Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

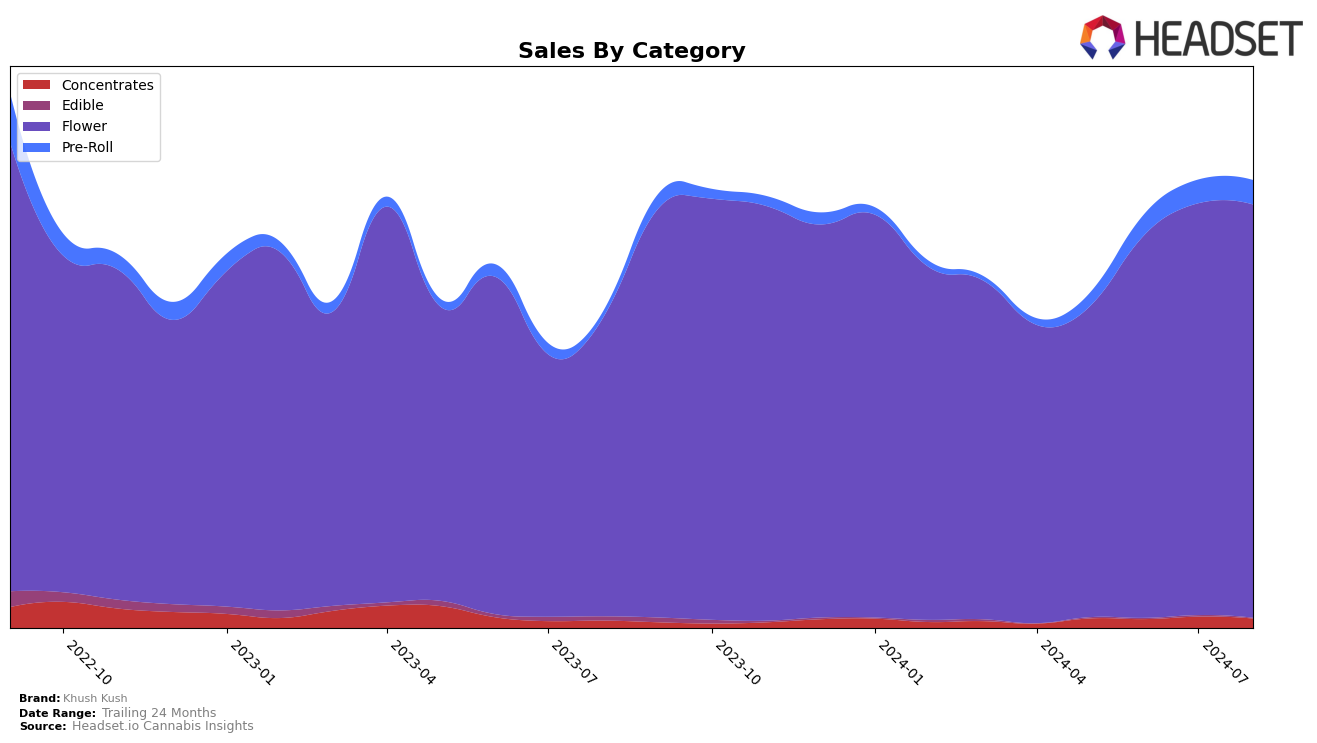

Khush Kush has shown a notable performance in the Washington market, particularly in the Flower category. Over the past few months, the brand has made significant strides, moving from a rank of 45 in May 2024 to consistently holding the 30th position from June through August 2024. This upward movement highlights Khush Kush’s growing presence and competitiveness in the Washington market. The brand’s sales figures also reflect this positive trend, with sales increasing from $195,198 in May to $259,213 by August, indicating strong consumer demand and effective market strategies.

However, Khush Kush's performance is not uniform across all states and categories. The brand did not rank within the top 30 in several other states and categories, suggesting areas for potential improvement and market expansion. While their steady rise in Washington is commendable, the absence from top rankings in other regions could be seen as a missed opportunity or a challenge that needs addressing. This mixed performance provides a nuanced view of Khush Kush’s market presence, showcasing both their strengths in certain areas and the potential for growth in others.

Competitive Landscape

In the competitive landscape of the Washington Flower category, Khush Kush has shown a consistent performance by maintaining its rank at 30th place from June to August 2024, after a notable rise from 45th in May. This stability in rank is indicative of Khush Kush's solid market presence. However, competitors like Green Haven and Withit Weed have demonstrated significant upward mobility, with Green Haven climbing from 55th to 36th and Withit Weed making a remarkable jump from 51st to 28th over the same period. Meanwhile, EZ Vape experienced a fluctuation, peaking at 21st in July before dropping to 33rd in August. Another strong performer, Cheef, surged from 83rd in May to 29th in August. These shifts suggest a dynamic market where Khush Kush's competitors are aggressively vying for higher ranks, potentially impacting Khush Kush's sales growth and market strategy.

Notable Products

In August 2024, Sticky Gorilla #4 (3.5g) retained its top position among Khush Kush products, achieving sales of 1375 units. The Wonder Kid (3.5g) surged to the second spot, showing a significant increase from its fifth-place ranking in July. Gelato Larry #2 (3.5g) held steady in third place, maintaining consistent performance over the past few months. Samoas (3.5g) entered the rankings for the first time, securing the fourth position. Tropicana Banana (3.5g) experienced a slight decline, dropping to fifth place from its previous ranks in May and June.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.