Oct-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

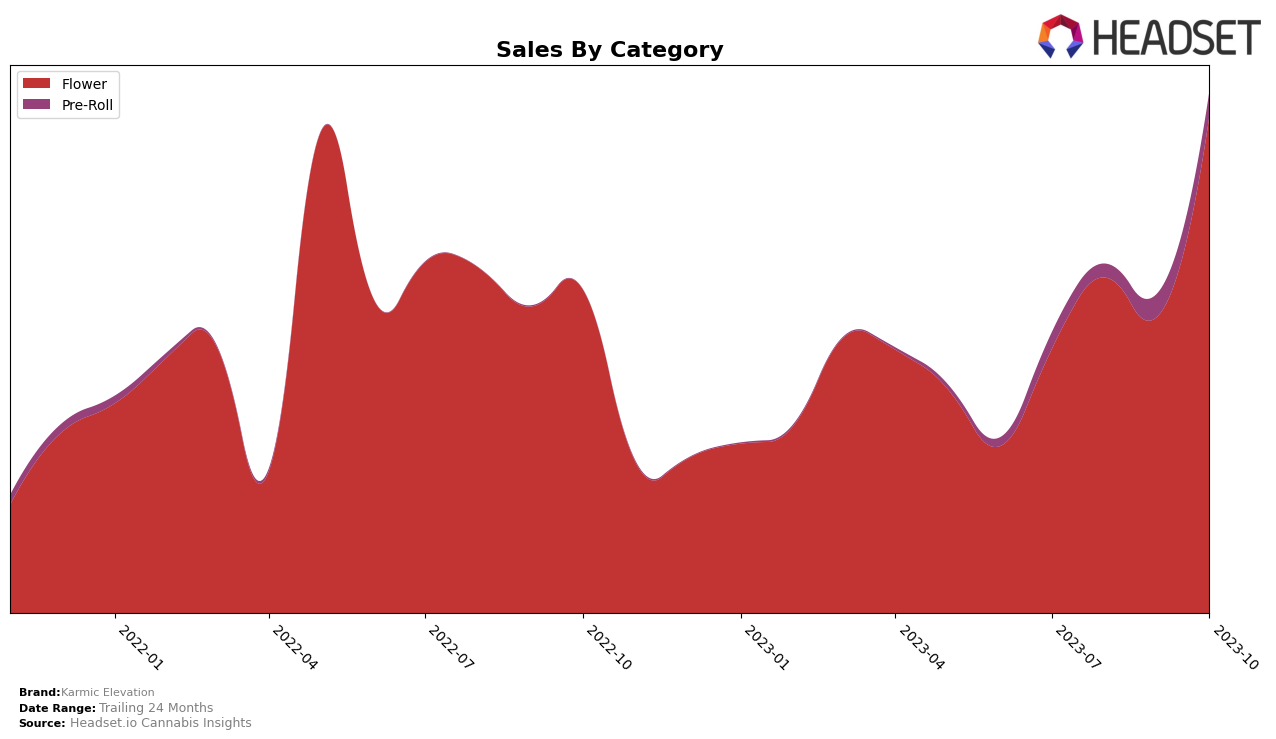

Over the course of four months, Karmic Elevation has shown a promising upward trend in the flower category in Oregon. Starting from the 45th rank in July 2023, it gradually climbed up the ladder to secure the 18th spot by October 2023. This significant leap in rankings is an indication of a positive market response and increased sales. In fact, the brand experienced a notable jump in sales from July to October, reflecting the successful growth strategy of Karmic Elevation in this category.

On the other hand, Karmic Elevation's performance in the Pre-Roll category in Oregon has been less stellar. The brand did not make it to the top 20 in July and August 2023, which suggests room for improvement in this category. However, the brand maintained a steady rank of 86 in September and October. While the lack of a top 20 ranking could be seen as a setback, the consistency in the lower rankings may also indicate a potential for gradual growth in the future. It's worth noting that despite the lower rankings, there was a slight increase in sales from September to October.

Competitive Landscape

In the Oregon flower market, Karmic Elevation has shown a notable upward trend in its rank, moving from 45th in July to 18th in October 2023, indicating a positive growth in its market position. This is in contrast to Emerald Fields Cannabis which has seen a drop in rank from 4th to 19th over the same period. Similarly, Otis Garden has also seen a fluctuation in its rank, moving from 25th to 10th, then dropping to 20th by October. Boring Glory (formerly Boring Weed Company) has also shown a steady rise in rank, moving from 31st to 17th. Meanwhile, Kaprikorn has maintained a relatively stable position, hovering around the 16th rank. While specific sales numbers are not disclosed, the changes in rank suggest a dynamic competitive landscape with Karmic Elevation making significant strides.

Notable Products

In October 2023, the top-performing product from Karmic Elevation was 'Acapulco Gold (Bulk)' from the Flower category, maintaining its first position from previous months with a notable sales figure of 3842. The 'Fancy Girl Pre-Roll (1g)' from the Pre-Roll category moved up to second place after being unranked in August and ranking third in September. The 'Lemon Jeffery (Bulk)', another Flower category product, made a significant entrance into the top rankings at third place. 'Acapulco Gold Pre-Roll (1g)' dropped two places to fourth compared to September, while 'Fancy Girl (Bulk)' re-entered the top five after being unranked in September. These shifts demonstrate a dynamic market with changing consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.