Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

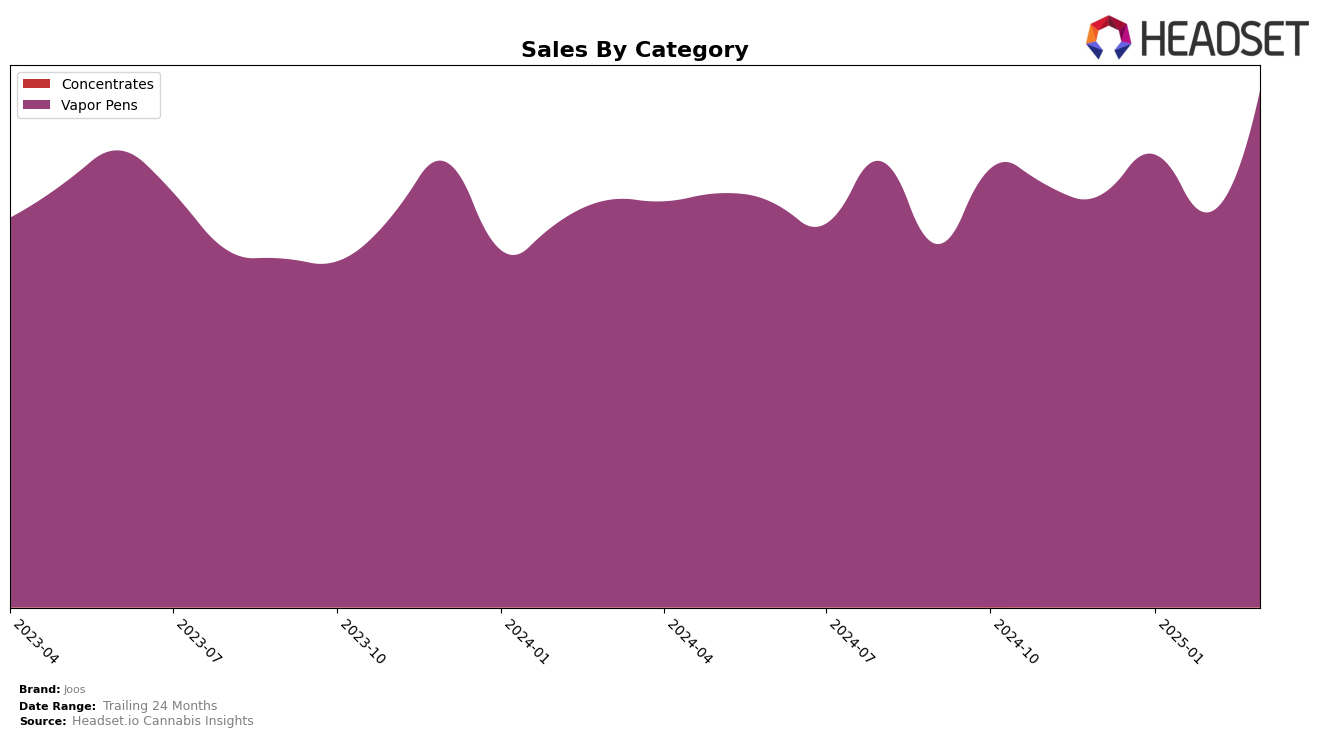

In the state of Illinois, Joos has shown consistent performance in the Vapor Pens category. Throughout the months from December 2024 to March 2025, Joos maintained a solid presence within the top 5 brands, fluctuating between the 3rd and 4th positions. This indicates a stable demand for their products in this category, with a notable peak in sales during March 2025. Such performance suggests that Joos has managed to capture and retain a significant share of the Illinois market in the Vapor Pens segment, which could be attributed to consumer loyalty or effective brand strategies.

However, the absence of Joos in the top 30 brands in other states or categories during the same period may suggest areas where the brand has yet to establish a strong foothold. This lack of presence could be interpreted as either a challenge or an opportunity for growth, depending on their strategic goals. The variability in their rankings across different states and categories highlights the competitive nature of the cannabis market and the importance of targeted market strategies to expand Joos' reach and influence.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, Joos has demonstrated notable resilience and adaptability. Over the period from December 2024 to March 2025, Joos experienced fluctuations in its rank, moving from 4th to 3rd in January, then back to 4th in February, and again climbing to 3rd in March. This dynamic positioning highlights Joos's ability to effectively compete with major players like &Shine, which consistently held the top rank, and Select, which maintained a steady 2nd position. Despite these shifts, Joos's sales trajectory shows a positive trend, particularly with a significant increase in March 2025, suggesting successful strategic initiatives or product offerings that resonated with consumers. Meanwhile, Ozone and (the) Essence have remained stable in their respective ranks, with Ozone occasionally swapping positions with Joos, indicating a closely contested market space. This competitive environment underscores the importance for Joos to continue innovating and leveraging market insights to sustain and enhance its market position.

Notable Products

In March 2025, Northern Lights Distillate Cartridge (1g) emerged as the top-performing product for Joos, reclaiming its number one rank with sales figures reaching 6772. OG Kush Distillate Cartridge (1g) followed closely, slipping from its previous top spot in February to rank second with sales of 6733. Notably, Green Crack Distillate Cartridge (1g) made a strong debut in the rankings at third place, indicating a successful launch. Chicago Blue Dream CDT Distillate Cartridge (1g) improved its position from fifth in February to fourth in March. Meanwhile, Jack Herer CDT Distillate Cartridge (1g) saw a slight drop, moving from third to fifth place over the same period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.