Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

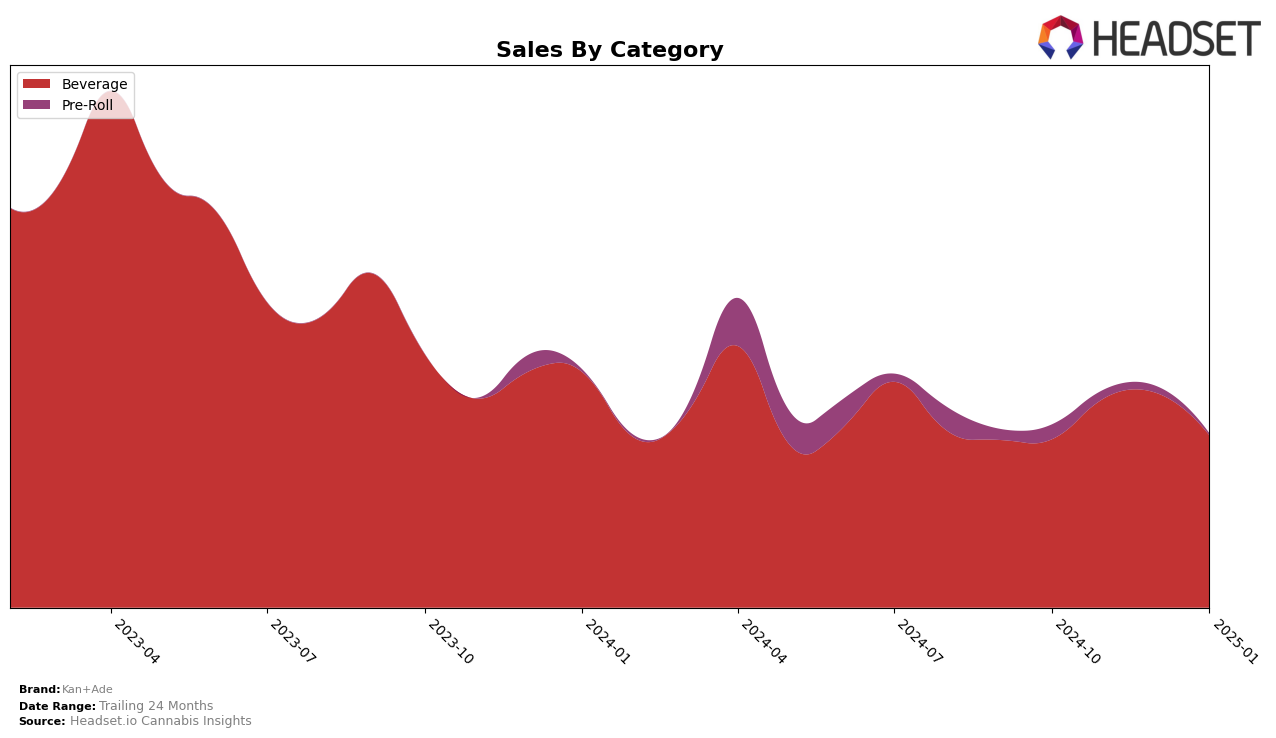

Kan+Ade has demonstrated a consistent presence in the California market, maintaining its position within the top 20 beverage brands from October 2024 to January 2025. Despite a slight dip in sales from December to January, the brand has managed to hold steady at the 19th rank for three consecutive months, indicating a stable consumer base. This consistency in ranking suggests that while there may be fluctuations in sales figures, Kan+Ade's market presence remains resilient in the competitive California beverage category.

In contrast, Kan+Ade's performance in other states or categories is not mentioned, which implies that they did not break into the top 30 in those markets during the same period. This absence could be interpreted as a potential area for growth or a reflection of the intense competition in those regions. Focusing on California, the brand's ability to maintain its rank despite sales variations points to effective market strategies and a loyal customer segment, which could be leveraged to improve performance in other regions.

Competitive Landscape

In the competitive landscape of the California beverage category, Kan+Ade experienced a relatively stable performance from October 2024 to January 2025, maintaining a rank of 19th for three consecutive months before slightly improving to 18th in January. Despite this consistency, Kan+Ade faces stiff competition from brands like High Power, which consistently ranked higher, fluctuating between 16th and 18th place, and Kikoko, which showed a steady upward trend, moving from 19th to 17th place over the same period. Kan+Ade's sales peaked in December 2024, but saw a decline in January 2025, contrasting with the upward sales trajectory of Kikoko. Meanwhile, Treesap and 5G (530 Grower) were not in the top 20 until January, indicating a less competitive threat in the earlier months. This data suggests that while Kan+Ade remains a steady player, there is a need to strategize for growth to compete more effectively against brands that are climbing the ranks.

Notable Products

In January 2025, Kan+Ade's top-performing product was the Naked Flavorless Medible Mixer (1000mg), maintaining its first-place ranking from previous months with sales of 380 units. The Juicy Peach Syrup Medible Mixer (1000mg) climbed to the second position, showing a consistent improvement from its fifth rank in October 2024. Blueberry Pomegranate Syrup (1000mg) held steady in the third position, despite a slight drop in sales compared to December 2024. Juicy Watermelon Medible Mixer (1000mg THC, 150ml) also shared the third rank, having re-entered the rankings in December 2024. Lastly, the Grape Medible Mixer (1000mg) fell to fourth place, experiencing a notable decrease in sales figures since November 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.