Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

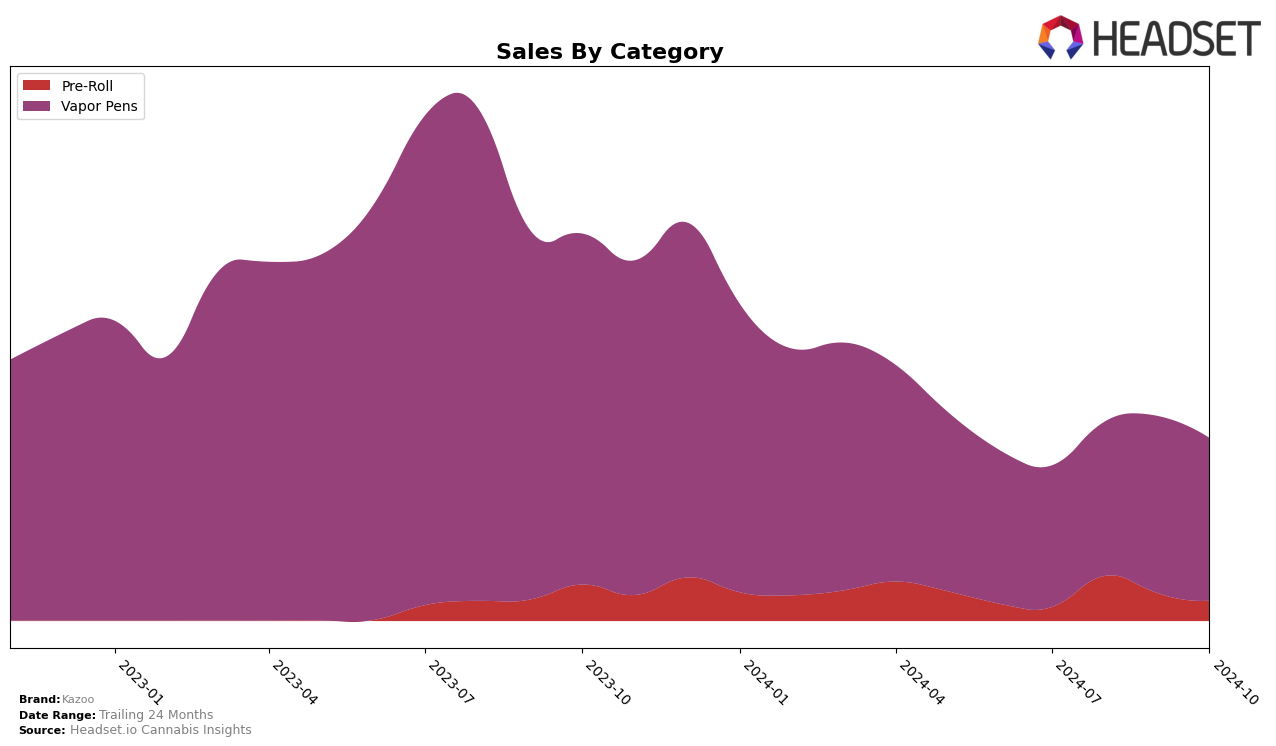

In the Canadian cannabis market, Kazoo's performance across various categories and provinces shows a mixed trajectory. Notably, in the Pre-Roll category within Alberta, Kazoo did not make it into the top 30 brands from July to October 2024, indicating a challenging market presence in this category. Conversely, Kazoo's Vapor Pens in Alberta have shown a positive trend, climbing from 41st place in July to 27th in October. This upward movement suggests a growing consumer preference or effective market strategies in Alberta's Vapor Pens segment.

In British Columbia, Kazoo's Vapor Pens experienced fluctuations, with rankings moving from 40th in July to 44th in October, despite a brief improvement in September. This variability highlights potential volatility or competitive pressures in the province. Meanwhile, in Ontario, Kazoo maintained a relatively stable position in the Vapor Pens category, albeit with a slight decline from 42nd to 51st over the four months. This consistency, despite the slight drop, might suggest a steady consumer base or market saturation challenges in Ontario.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Kazoo has shown a notable upward trajectory in its rankings over the past few months, moving from 41st in July 2024 to 27th by October 2024. This improvement in rank is indicative of a positive trend in sales, as Kazoo's sales figures have consistently increased, peaking in September before a slight dip in October. In contrast, Versus, which started at a higher rank of 19th in July, has seen fluctuations, ultimately stabilizing at 25th in October, suggesting a more volatile sales pattern. Meanwhile, Disco Fsh and Tasty's (CAN) have experienced minor rank changes, with Disco Fsh improving slightly and Tasty's (CAN) showing a slight decline. Adults Only has seen a decline from its peak in August, falling to 26th in October, which might indicate a competitive pressure that Kazoo is capitalizing on. Overall, Kazoo's consistent rise in rank amidst these competitors highlights its growing presence and potential in the Alberta vapor pen market.

Notable Products

In October 2024, Blue Tongue Bubble Gum Distillate Disposable (1g) continues to dominate the Vapor Pens category, maintaining its top position with sales reaching 2,155 units. Grapes On Skates Distillate Disposable (1g) climbs back up to second place, showing a significant increase from its fourth place in the previous two months, with sales of 1,026 units. Melon Monroe Distillate Disposable (1g) drops to third place, while its smaller variant, the 0.3g version, makes a notable entry into the top five at fourth place with 792 units sold. Toasted Cinnamon Crunch Distillate Disposable (1g) rounds out the top five, although its sales have decreased compared to September. Overall, Kazoo's Vapor Pens lineup shows dynamic shifts in rankings, with consistent high performance from Blue Tongue Bubble Gum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.