Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

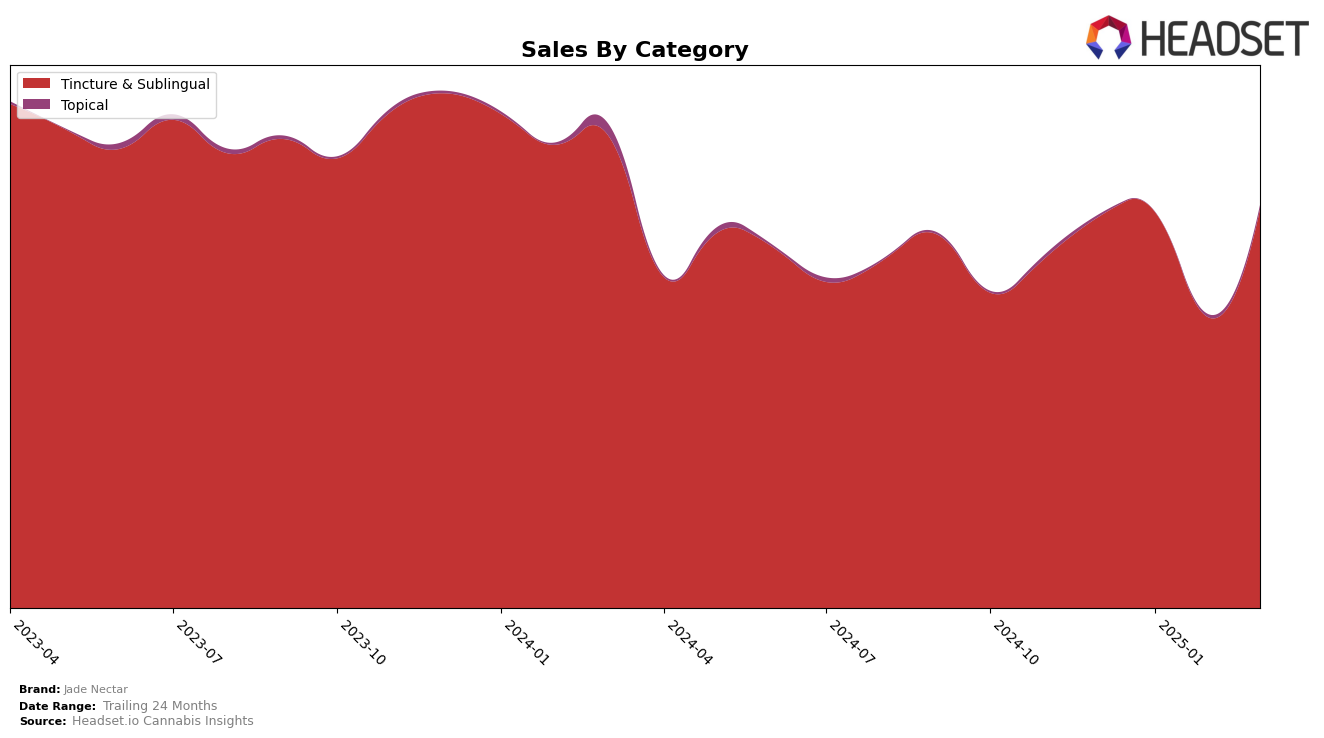

Jade Nectar has demonstrated a consistent presence in the California market, particularly in the Tincture & Sublingual category. Throughout the months from December 2024 to March 2025, the brand maintained a top 10 position, with a slight dip in February where it ranked 9th before returning to the 8th position in March. This stability suggests a strong consumer base and effective market strategies within California. The brand's sales figures, while fluctuating, show a noticeable recovery in March, indicating a potential seasonal trend or successful promotional activities that month.

In other states, Jade Nectar's performance is less visible, as they did not appear in the top 30 brands in any other state or category during this period. This absence could be seen as a missed opportunity for expansion or a strategic focus on their home state of California. The lack of presence in other markets might suggest that Jade Nectar is either not prioritizing growth outside California or is facing significant competition that limits its visibility in those regions. The brand's concentrated effort in California could be a double-edged sword, providing a stronghold in one market but potentially limiting broader brand recognition and revenue streams.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, Jade Nectar has shown a relatively stable performance, maintaining its rank around the 8th and 9th positions from December 2024 to March 2025. Despite a dip in sales in February 2025, Jade Nectar managed to recover by March, indicating resilience in its market position. In contrast, Friendly Farms consistently outperformed Jade Nectar, holding a higher rank and demonstrating stronger sales figures, particularly in January 2025. Meanwhile, ABX / AbsoluteXtracts maintained a steady 7th rank, directly above Jade Nectar, suggesting a competitive challenge for Jade Nectar to climb higher. Proof remained close in competition, often just a rank below or above Jade Nectar, which could indicate a potential opportunity for Jade Nectar to leverage its strengths to surpass Proof consistently. Overall, while Jade Nectar is holding its ground, there is a clear opportunity to strategize for improved market penetration and sales growth to challenge the leading brands in this category.

Notable Products

In March 2025, the top-performing product from Jade Nectar was the CBD/THC 30:1 CBD Drops with a remarkable sales figure of 1329 units, maintaining its first-place position consistently since December 2024. The Indica High Potency Tincture secured the second rank, showing a stable performance compared to February 2025. The Indica Sativa High Potency Blend Tincture improved its rank from fourth to third, indicating a positive sales trend. CBD/THC 20:1 CBD Drops for Pets maintained its fourth position, while the Sativa Tincture Drops, despite a dip in sales, held onto the fifth rank. Overall, the rankings for March 2025 remained relatively stable with minor shifts, reflecting consistent consumer preferences for Jade Nectar's tincture products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.