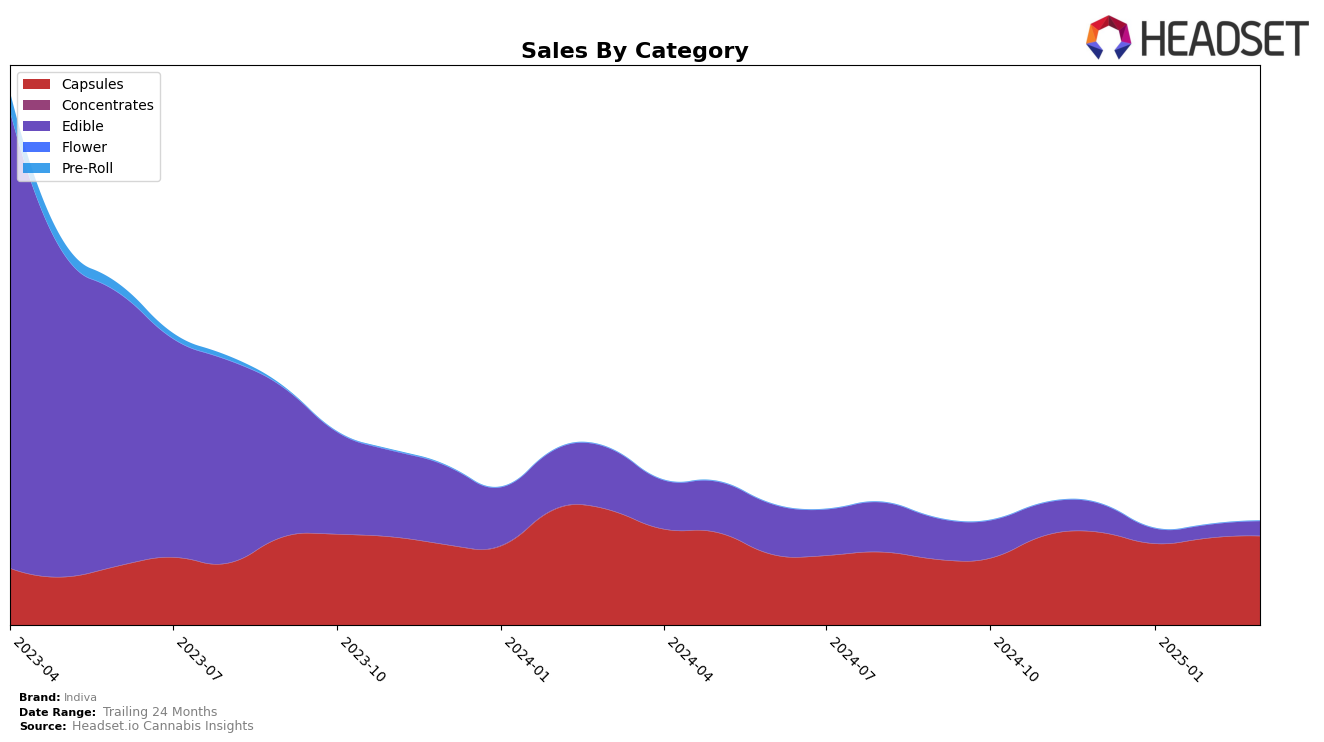

Indiva has shown a consistent performance in the Capsules category across multiple Canadian provinces. In Alberta, the brand maintained a steady ranking, holding the 7th position in both December 2024 and January 2025, before improving to 6th place in February and March 2025. This indicates a positive momentum in the province. Similarly, in British Columbia, Indiva consistently ranked within the top four, maintaining a strong 3rd place in three out of the four months analyzed. Meanwhile, in Ontario, the brand held a stable 6th position throughout the same period, showcasing its reliable presence in the Capsules market.

In contrast, Indiva's performance in the Edible category reveals some variability. In Alberta, the brand did not appear in the top 30 rankings after December 2024, which might indicate a challenge in maintaining competitiveness in this category. However, in British Columbia, Indiva showed a gradual improvement, moving from the 26th position in December to 22nd by March 2025. This upward trend suggests potential growth opportunities in the region. In Ontario, the brand made slight progress, climbing from 26th to 24th place by February and maintaining that position in March, indicating a modest but positive shift in its market standing.

Competitive Landscape

In the Ontario capsules market, Indiva has consistently maintained its position at rank 6 from December 2024 to March 2025, indicating a stable performance amidst a competitive landscape. Notably, Glacial Gold has held a steady rank of 4, consistently outperforming Indiva, while Emprise Canada remains at rank 5, just ahead of Indiva. Despite this, Indiva's sales have shown a positive trend, with a noticeable increase from February to March 2025, suggesting potential for upward movement in rank if this growth continues. Meanwhile, Dosecann experienced fluctuations, dropping to rank 9 in January and February before recovering to rank 8 in March, which could present an opportunity for Indiva to further solidify its position. Additionally, Decimal has shown improvement, moving from rank 9 in December to rank 7 from January onwards, indicating a competitive push that Indiva must monitor closely to maintain its market share.

Notable Products

In March 2025, the top-performing product from Indiva was Blips THC Tablets 25-Pack (250mg) in the Capsules category, maintaining its consistent first-place ranking with sales reaching 7261 units. Following closely, Vanilla Double Stuffed Chocolate Cookie (10mg) in the Edible category held its position at rank two, although its sales slightly decreased compared to previous months. Doppio- Fudge Double Stuffed Chocolate Cookie (10mg) also remained steady at rank three, showing a gradual increase in sales to 2600 units. Big Blips THC Tablets 55-Pack (550mg) in the Capsules category maintained its fourth-place ranking with a slight decline in sales. Lastly, the Dark Chocolate Bar (10mg) entered the rankings at fifth place, showing promising growth with sales increasing to 783 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.