Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

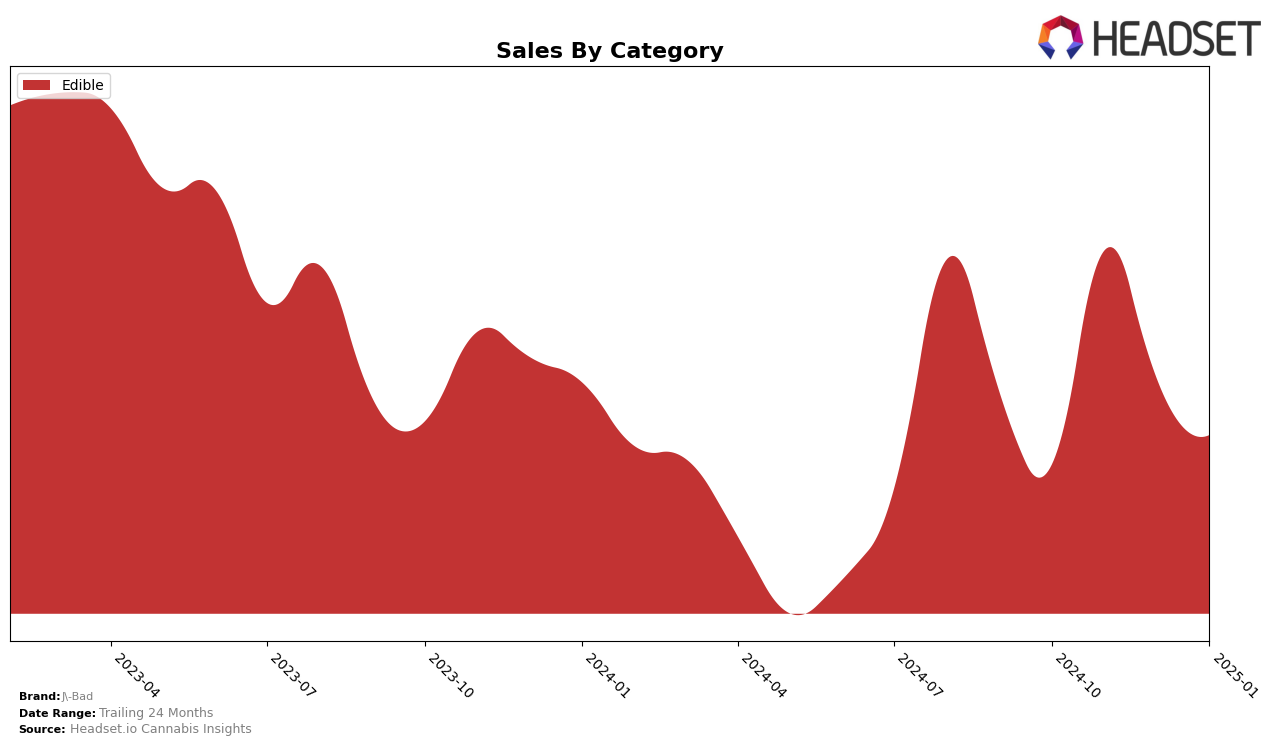

J-Bad has demonstrated a consistent presence in the Ohio edible market, maintaining a position within the top 30 brands over the past few months. Starting at rank 28 in October 2024, the brand improved to 25th place in November, showcasing a positive trajectory. However, it experienced a slight decline in December, dropping to 29th, before climbing back up to 27th in January 2025. This fluctuation indicates a competitive landscape where J-Bad has managed to sustain its market presence, albeit with some challenges in maintaining a steady upward climb.

Despite these ranking shifts, J-Bad's sales figures in Ohio reflect an interesting pattern. The brand saw a significant sales increase from October to November, followed by a decrease in December, and a slight rebound in January. While the sales in January 2025 did not match the November peak, the ability to remain within the top 30 brands each month suggests a resilient demand for J-Bad's edibles. The absence of J-Bad from the top 30 in other states or provinces could indicate potential areas for growth or a more focused strategy within Ohio's market.

Competitive Landscape

In the Ohio edible cannabis market, J-Bad has experienced fluctuations in its competitive positioning over the past few months. Notably, J-Bad's rank improved from 28th in October 2024 to 25th in November 2024, before slipping to 29th in December 2024 and recovering slightly to 27th in January 2025. This volatility contrasts with the more stable performance of competitors like Eden's Trees, which maintained a top-25 position throughout the same period, and Revive, which consistently hovered around the high 20s. Meanwhile, Wonder Wellness Co. demonstrated a notable rebound, climbing from 34th in December 2024 to 24th in January 2025, indicating a potential threat to J-Bad's market share. Despite these challenges, J-Bad's sales figures reveal resilience, with a significant sales increase in November 2024, although it faced a decline in December before stabilizing in January 2025. This dynamic landscape suggests that while J-Bad remains a competitive player, it must strategize to maintain and improve its market position amidst strong competition.

Notable Products

In January 2025, J-Bad's Field Pack - Green Apple Sour Gummy (110mg) maintained its position as the top-selling product, with a notable sales figure of 897 units. The Tangerine Sour Gummy 4-Pack (110mg) climbed to the second position, showing a significant improvement from its fifth place in December 2024. Field - Sour Peach Gummies (110mg) held steady at the third rank for two consecutive months. Sour Peach Gummies 16-Pack (440mg) also maintained its position, ranking fourth in January 2025, consistent with its December 2024 ranking. Notably, the Sour Blue Razz Gummies 4-Pack (110mg) experienced a drop, slipping from second place in December 2024 to fifth in January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.