Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

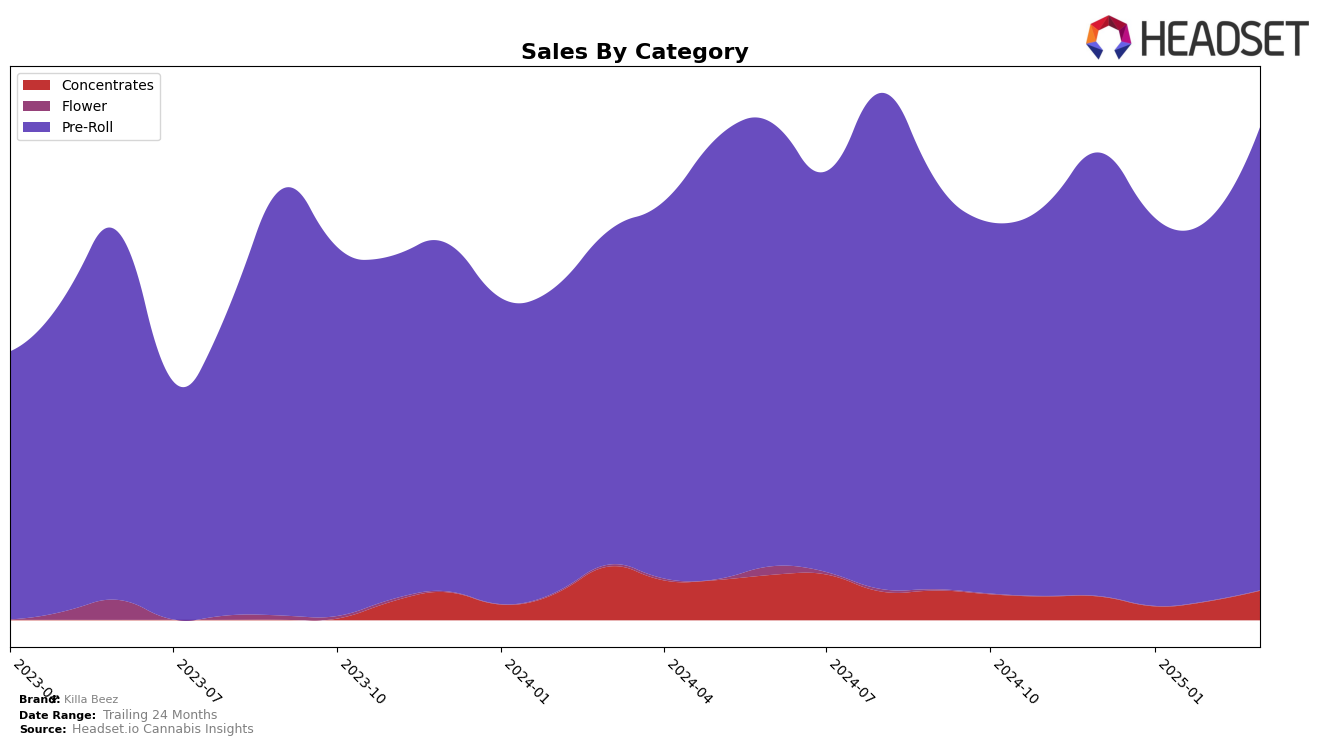

Killa Beez has shown a notable performance in the Oregon market, particularly within the Pre-Roll category. In December 2024, Killa Beez was ranked 4th, maintaining a strong presence by staying within the top 6 through March 2025. This consistent ranking highlights the brand's solid foothold in the Pre-Roll category in Oregon, despite a slight dip in January and February. Interestingly, the sales figures for March 2025 indicate a resurgence, surpassing December's sales and suggesting a positive trend moving forward.

In contrast, Killa Beez's performance in the Concentrates category in Oregon has been less stable, with rankings fluctuating outside the top 30 for most months. However, March 2025 saw an improvement, as the brand climbed back into the top 50. This movement could be indicative of a strategic shift or a growing consumer interest in their concentrates. Despite not being in the top 30 for several months, the sales increase in March suggests potential for growth in this category. The performance across these categories illustrates the brand's varying market dynamics and potential areas for strategic focus.

Competitive Landscape

In the competitive landscape of Oregon's Pre-Roll category, Killa Beez has experienced a dynamic shift in its market position from December 2024 to March 2025. Initially ranked 4th in December 2024, Killa Beez saw a slight decline to 5th in January 2025, maintaining this position through February and March. This fluctuation in rank can be attributed to the aggressive performance of competitors like Kaprikorn, which consistently outperformed Killa Beez, holding the 4th position in March 2025 with a notable increase in sales. Meanwhile, STiCKS also showed significant growth, climbing from 9th to 5th place, matching Killa Beez's rank by March. Despite these competitive pressures, Killa Beez maintained a stable sales trajectory, indicating a resilient market presence. However, to regain its higher ranking, Killa Beez may need to innovate or enhance its marketing strategies to differentiate itself from brands like Benson Arbor and Kites, which also remain strong contenders in the market.

Notable Products

In March 2025, the top-performing product for Killa Beez was the Variety Pack Pre-Roll 12-Pack (6g) in the Pre-Roll category, maintaining its consistent number 1 ranking from previous months with a sales figure of 4351 units. Dream Diesel Pre-Roll 6-Pack (3g) climbed to the second position from fourth in February, showing a significant increase in popularity. The Pineapple Express Pre-Roll 2-Pack (1g), a new entrant in the rankings, debuted at the third position. Diamonds Pre-Roll 2-Pack (1g) followed closely in fourth place, indicating strong demand for smaller pack sizes. The Variety Pack Pre-Roll 6-Pack (3g) secured the fifth spot, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.