Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

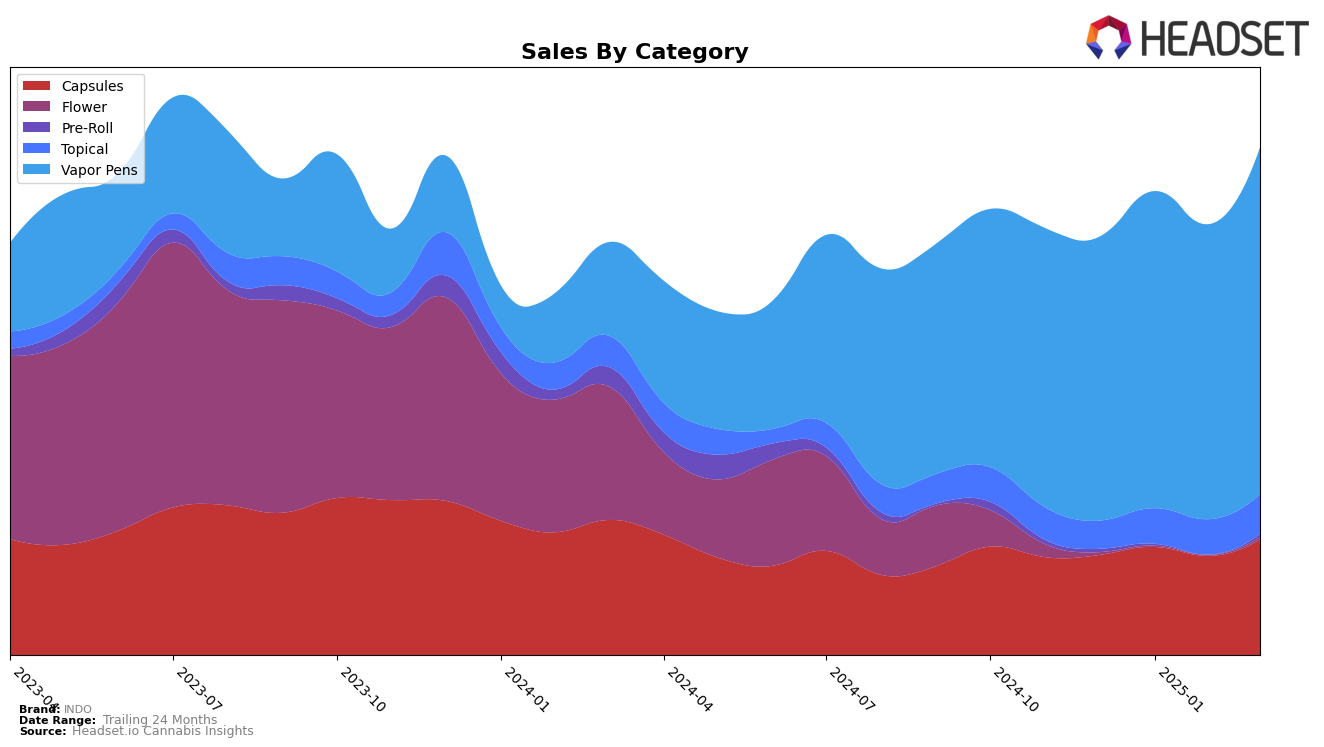

INDO has demonstrated a strong presence in the Nevada cannabis market, particularly in the Capsules category where it consistently ranks at the top. Notably, INDO maintained the number one position in January and March 2025, reflecting a robust demand for their capsules. The brand's performance in the Topical category also showed positive movement, climbing from third in December 2024 to second by March 2025. This upward trend in Topicals suggests an increasing consumer interest and a solidifying market position for INDO in Nevada. However, the absence of a ranking in other states or provinces indicates that INDO's influence might be more concentrated in Nevada, which could be a strategic focus or a limitation in broader market penetration.

In the Vapor Pens category, INDO has shown a commendable improvement in Nevada, advancing from the tenth position in December 2024 to seventh by March 2025. This progression highlights a growing acceptance and popularity of their vapor pen products among consumers. Despite these gains, the brand did not appear in the top 30 rankings for any other states or provinces across the categories, which might suggest either a highly competitive environment in those regions or a strategic decision to concentrate efforts within Nevada. Such insights could be pivotal for stakeholders assessing INDO's market strategies and potential areas for expansion or improvement.

Competitive Landscape

In the competitive landscape of the Nevada vapor pens market, INDO has shown a promising upward trajectory in recent months. Starting from a consistent 10th place ranking from December 2024 through February 2025, INDO made a significant leap to 7th place by March 2025. This improvement in rank is indicative of a strong sales performance, with a notable increase in sales from February to March. In comparison, Provisions also improved its position, moving from 14th to 9th place, yet its sales figures remained consistently lower than INDO's. Meanwhile, City Trees experienced fluctuations, dropping from 7th in December to 11th in January, and eventually settling at 10th in March, suggesting a less stable market presence. Medizin outpaced INDO in March, climbing to 5th place, reflecting a significant sales surge. However, Sauce Essentials maintained a consistently higher rank, though its sales saw a decline in March. These dynamics highlight INDO's growing competitiveness and potential for further market penetration in Nevada's vapor pens category.

Notable Products

For March 2025, the top-performing product from INDO was the CBD/CBN/THC 4:4:1 Jungle Stick IndoBalm (400mg CBD, 400mg CBN, 100mg THC) in the Topical category, maintaining its number one rank from the previous months with notable sales of 1959 units. The Acapulco Gold Distillate Disposable (0.9g) in the Vapor Pens category held steady at the second position, showing a significant increase in sales compared to February. The Blueberry Punch Distillate Disposable (0.9g) moved up to the third position in March, recovering from a dip in rank in January. Hulk's Breath Distillate Cartridge (1g) entered the rankings for the first time, securing the fourth spot. THC Maxtabs 2-Pack (200mg) in the Capsules category dropped from third to fifth, despite an increase in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.