May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

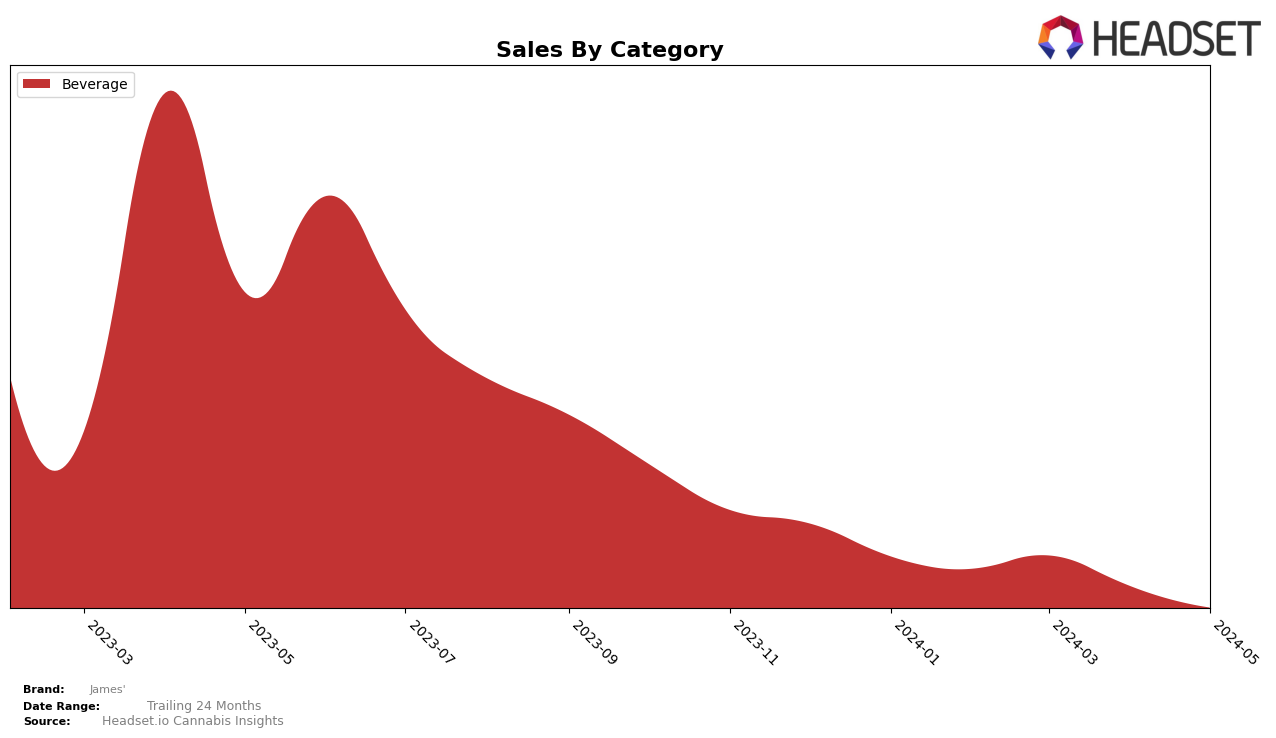

James' has shown notable performance in the Beverage category within Missouri. In February 2024, James' was ranked 8th, and by March 2024, it had climbed to 7th place, reflecting a positive trajectory. This upward movement indicates a growing acceptance and popularity of their products in the state. The brand's sales in Missouri increased from $13,449 in February to $16,316 in March, demonstrating a solid growth in consumer demand. However, the absence of rankings for April and May suggests that James' did not maintain a position within the top 30 brands during these months, which could be a cause for concern regarding its sustainability in the competitive market.

The lack of rankings in April and May across all categories and states indicates that James' might be facing challenges in maintaining its market presence beyond the initial months of 2024. This drop-off could be attributed to various factors such as increased competition, market saturation, or potential shifts in consumer preferences. The initial positive momentum in Missouri shows that James' has the potential to perform well, but the absence in the top 30 rankings later on highlights the need for strategic adjustments to regain and sustain market share. Monitoring future sales and rankings will be crucial to understanding the brand's long-term viability and success.

Competitive Landscape

In the competitive landscape of the Beverage category in Missouri, James' has shown promising performance, particularly in the first quarter of 2024. James' ranked 8th in February and improved to 7th in March. However, it is notable that James' did not appear in the top 20 brands for April and May, indicating a potential decline in market presence or sales. In contrast, High Five and Midwest Magic have demonstrated more consistent rankings. High Five improved from 9th in February to 7th in April, before dropping out of the top 20 in May. Meanwhile, Midwest Magic fluctuated, moving from 10th in February to 8th in March, then back to 10th in April, also not appearing in the top 20 in May. These trends suggest that while James' had a strong start to the year, it may need to address factors contributing to its recent decline to maintain competitiveness against brands like High Five and Midwest Magic, which have shown resilience and adaptability in the Missouri market.

Notable Products

In May-2024, the top-performing product from James' was Fruit Punch Drink (100mg THC, 16oz) in the Beverage category, maintaining its number one rank from April-2024 with a notable sales figure of 119 units. Hybrid Infused Lemonade (20mg THC, 8oz) climbed to the second position from its consistent fourth rank in the previous months, showing a slight increase in sales to 20 units. Fruity Punch Drink (20mg THC, 8oz) held steady at the third rank, despite a significant drop in sales to 15 units. Hybrid Infused Lemonade (100mg THC, 16oz) saw a sharp decline, falling from second to fourth place with only 9 units sold. Notably, Pink Lemonade Fruit Drink (100mg) did not appear in the rankings for May-2024, indicating a potential discontinuation or a significant drop in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.