Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

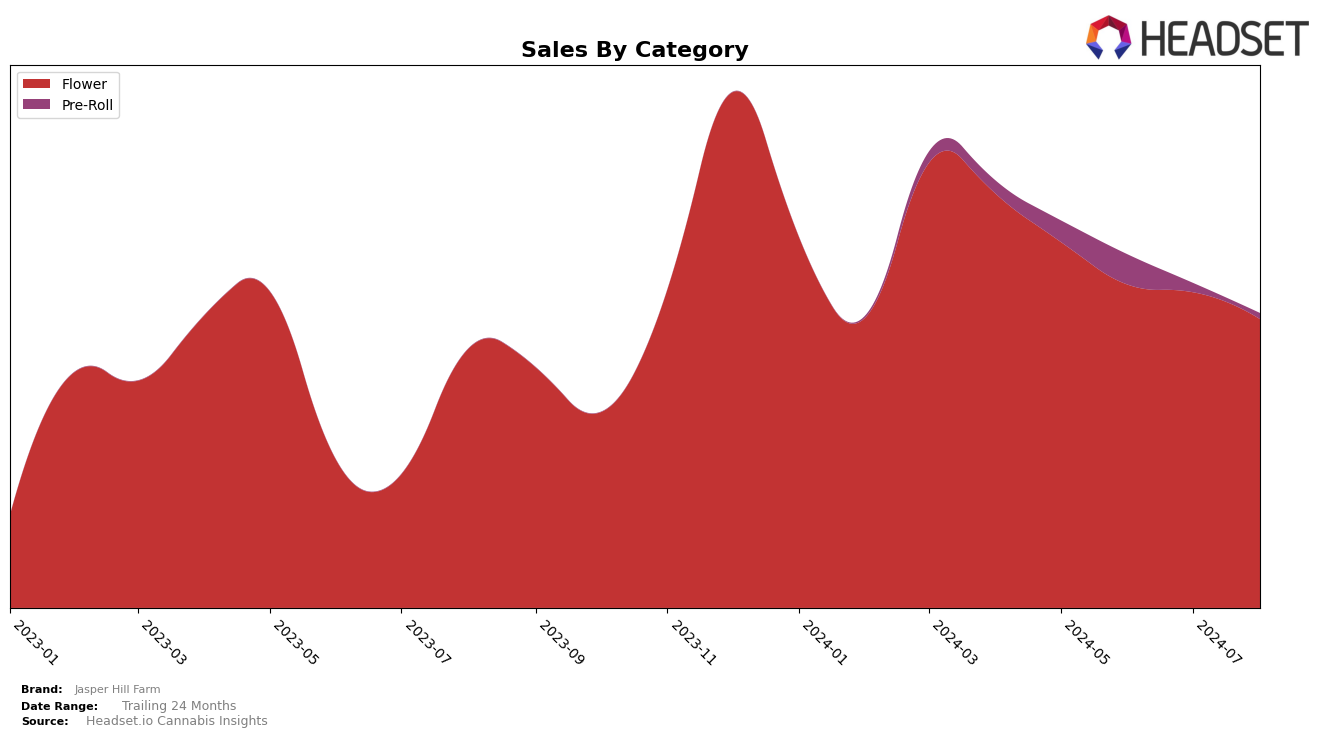

Jasper Hill Farm has shown a consistent presence in the Nevada cannabis market, particularly in the Flower category. Over the past four months, the brand has maintained its position within the top 30, although there has been some fluctuation in its rankings. In May 2024, Jasper Hill Farm was ranked 25th, slightly improving to 24th in June, then returning to 25th in July, and finally dropping to 30th in August. This movement suggests a stable yet competitive performance in the Flower category. However, the brand's sales figures have shown a downward trend, decreasing from $278,317 in May to $219,670 in August, indicating potential challenges in maintaining market share or consumer interest.

In the Pre-Roll category, Jasper Hill Farm's performance in Nevada has been less consistent. The brand ranked 64th in May 2024 but saw a significant improvement to 48th in June. Unfortunately, it did not maintain this upward momentum, as it fell out of the top 30 rankings in July and August. This inconsistency could be seen as a negative indicator of the brand's ability to compete in the Pre-Roll market. Despite this, the sales figures for June show a positive trend with an increase to $22,639 from May's $16,161, suggesting that there was a brief period of increased consumer interest or effective marketing efforts during that month.

Competitive Landscape

In the competitive landscape of the Flower category in Nevada, Jasper Hill Farm has experienced a notable decline in rank and sales over the past few months. Starting at rank 25 in May 2024, Jasper Hill Farm dropped to rank 30 by August 2024, indicating a downward trend. This decline is contrasted by the performance of competitors such as The Grower Circle, which improved from rank 42 in May to rank 28 in August, and TRENDI, which rose from rank 40 to rank 29 over the same period. Meanwhile, Polaris MMJ and Fleur showed fluctuating ranks but did not surpass Jasper Hill Farm consistently. The competitive pressure from these brands, especially those showing upward trends, suggests that Jasper Hill Farm needs to strategize effectively to regain its market position and counteract the sales decline observed in recent months.

Notable Products

In August 2024, the top-performing product from Jasper Hill Farm was Lemon MACmelon (3.5g) in the Flower category, maintaining its rank from July with sales of 2044 units. Sour Durban Cookies (3.5g) took the second spot, showing a strong resurgence after not being ranked in the previous months, with notable sales of 1261 units. Lemon Pastries (3.5g) entered the rankings at third place, while Mango Mentality (3.5g) dropped to fourth place from its previous second place in May. Ruby Violet (3.5g) rounded out the top five, dropping from its second place in July to fifth in August. This shift indicates a dynamic market with fluctuating consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.