Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

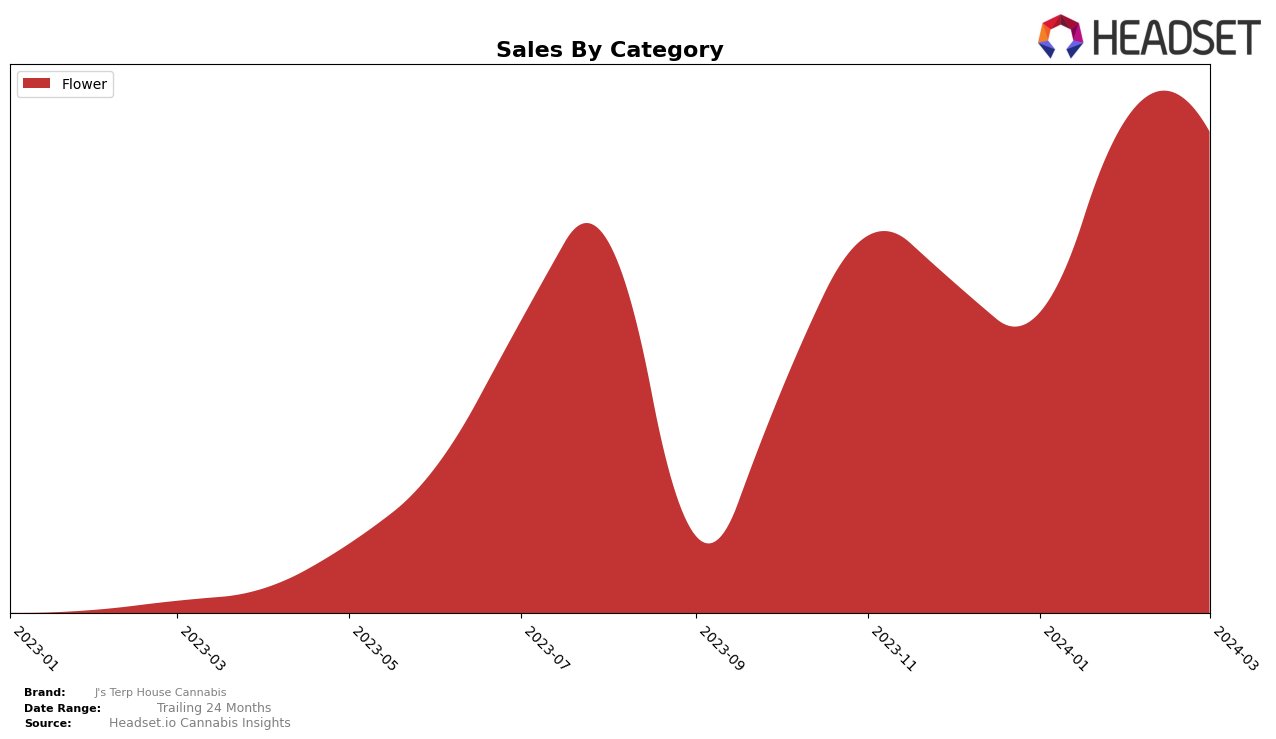

In Michigan, J's Terp House Cannabis has shown a notable improvement in its performance within the Flower category over the recent months. Initially, the brand was not ranked within the top 30 brands in December 2023 and January 2024, which indicates a potential lack of visibility or consumer preference during those months. However, a significant turnaround is observed as the brand jumped to the 22nd position in February 2024, followed by a slight adjustment to the 24th position in March 2024. This upward movement in rankings is a positive indicator of increasing consumer interest and possibly enhanced marketing efforts. The sales data reflects this positive trend, with a remarkable increase from December’s sales of $693,897 to March's sales figures, showcasing the brand's growing traction in Michigan's competitive cannabis market.

The consistency in J's Terp House Cannabis's performance, especially in the Flower category, suggests a growing consumer base and improved brand recognition. While the initial absence from the top 30 rankings might have been a cause for concern, the subsequent rise in the rankings highlights the brand's resilience and ability to capture market share. Although specific sales figures after December 2023 are not disclosed, the directional movement in sales, alongside the rankings, suggests a healthy growth trajectory. This performance is particularly impressive given the competitive nature of Michigan's cannabis market, where numerous brands vie for consumer attention. J's Terp House Cannabis's journey from not being in the top 30 to securing a place among them within a few months is an achievement that signals potential for further growth and market penetration.

Competitive Landscape

In the competitive landscape of the Michigan flower cannabis market, J's Terp House Cannabis has shown a notable performance amidst its competitors. From December 2023 to March 2024, J's Terp House Cannabis experienced a fluctuation in rank, moving from 37th to 24th position, indicating a positive trajectory in its market presence. This is particularly impressive when compared to brands like Galactic (fka Galactic Meds), which saw a significant rise and fall within the same period, and Glacier Cannabis, which also experienced volatility in its rankings. Notably, Pressure Pack made a remarkable leap from 68th to 22nd place before stabilizing, showcasing the dynamic nature of the market. Meanwhile, Fawn River maintained a relatively stable position, closely aligning with J's Terp House Cannabis in terms of market movements. The upward movement in rank for J's Terp House Cannabis, coupled with its sales increase, suggests a growing consumer preference and market share within Michigan's competitive flower category, positioning it as a brand to watch in the evolving cannabis landscape.

Notable Products

In March 2024, J's Terp House Cannabis saw Cherry Runtz (28g) leading its sales with a remarkable figure of 2358 units, positioning it as the top-selling product in their lineup. Following closely were J Roc Moon Rocks (1g) and Kush Sorbet (28g), securing the second and third spots, respectively, indicating a strong preference for flower category products among their customers. Banana Jealousy (28g) and Mango Madness (28g) rounded out the top five, showcasing a diverse interest in flavor profiles. Notably, this month marked a significant shift in consumer preferences, as there were no previous data points for these products in the months leading up to March, suggesting either new introductions or a resurgence in popularity. This change highlights the dynamic nature of the cannabis market and J's Terp House Cannabis's ability to capture interest with their product offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.