Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

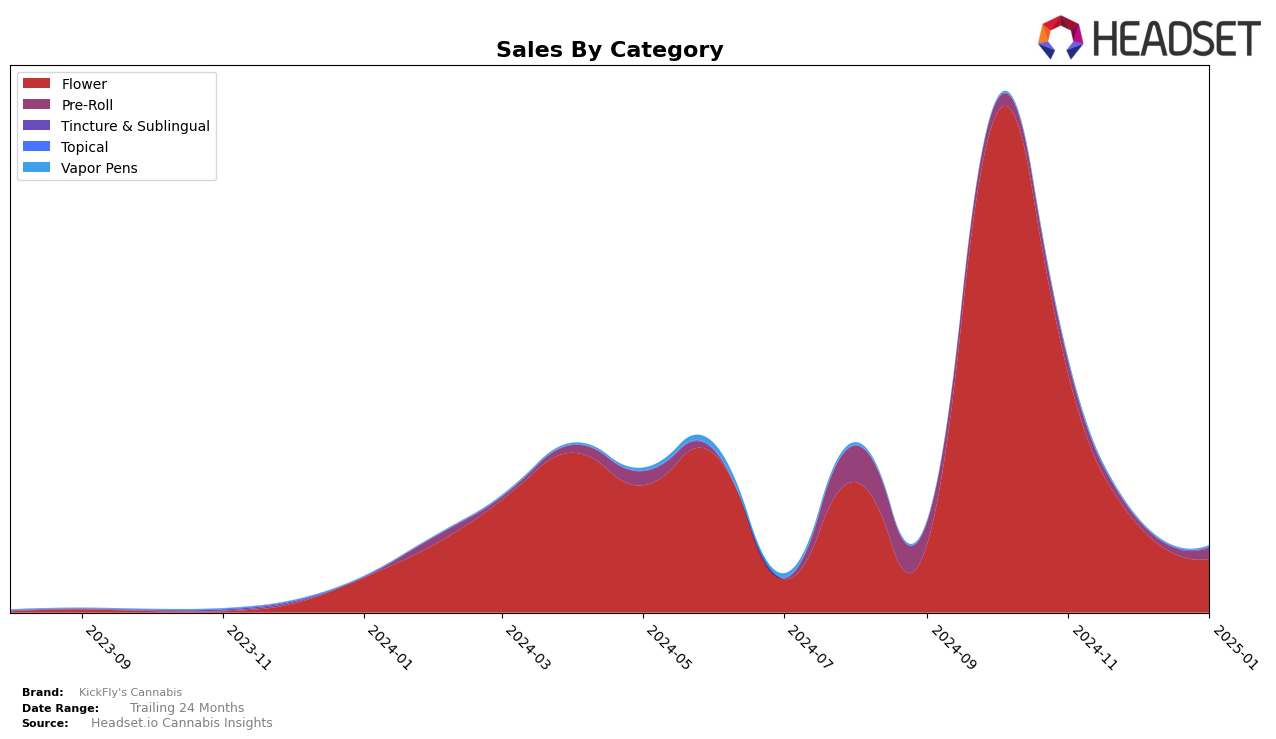

KickFly's Cannabis has experienced notable fluctuations in its performance across different categories and states over recent months. In New York, the brand's presence in the Flower category saw a decline, with its ranking dropping from 41st in October 2024 to 77th in November 2024. This drop indicates a significant decrease in market competitiveness, as the brand did not appear in the top 30 rankings for December 2024 and January 2025. Such a movement can reflect various factors, including increased competition, changes in consumer preferences, or potential supply chain issues. The sales figures corroborate this trend, showing a decline from $162,532 in October to $77,192 in November. However, the absence of rankings beyond November suggests that the brand might need to reassess its strategies to regain its standing.

While the data for other states or categories is not explicitly detailed, the performance in New York provides a glimpse into the challenges KickFly's Cannabis might be facing. The brand's inability to maintain a top 30 position in subsequent months could imply similar trends in other regions or categories. This scenario might prompt the brand to explore new marketing strategies, product innovations, or partnerships to enhance its market presence. Keeping an eye on these developments will be crucial for stakeholders and consumers interested in the brand's trajectory in the competitive cannabis market.

Competitive Landscape

In the competitive landscape of the Flower category in New York, KickFly's Cannabis has experienced notable fluctuations in its market position, which could impact its sales trajectory. In October 2024, KickFly's Cannabis held a relatively strong position at rank 41, but by November 2024, it had dropped significantly to rank 77. This decline in rank coincided with a decrease in sales, indicating potential challenges in maintaining market share. In comparison, Snobby Dankins also saw a drop in rank from 63 to 88 over the same period, suggesting a broader competitive pressure in the market. Meanwhile, urbanXtracts maintained a lower rank, moving from 91 to 98, which might indicate less aggressive competition from this brand. These dynamics suggest that while KickFly's Cannabis faces challenges, there is an opportunity to regain market share by addressing the factors contributing to its rank decline, especially as competitors also experience volatility.

Notable Products

In January 2025, The Soap (3.5g) from KickFly's Cannabis maintained its top position in the Flower category, despite a decline in sales to 340 units. The Flamingo Pre-Roll 8-Pack (4g) rose significantly to second place in the Pre-Roll category, with notable sales growth to 74 units. Queen of the South (3.5g) remained steady in third place in the Flower category, with consistent sales figures over the months. Lemonade (3.5g) saw a drop in rank to fourth place, as its sales decreased significantly from previous months. Diesel (3.5g) fell to fifth place, showing a consistent decline in sales since October 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.