Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

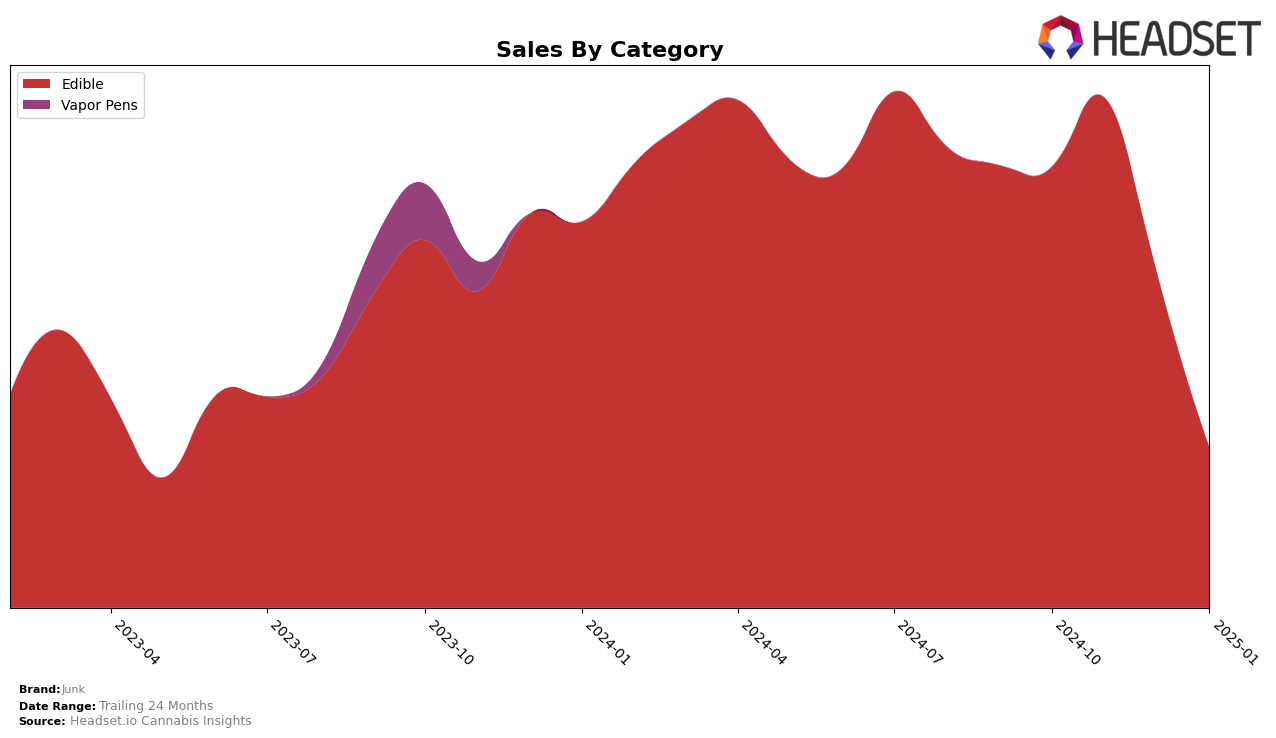

Junk's performance in the Edible category in Oregon has shown notable fluctuations over the past few months. Starting from a solid position at rank 16 in both October and November 2024, the brand experienced a decline, slipping to rank 23 in December and further to rank 29 by January 2025. This downward trend suggests challenges in maintaining market share, possibly due to increased competition or shifts in consumer preferences. Despite a commendable sales figure of $67,751 in November, the subsequent months saw a decrease, highlighting an area for potential strategic adjustments.

Interestingly, Junk's presence in other states or categories is not listed among the top 30 brands, indicating either a lack of market penetration or a strategic focus primarily on the Oregon Edible market. This absence in other rankings could be perceived as an opportunity for Junk to explore and expand its brand reach. The data suggests that while Junk has established a foothold in Oregon, diversifying its market presence could be beneficial for future growth and stability. Observing how Junk navigates these challenges and opportunities in the coming months will be crucial for stakeholders and industry observers alike.

Competitive Landscape

In the Oregon edible market, Junk has experienced notable fluctuations in its rank and sales over the past few months. Starting strong in October 2024 with a rank of 16, Junk maintained this position in November before slipping to 23 in December and further down to 29 by January 2025. This decline in rank is mirrored in its sales, which peaked in November but saw a significant drop by January. In contrast, Concrete Jungle has shown a consistent upward trend, improving its rank from 36 in October to 28 by January, indicating a steady increase in consumer preference. Similarly, Retreats also improved its standing, moving from 31 in October to 27 in January, with sales reflecting this positive trajectory. Meanwhile, Joyibles experienced a similar rank decline to Junk, dropping from 29 in October to 30 in January, though its sales decline was less pronounced. The data suggests that Junk may need to reassess its market strategies to regain its competitive edge in the Oregon edibles category.

Notable Products

In January 2025, Junk's top-performing product remained the THC:CBN 2:1 Dreamboat Functional Magic Gummy 10-Pack, holding its first-place rank consistently since October 2024, despite a sales decrease to 614 units. The Tiger Blood Gummies 10-Pack maintained its second-place position, following a stable ranking since November 2024. The CBD/THC 1:1 Field Trip Functional Magic Gummies 10-Pack remained in third place, continuing its trend from December 2024. Notably, the Sleepy Dreamboat Gummies 10-Pack rose to fourth place, showing improvement from its fifth-place ranking in December 2024. The CBD:THC 3:2 Dynamites Sour Orange, although fifth in January, had previously climbed from an unranked position in October to fourth in December, before slightly dropping back.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.