Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

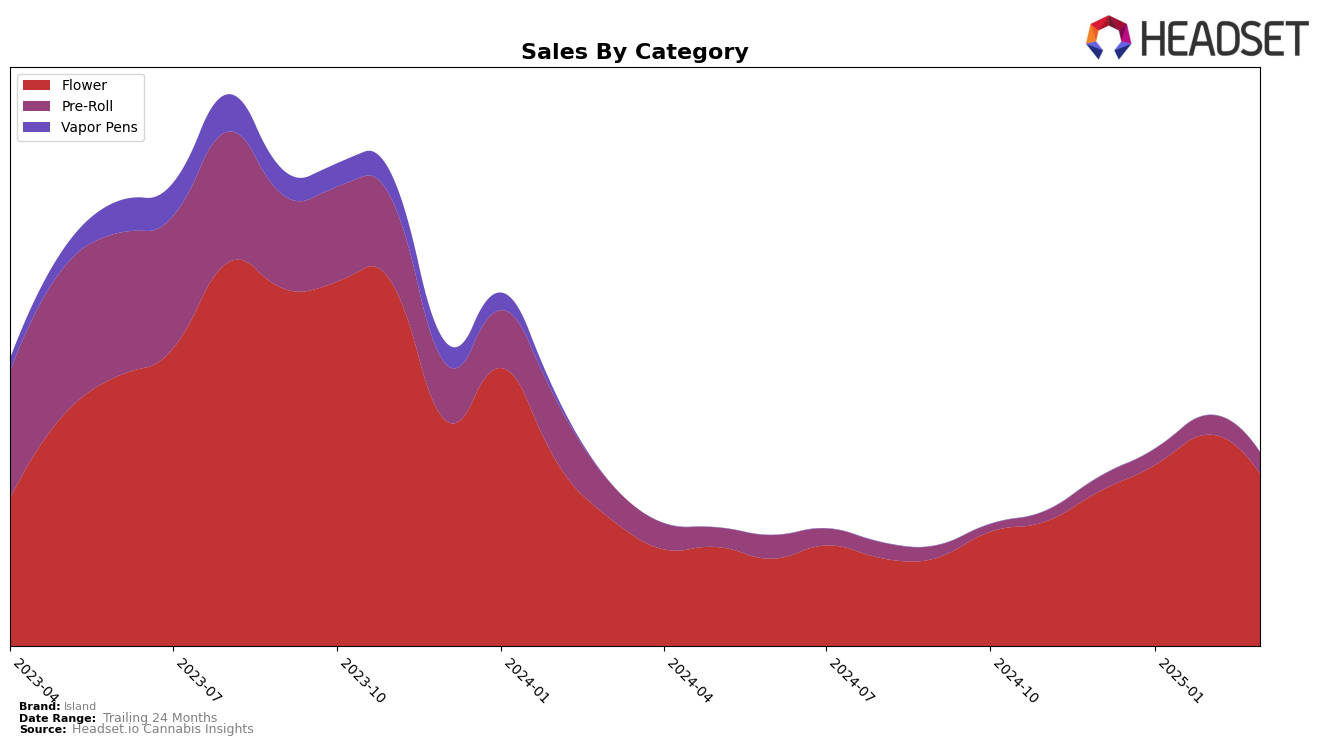

Island's performance in the Illinois market has shown some interesting movements, particularly in the Flower category. Starting from a rank of 25 in December 2024, the brand improved to 20 by February 2025, before slightly dropping to 23 in March 2025. This fluctuation corresponds with a notable increase in sales from $741,814 in December to $959,903 in February, indicating a strong demand before a slight decline. In the Pre-Roll category, however, Island did not manage to break into the top 30, suggesting room for growth despite some sales increases. These shifts highlight the brand's potential to capitalize on its strengths in the Flower category while needing to strategize better in Pre-Rolls.

In Massachusetts, Island's Flower category performance exhibited a different trend. The brand moved from a low rank of 56 in December 2024 to 34 by February 2025, reflecting a significant improvement. However, March 2025 saw a drop to rank 74, a notable decline that might concern stakeholders. This volatility suggests that while Island can achieve rapid growth in certain months, maintaining consistent performance remains a challenge. The sales figures parallel this trend, with a peak in January 2025 followed by a decrease in March. These insights could serve as a focal point for Island to address its market strategy in Massachusetts, particularly in sustaining momentum post-peak periods.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Island has shown a notable fluctuation in its rankings over the past few months, indicating a dynamic market presence. Starting from a position outside the top 20 in December 2024, Island climbed to the 20th spot by February 2025, before slightly dropping to 23rd in March 2025. This upward movement in February was accompanied by a significant increase in sales, suggesting a successful strategy or product launch during that period. In contrast, 93 Boyz maintained a consistent ranking around the 21st position, although their sales showed a slight decline from January to March. Meanwhile, (the) Essence demonstrated a strong performance, peaking at 18th in January, which may have contributed to competitive pressure on Island. Additionally, Kaviar and Interstate 420 were positioned lower in the rankings, with Kaviar showing a gradual improvement by March. These dynamics highlight the competitive challenges Island faces in maintaining and improving its market position in Illinois.

Notable Products

In March 2025, Island's top-performing product was Lemon Fatman (3.5g) in the Flower category, securing the number one rank with sales of 1882 units. Lemon Fatman Pre-Roll (1g) climbed to the second position from its third-place ranking in February, indicating a positive sales momentum. Layer Cake (3.5g) emerged in the third spot, maintaining a strong presence in the Flower category. Scooby Snacks (1g) and Kush Mints Pre-Roll (1g) rounded out the top five, both debuting in the rankings for March. The shifts in rankings suggest a growing consumer preference for Island's Flower products, with notable gains in the Pre-Roll category as well.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.