Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

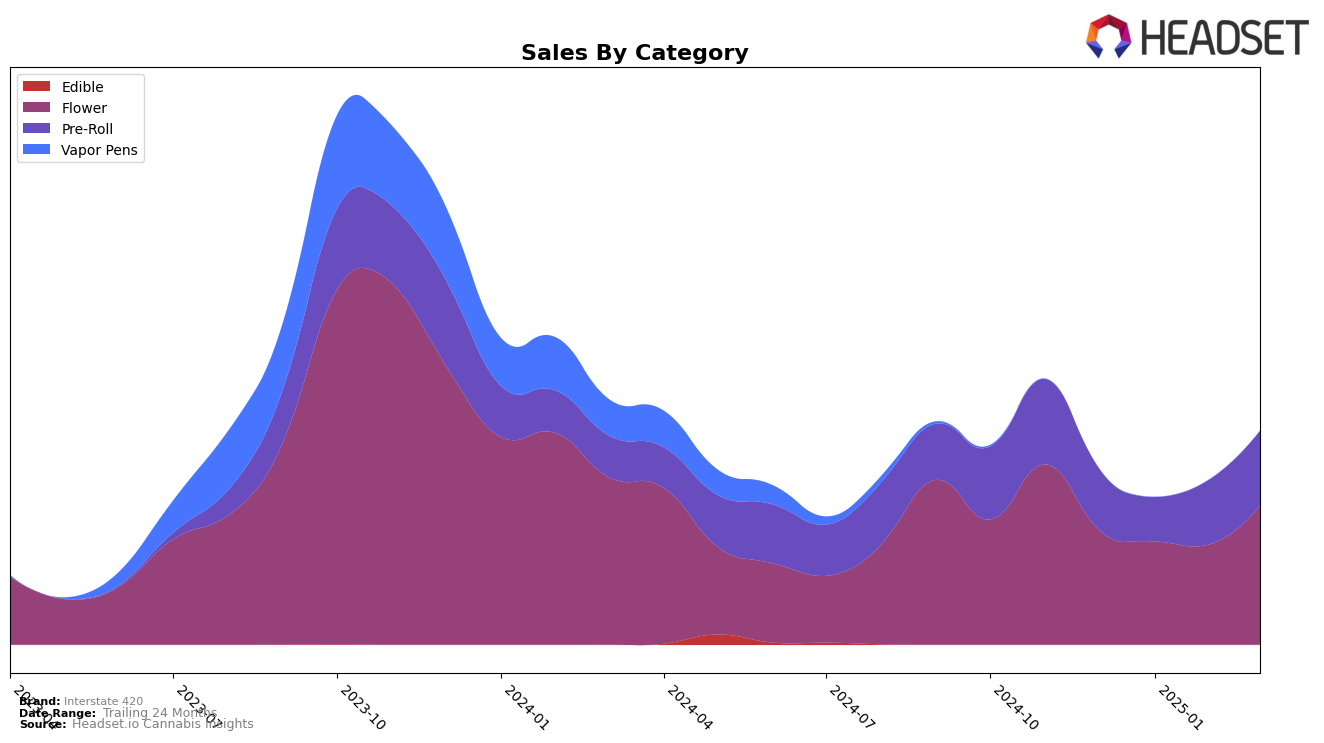

Interstate 420 has shown a noteworthy performance in the Illinois market, particularly in the Flower category. Over the span from December 2024 to March 2025, the brand improved its ranking from 31st to 25th, indicating a positive trajectory in consumer preference and market penetration. This upward movement was accompanied by a significant sales increase in March 2025, suggesting a successful strategy in capturing market share. However, the brand's position just breaking into the top 30 in December 2024 highlights a competitive landscape where maintaining visibility is crucial.

In contrast, the Pre-Roll category in Illinois has seen Interstate 420 maintain a relatively stable presence, with rankings fluctuating slightly but consistently staying within the top 20. The brand's ability to hold steady at 16th place from February to March 2025 suggests a strong consumer base and effective product offerings. The sales figures for this category demonstrate a clear upward trend, especially noticeable in March, aligning with the brand's consistent rankings. It's important to note that not appearing in the top 30 in other states or categories could indicate areas for potential growth or a need for strategic adjustments.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Interstate 420 has demonstrated a notable upward trajectory in its rankings from December 2024 to March 2025. Starting at rank 31 in December, Interstate 420 climbed to rank 25 by March, indicating a positive shift in market presence. This improvement is particularly significant when compared to competitors like Island, which fluctuated between ranks 20 and 25, and Kaviar, which showed a more stable performance, maintaining a rank around 24. Meanwhile, FloraCal Farms experienced a decline, dropping out of the top 20 entirely during this period. The sales trends also reflect these dynamics, with Interstate 420 showing a substantial increase in sales by March, surpassing the declining sales of FloraCal Farms and closing the gap with Island. These insights suggest that Interstate 420 is strengthening its market position, potentially appealing to consumers seeking consistency and growth in the flower category.

Notable Products

In March 2025, Interstate 420's top-performing product was the Don Shula Pre-Roll (0.7g), maintaining its number one rank consistently since December 2024, with sales reaching 9,071 units. The Black Cherry Gelato Pre-Roll (0.7g) rose to the second position, a significant jump from its previous rank of fourth in December 2024, with sales of 3,372 units. The Double Stuffed Kush Pre-Roll (0.7g) debuted in the rankings at third place, marking its first appearance with 3,080 units sold. The Blue Dream Pre-Roll (0.7g) dropped to fourth place from its second position in February, indicating a decrease in popularity. Acapulco Gold Pre-Roll (0.7g) held steady at fifth place, showing consistent performance over the last two months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.