Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

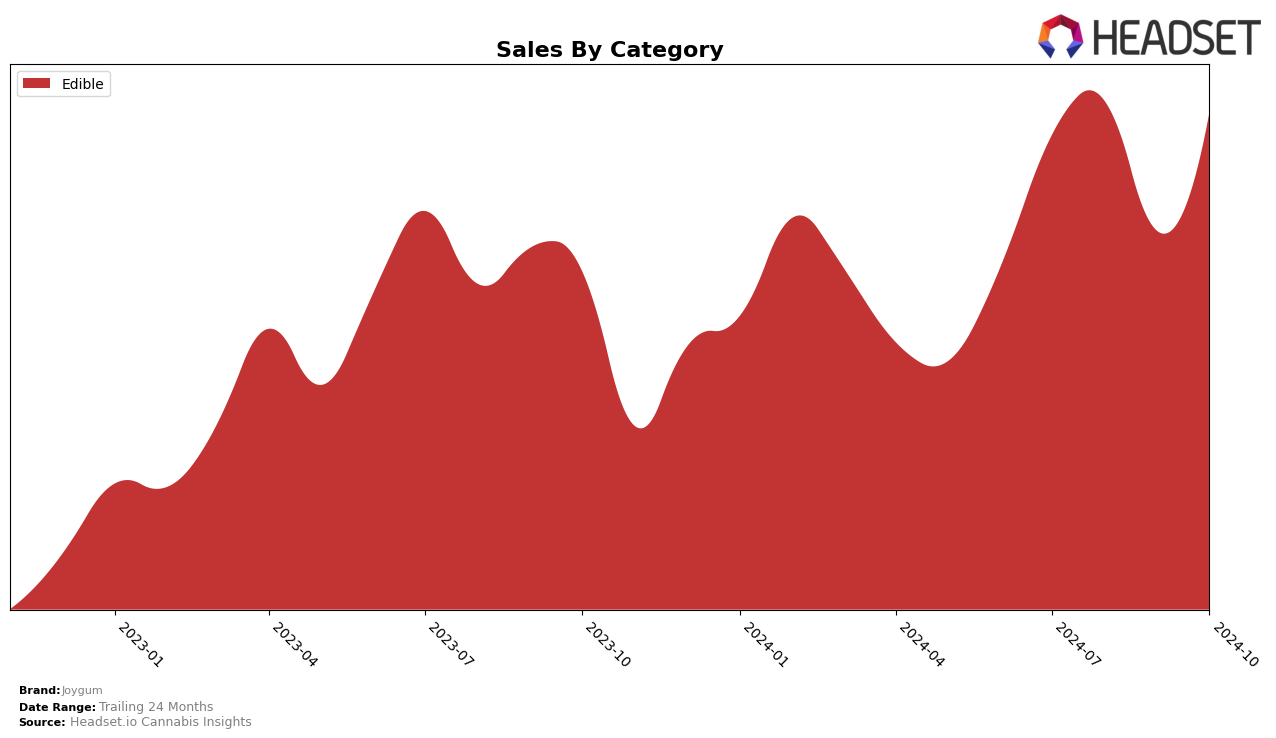

Joygum has demonstrated a consistent performance in the Colorado edibles market, maintaining a steady rank of 7th from July to October 2024. This stability suggests a strong foothold in the region, with sales figures reflecting a slight dip in September followed by a recovery in October. In contrast, Joygum's presence in the Massachusetts edibles market shows a more dynamic movement. Starting at the 25th position in July, the brand improved its ranking to 20th by October, indicating a positive trend and increasing acceptance among consumers. The steady climb in rankings in Massachusetts highlights Joygum's potential for growth in this competitive market.

While Joygum has successfully maintained its position in Colorado, its fluctuating rankings in Massachusetts suggest a strategic focus on enhancing its market presence in the state. The absence of Joygum from the top 30 in any other states or categories could be seen as a missed opportunity for expansion, or it could indicate a targeted approach to solidifying its brand in key markets before broadening its reach. The upward trend in Massachusetts, coupled with consistent sales in Colorado, underscores the brand's efforts to balance stability with growth, potentially setting the stage for future expansion. However, further analysis would be needed to understand the full scope of Joygum's market strategy and its implications for future performance.

Competitive Landscape

In the Colorado edible market, Joygum has maintained a consistent rank of 7th place from July to October 2024, indicating a stable position amidst fluctuating sales dynamics. Despite a dip in sales in September, Joygum rebounded in October, showcasing resilience and the potential for growth. Competitors such as Dialed In Gummies and Good Tide have experienced more volatility in their rankings and sales, with Dialed In Gummies dropping from 4th to 6th place and Good Tide climbing to 5th place in October. Meanwhile, Incredibles and Smokiez Edibles have shown steady improvements, with Smokiez Edibles advancing from 12th to 9th place. This competitive landscape suggests that while Joygum remains a strong contender, there is a dynamic shift among its competitors, which could impact its future market position and sales strategies.

Notable Products

In October 2024, Joygum's top-performing product was Joybombs - Sour Fruit Chews 40-Pack (100mg), maintaining its first-place rank for four consecutive months with sales reaching 10,697 units. Following closely, Joy Bombs - Original Fruit Chews 40-Pack (100mg) secured the second position consistently over the same period. The Joybomb - CBD/THC 1:1 Sour Berry Blend Chew 40-Pack (100mg CBD, 100mg THC) continued to hold the third spot, showing stable performance. Joybombs - Tropical Haze Fruit Chews 40-Pack (100mg) remained in fourth place, indicating steady consumer preference. Notably, the Joybomb - CBN:THC 1:1 Dream Blend Chew 40-Pack (100mg CBN, 100mg THC) debuted at fifth place, marking its entry into the top rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.