Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

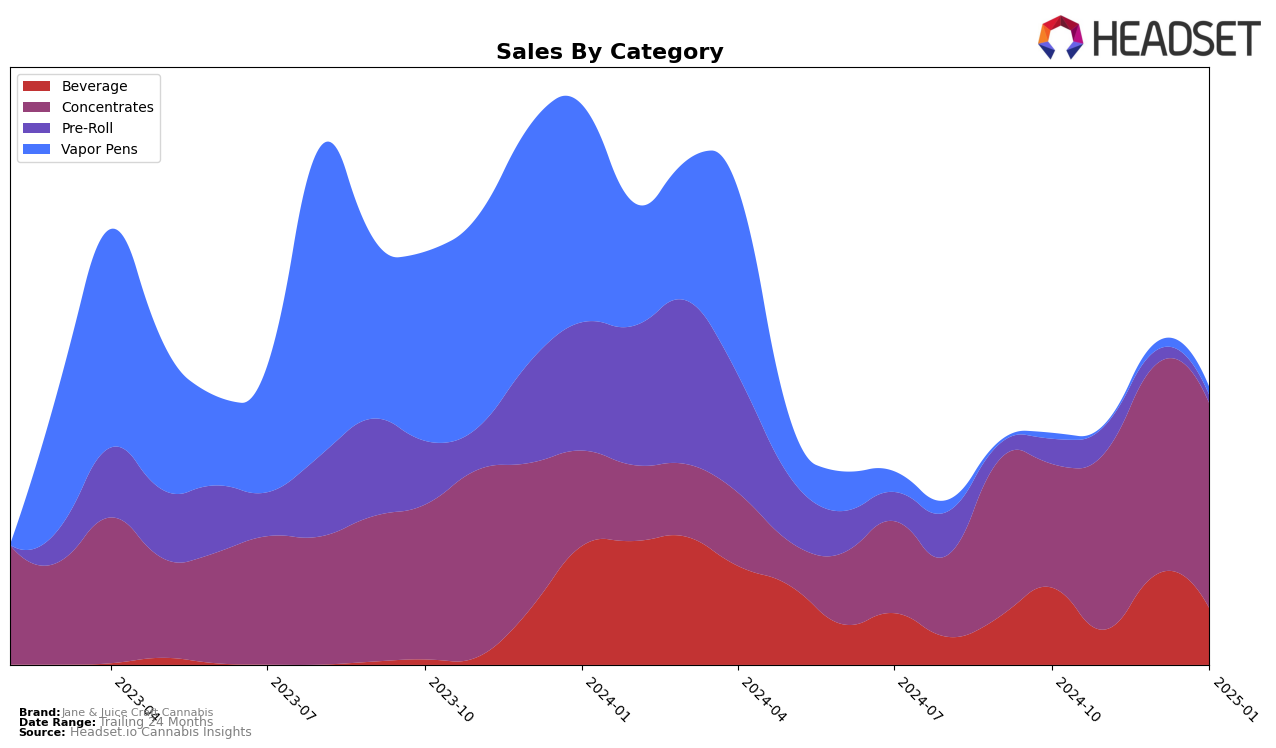

In the competitive landscape of cannabis brands, Jane & Juice Craft Cannabis has shown notable performance variations across different states and categories. In the Ontario market, the brand has not secured a spot in the top 30 for the Concentrates category over the last few months, indicating a challenging environment or potential areas for growth. Despite this, the brand has maintained a steady sales volume, with a slight decrease from October 2024 to January 2025. This trend suggests that while the brand is not leading in rankings, it has a consistent consumer base that continues to engage with its products.

Interestingly, the data from Ontario reveals a gradual decline in sales from October 2024 to January 2025, with the brand's sales figures dropping from $12,895 in October to $10,705 in January. This downward trajectory in sales might reflect broader market trends or increased competition in the Concentrates category. The absence of Jane & Juice Craft Cannabis from the top 30 rankings could be a point of concern, highlighting the need for strategic adjustments to enhance market penetration and visibility. Understanding these dynamics is crucial for stakeholders looking to optimize brand performance and capture a larger market share in the evolving cannabis industry.

Competitive Landscape

In the competitive landscape of concentrates in Ontario, Jane & Juice Craft Cannabis has experienced a challenging period, with its rank fluctuating between 53rd and 57th from November 2024 to January 2025. This indicates a struggle to maintain a strong foothold in the market, especially when compared to competitors like Good Supply, which held a solid 10th position in November 2024. Despite the competitive pressure, Jane & Juice Craft Cannabis has managed to maintain a consistent presence in the top 60, unlike Viola, which did not make it into the top 20 during this period. However, brands like Stigma Grow and Jublee have shown more dynamic movements, with Jublee even surpassing Jane & Juice Craft Cannabis in December 2024. The sales figures reflect these rankings, with Jane & Juice Craft Cannabis experiencing a downward trend, which could be a signal for the brand to reassess its market strategies to regain a competitive edge.

Notable Products

In January 2025, the top-performing product for Jane & Juice Craft Cannabis was the CBD/THC/CBG/CBN 2:2:1:1 The Dream Drops Ampules from the Beverage category, which ascended to the number one rank with impressive sales of 716 units. Following closely, the CBD;THC 1:1 Synchronicity Drops Ampules, also in the Beverage category, held the second position, maintaining its strong performance from previous months. MTL Blonde Hash, a Concentrates product, secured the third rank, showing consistency in its placement. Black Cherry Punch Shatter, another Concentrates item, entered the rankings at fourth position, marking its first appearance in the top five. The Gold Rush Drop ampules, despite being in the top five, remained steady at fifth place, reflecting a stable yet less dominant sales trend compared to other months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.