Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

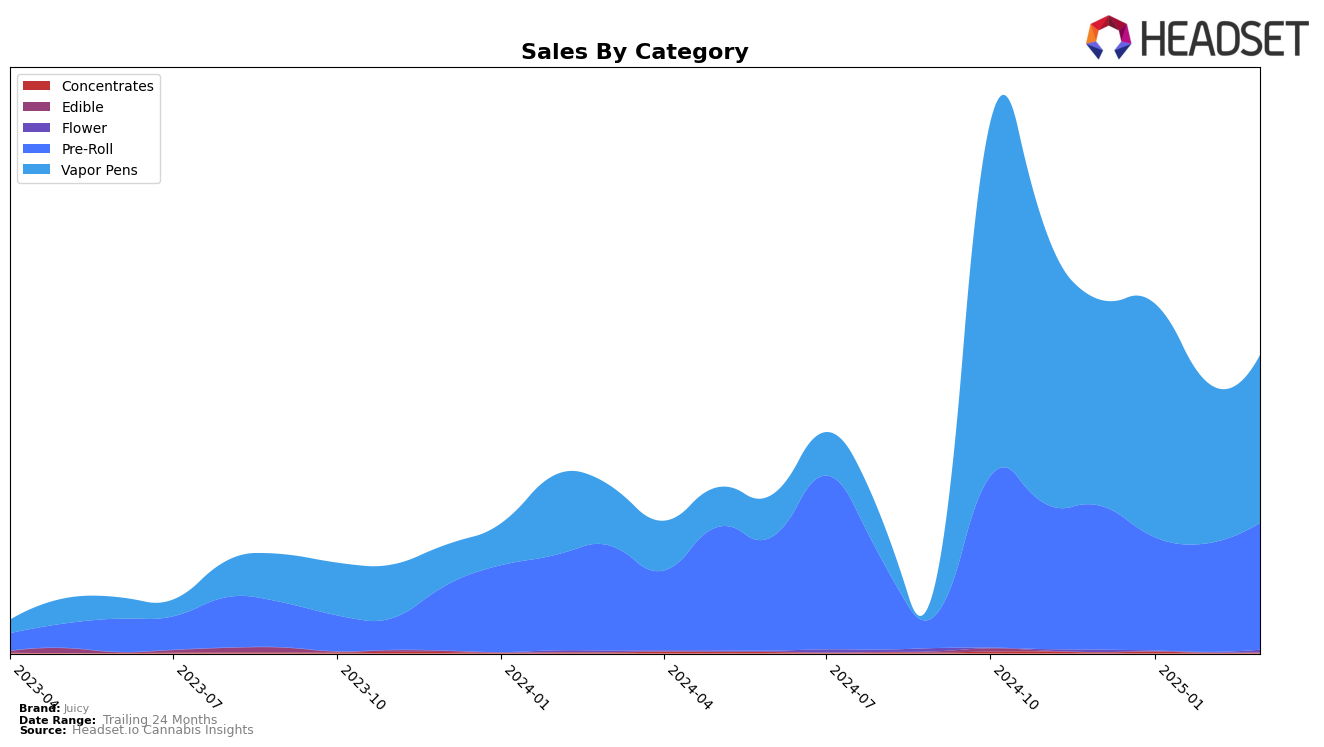

Juicy's performance across various product categories in Colorado has shown some notable trends over recent months. In the Pre-Roll category, Juicy maintained a steady presence in the top 30, although its rank slightly decreased from 16th in December 2024 to 21st by March 2025. This decline in ranking could be concerning, as it indicates increased competition or a potential drop in consumer preference for Juicy's Pre-Rolls. However, it is worth noting that despite the drop in ranking, their sales figures showed a positive uptick in March 2025, suggesting a rebound or successful promotional efforts during that period.

In the Vapor Pens category, Juicy's performance in Colorado has been less consistent, with rankings fluctuating outside the top 30 in February 2025, before climbing back to 39th place in March 2025. This volatility might reflect challenges in maintaining market share or adapting to consumer trends within the Vapor Pens segment. Despite this, Juicy's sales in this category indicate some resilience, as seen by the increase in sales from February to March 2025. The brand's ability to recover in terms of sales, even when rankings dipped, suggests potential strategic adjustments that could be explored further for insights into their operational tactics.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Juicy has experienced notable fluctuations in its market position from December 2024 to March 2025. Despite a dip in February, Juicy managed to maintain a relatively stable rank, closing March at 39th, slightly improving from its February position of 41st. This stability is significant given the competitive pressures from brands like Pyramid Pens, which consistently outperformed Juicy, ranking as high as 33rd in January. Meanwhile, Newt Brothers Artisanal showed a strong upward trend, improving from 53rd in December to 38th in March, indicating a potential threat to Juicy's market share. Juicy's sales figures reflect these ranking dynamics, with a peak in January followed by a decline in February, before recovering slightly in March. This suggests that while Juicy is holding its ground, it must strategize to counteract the rising momentum of competitors like Newt Brothers Artisanal and maintain its competitive edge in the Colorado vapor pen market.

Notable Products

In March 2025, Juicy's top-performing product was the Planet Of The Grapes Distillate Cartridge (1g) in the Vapor Pens category, maintaining its consistent number one rank from previous months with sales of 1755 units. Revenge of the Blueberries Infused Pre-Roll (1g) secured the second position, a rank it also held in February, showing a stable performance with notable sales growth. The Planet of the Grapes Infused Pre-Roll (1g) entered the rankings at third place, indicating strong market entry. What a Melon Infused Pre-Roll (1g) dropped slightly to fourth place from its earlier position in February, while Purp Fiction Infused Pre-Roll (1g) rounded out the top five, climbing from a previous fourth-place rank in January. These shifts highlight competitive dynamics within Juicy's product lineup, particularly in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.