Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

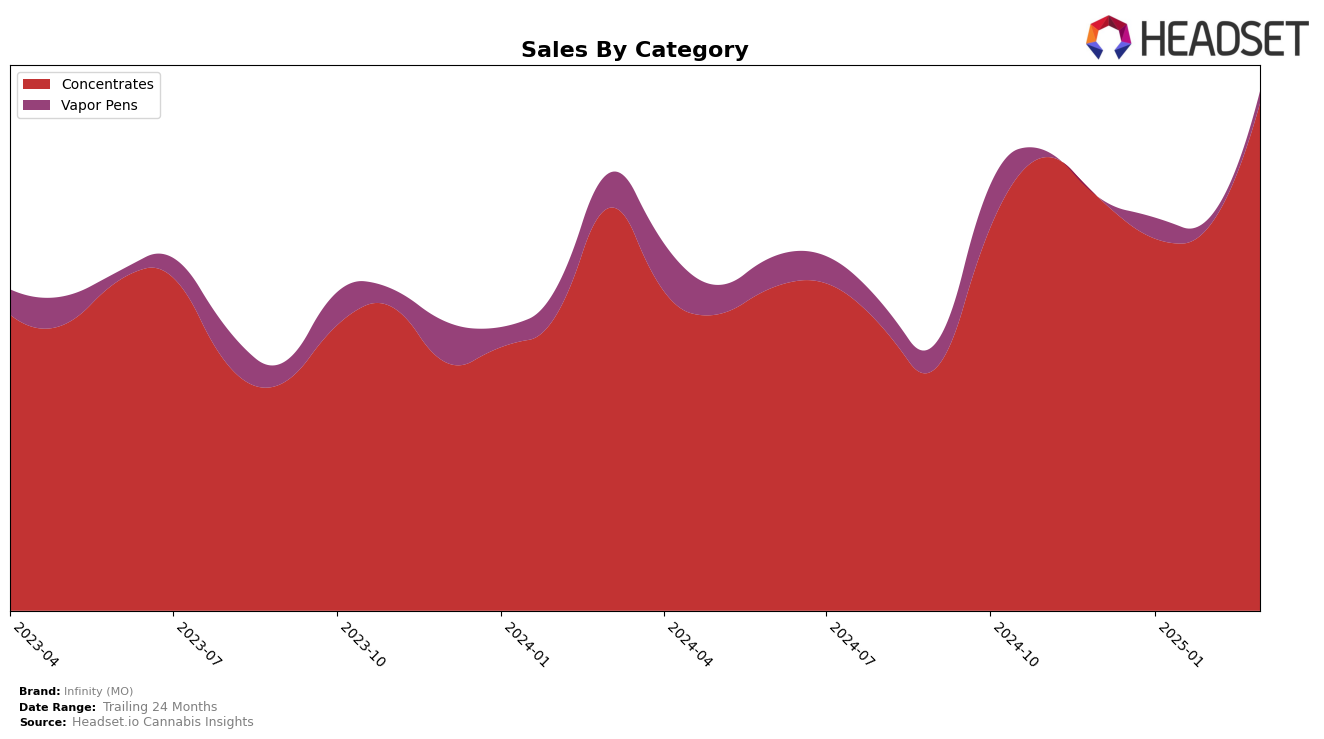

Infinity (MO) has demonstrated notable performance in the Concentrates category within Missouri. The brand maintained a strong presence, consistently ranking within the top four positions from December 2024 to March 2025. Notably, Infinity (MO) improved its ranking from fourth in January to second by March, indicating a positive upward trend. This improvement was accompanied by a significant increase in sales, with March 2025 sales surpassing the $500,000 mark, highlighting the brand's growing influence and consumer preference in the Concentrates category.

In contrast, Infinity (MO)'s performance in the Vapor Pens category in Missouri reflects a more challenging landscape. The brand struggled to break into the top 30, ranking 60th and 61st in February and March 2025, respectively. This indicates a need for strategic adjustments to capture a larger market share in this category. Despite these challenges, Infinity (MO) did manage to increase its sales from January to March, suggesting potential for growth with the right market strategies. The brand's ability to elevate its position in the Concentrates category could serve as a blueprint for improving its performance in Vapor Pens.

Competitive Landscape

In the Missouri concentrates market, Infinity (MO) has demonstrated a strong performance with notable fluctuations in rank over the past few months. Starting from December 2024, Infinity (MO) held the 3rd position, but experienced a slight dip to 4th place in January 2025, before climbing back to 3rd in February and securing the 2nd spot by March 2025. This upward trajectory in rank is indicative of a positive trend in sales performance, especially when compared to competitors like Cloud Cover (C3) and Elevate (Elevate Missouri). While Vivid (MO) consistently maintained the top position, Infinity (MO)'s ability to surpass other brands such as Elevate, which jumped from 12th in December to 2nd in February, highlights its competitive edge and adaptability in the market. This dynamic shift in rankings underscores the competitive landscape and presents an opportunity for Infinity (MO) to capitalize on its momentum to further enhance its market position.

Notable Products

In March 2025, Pineapple Unicorn Cured Wax (1g) from Infinity (MO) emerged as the top-performing product, securing the first rank in the Concentrates category with sales of 1,393 units. Frozen Coke Cured Shatter (1g) followed closely in second place, showing a significant presence in the market. Grape Cream Cake Shatter (1g), which previously held the top position in January 2025, slipped to third place this month, indicating a shift in consumer preference. Punch Breath Cured Wax (1g), which was the leader in February 2025, dropped to fourth place, reflecting a decline in its sales momentum. Dawg Lemons Shatter (1g) maintained a steady performance, debuting in fifth place for March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.