Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

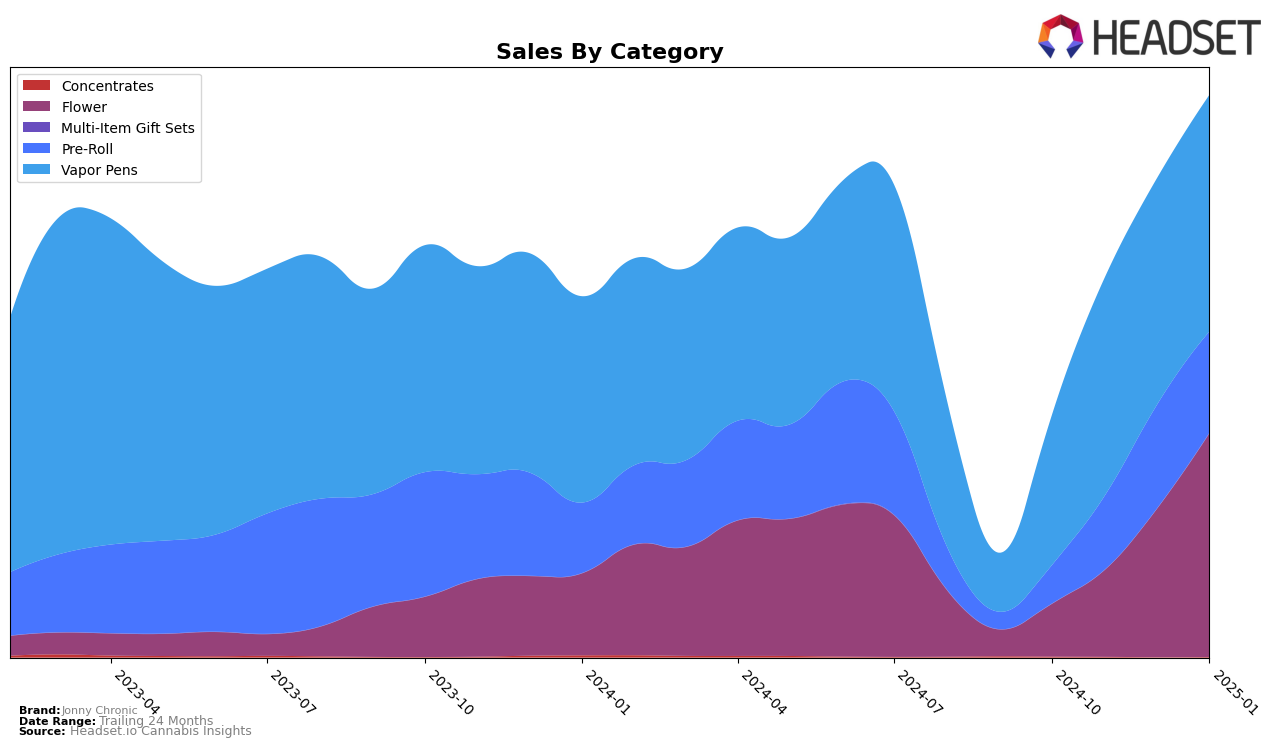

Jonny Chronic has shown a varied performance across different categories and provinces. In the Alberta market, the brand has struggled to maintain a top position in the Flower and Pre-Roll categories, where it failed to secure a spot in the top 30 for October 2024 and continued to slide downward in subsequent months. However, the Vapor Pens category in Alberta tells a different story, with Jonny Chronic climbing from a rank of 51 in October 2024 to 15 by January 2025, reflecting a significant upward trajectory in sales performance. This suggests a growing consumer preference for their vapor pen products in this region.

In contrast, the performance in British Columbia and Ontario shows a more consistent improvement across multiple categories. In British Columbia, Jonny Chronic's Flower category improved significantly, advancing from rank 55 in October 2024 to 15 in January 2025. This upward trend is mirrored in Ontario, where the Flower category climbed from 68 to 27 over the same period. Notably, Jonny Chronic's Vapor Pens have maintained a strong presence in both provinces, with consistent top 20 rankings, demonstrating their strength in this category. Meanwhile, the brand's performance in the Saskatchewan market for Vapor Pens remained stable, consistently holding a top 10 position, which indicates a strong foothold in this specific product line within the province.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Jonny Chronic has demonstrated a remarkable upward trajectory in both rank and sales over the past few months. Starting from a rank of 68 in October 2024, Jonny Chronic has climbed steadily to reach the 27th position by January 2025, showcasing a significant improvement in market presence. This ascent is particularly notable when compared to competitors like BLKMKT, which remained outside the top 20 throughout the same period, and Carmel, which saw a decline from 21st to 29th place. Meanwhile, Divvy and Parcel maintained relatively stable positions, with Divvy slightly improving and Parcel experiencing minor fluctuations. Jonny Chronic's sales growth trajectory, moving from $152,634 in October to $567,677 in January, underscores its increasing consumer appeal and competitive edge in the Ontario market.

Notable Products

In January 2025, Jonny Chronic's top-performing product was Cherry Bomb Reefers Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its number one rank from the previous month with sales of 7,835 units. Following closely, the Reefers - Northern Lights Pre-Roll 3-Pack (1.5g) entered the rankings for the first time, securing the second position with notable sales. The Blueberry Kush Live Resin Cartridge (1g) in the Vapor Pens category dropped from second to third place, despite a steady increase in sales reaching 5,878 units. Acapulco Gold Live Resin Cartridge (1g) held its consistent fourth rank, showing a gradual sales increase over the months. Lastly, Acapulco Gold (3.5g) in the Flower category maintained its fifth position, continuing its upward sales trajectory.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.