Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

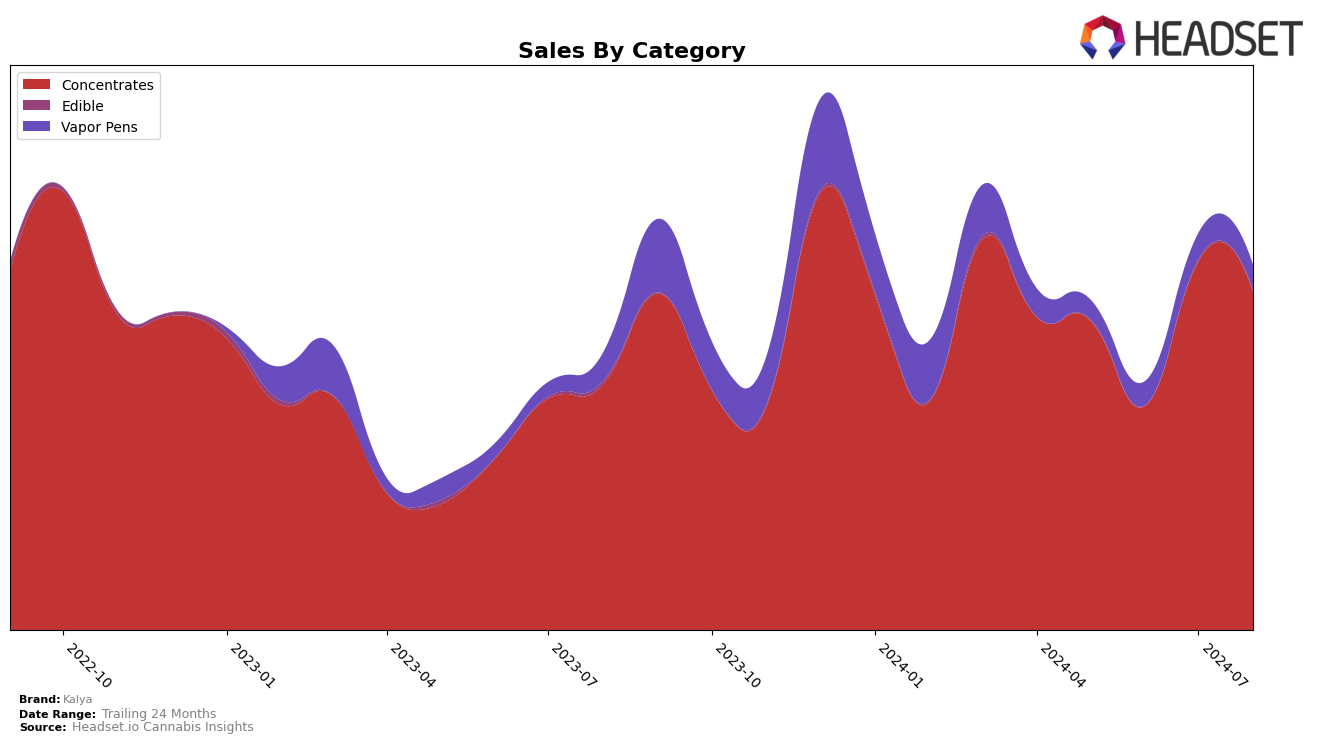

Kalya has shown notable progress in the California concentrates market over the past few months. Starting at rank 35 in May 2024, Kalya climbed to rank 27 by August 2024. This upward movement indicates a positive reception among consumers, despite a dip in June where it fell to rank 47. The brand's sales figures also reflect this trend, with a significant increase from $80,800 in June to $128,962 in July, before stabilizing at $122,574 in August. This suggests that Kalya's products have gained traction and sustained consumer interest in the highly competitive California market.

In Oregon, however, Kalya's performance in the concentrates category has been less consistent. The brand did not make it into the top 30 rankings for May, June, or July 2024, only appearing at rank 74 in August 2024. This indicates a struggle to establish a foothold in the Oregon market, which could be due to various factors such as local competition or market preferences. The sales data corroborates this, with only $15,984 recorded in August. This highlights a potential area of concern for Kalya as it seeks to expand its presence beyond California and into other states.

Competitive Landscape

In the competitive landscape of the California concentrates market, Kalya has shown notable fluctuations in rank and sales over the past few months. Despite starting at a lower rank of 35 in May 2024, Kalya has made a significant climb to rank 27 by August 2024, indicating a positive trend in market presence. This upward trajectory contrasts with brands like Buddies, which has seen inconsistent rankings, peaking at 29 in August after dropping to 43 in June. Meanwhile, Humboldt Terp Council has experienced a steady decline, moving from rank 21 in May to 26 in August, suggesting potential challenges in maintaining market share. Lime has also seen a downward trend, dropping from rank 15 in May to 25 in August, which could indicate a shift in consumer preferences or increased competition. On the other hand, Clsics has shown a similar positive trend to Kalya, improving from rank 44 in May to 28 in August. These insights suggest that while Kalya faces stiff competition, its recent performance indicates a strengthening position in the market, making it a brand to watch in the coming months.

Notable Products

In August 2024, the top-performing product for Kalya was Whitethorn Z Live Rosin (1g) in the Concentrates category, maintaining its first-place rank from July with notable sales of 515 units. Sticky Papaya Rosin (1g) climbed to the second position from fourth in July, showing significant growth. Whitehorn Z Cold Cure Rosin (1g) entered the rankings in third place, indicating a strong debut. Z Live Rosin (1g) dropped to fourth place from its consistent second-place ranking in the previous months. Sticky Papaya Full Melt Live Rosin (1g) secured the fifth position, marking its first appearance in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.