Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

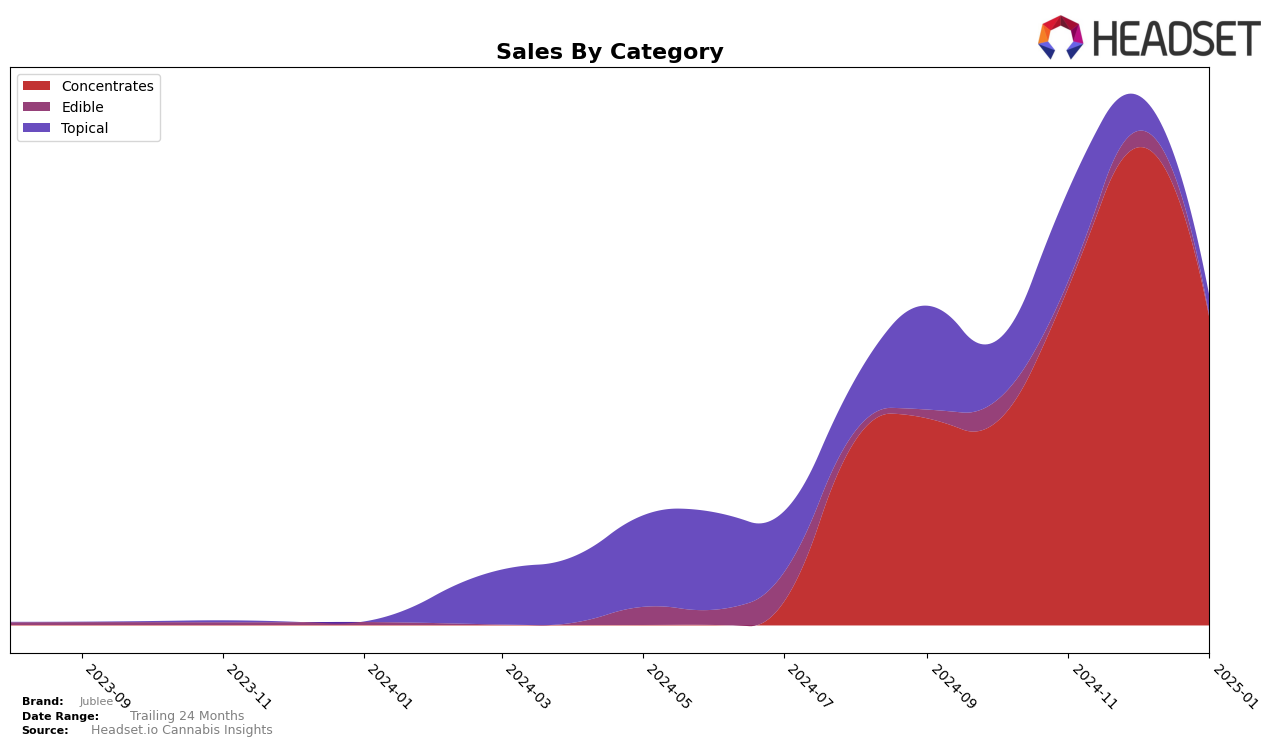

In the Canadian market, Jublee has shown fluctuating performance across different categories and provinces. Notably, in the Concentrates category in Ontario, Jublee was absent from the top 30 brands in October 2024, which indicates a challenging period for the brand. However, they managed to break into the rankings in subsequent months, peaking at 49th place in December 2024 before dropping to 56th in January 2025. This movement suggests that while Jublee is making efforts to improve its market presence, sustaining a consistent upward trajectory remains a challenge. The sales figures reflect this volatility, with a noticeable dip in January 2025 compared to previous months.

Jublee's performance in other states or provinces is not detailed here, but the available data from Ontario offers insights into their market dynamics. The brand's ability to re-enter the rankings after being absent highlights potential strategies or market conditions that could be influencing their performance. While specific sales numbers are not provided for other regions, observing the trends in Ontario could offer a microcosm of their broader market strategy. For those interested in a deeper dive into Jublee's performance across other categories and regions, further exploration into additional datasets would be beneficial.

Competitive Landscape

In the Ontario concentrates market, Jublee has shown a dynamic performance over the last few months, with its rank fluctuating from 55th in November 2024 to a peak at 49th in December 2024, before sliding back to 56th in January 2025. This volatility in rank suggests a competitive landscape where Jublee is jostling for position against brands like Stigma Grow, which maintained a relatively stable presence with ranks ranging from 47th to 57th during the same period. Notably, Jane & Juice Craft Cannabis and Wildcard Extracts also present competition, with both brands consistently appearing in the top 60. Despite the fluctuations, Jublee's sales saw a significant increase in December 2024, indicating a potential for growth if the brand can stabilize its market position. This competitive analysis highlights the need for Jublee to strategize effectively to maintain and improve its rank amidst strong contenders in the Ontario concentrates category.

Notable Products

In January 2025, Montreal Style Aged Hash (2g) from the Concentrates category maintained its position as the top-selling product for Jublee, consistent with its rank from previous months. Its sales figures reached 393 units, reflecting a slight decline from December 2024. The CBD Sweet Citrus Extra Strength Bath Salt (1000mg CBD, 250g) held onto the second position, showing stability in its ranking despite a decrease in sales figures. CBN Blueberry & Lavender Fruit Snacks 2-Pack (40mg CBN) occupied the third rank, dropping from its second-place finish in December 2024. Notably, the CBD Banana & Chocolate Fruit Bites 4-Pack (100mg CBD) re-entered the rankings in fifth place, marking its first appearance since October 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.