Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

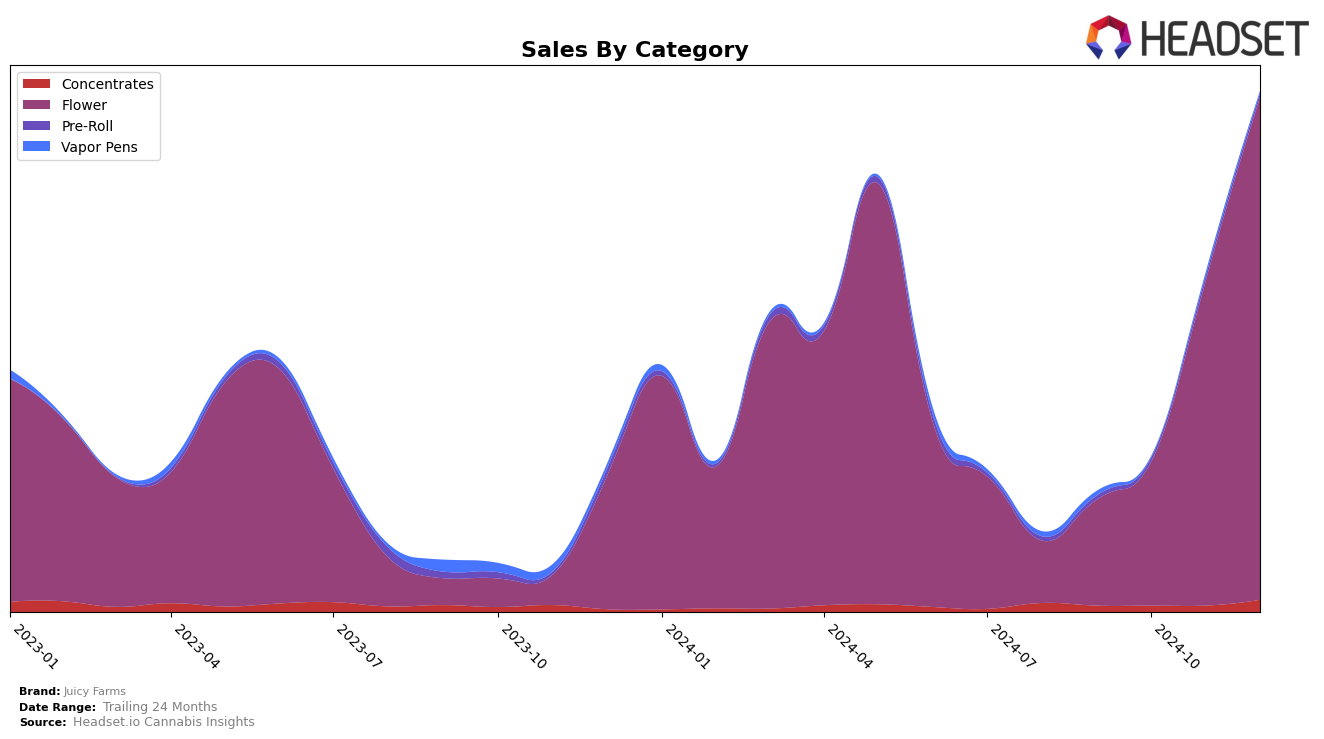

Juicy Farms has shown a notable upward trajectory in its performance within the Flower category in the state of Oregon. Starting from a rank of 91 in September 2024, the brand made significant strides to reach the 18th position by December 2024. This impressive climb suggests a growing consumer preference and possibly effective strategic initiatives by the brand. Despite not being in the top 30 at the beginning of this period, Juicy Farms' December ranking highlights its successful penetration and increasing market share in Oregon's competitive cannabis market.

The sales figures for Juicy Farms in Oregon reflect a positive trend, with a substantial increase from September to December 2024, indicating strong market demand and possibly effective distribution strategies. However, it's important to note that Juicy Farms' performance in other states or provinces is not provided here, which could offer additional insights into its broader market strategy. This focused success in Oregon might suggest a targeted approach, potentially leaving room for further expansion or similar strategic efforts in other regions. The absence of rankings in other states might suggest limited presence or focus outside Oregon, which could be a strategic decision or an area for future growth.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Juicy Farms has demonstrated a remarkable upward trajectory in recent months, climbing from a rank of 91 in September 2024 to an impressive 18 by December 2024. This significant improvement in rank is indicative of a substantial increase in market presence and consumer preference. Juicy Farms' sales growth is noteworthy, especially when compared to competitors like Oregrown, which improved its rank from 35 to 16, and Meraki Gardens, which saw fluctuations but maintained a strong position, peaking at rank 7 in November. Meanwhile, Rogue River Family Farms and Garden First also showed positive trends, but Juicy Farms' rapid ascent suggests a more aggressive capture of market share. This trend positions Juicy Farms as a formidable player in the Oregon flower market, potentially influencing consumer choices and competitive strategies in the coming months.

Notable Products

In December 2024, Gold Dropz (7g) emerged as the top-performing product for Juicy Farms, achieving the number one rank with a notable sales figure of 3816 units. Marionberry Kush (7g) followed closely in second place, maintaining a strong position from its previous rank of first in November. Gaschata (14g) entered the rankings for the first time, securing the third spot. Garlic Mac (14g) and Boston Runtz (14g) completed the top five, both experiencing a slight decline from their previous positions. Overall, the rankings indicate a dynamic shift in consumer preferences, with Gold Dropz (7g) making a significant leap to the top from its fifth-place start.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.