Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

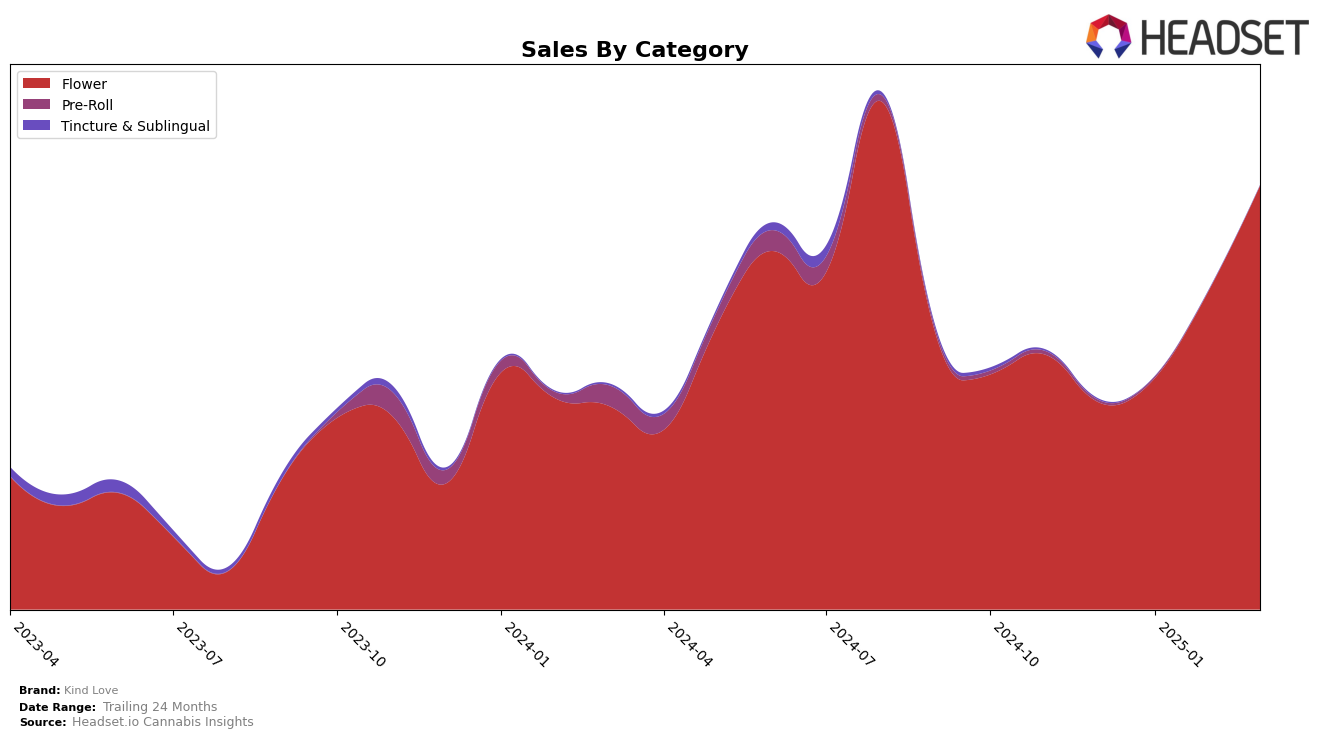

Kind Love has demonstrated a notable upward trajectory in the Colorado market, particularly within the Flower category. Starting from a rank of 45 in December 2024, the brand has climbed steadily to reach the 23rd position by March 2025. This significant improvement in ranking is indicative of a strong performance and growing consumer preference. The consistent rise in rank suggests that Kind Love is effectively capturing market share in a competitive landscape, which is a positive signal for their brand strategy and product offerings in this category.

Despite not being in the top 30 brands in other states or categories, Kind Love's progress in Colorado highlights its potential for further growth and expansion. The brand's sales figures have also shown a healthy increase, with March 2025 sales reaching over 300,000, which underscores the growing demand for their products. However, the absence of Kind Love in the top 30 rankings in other states or categories suggests areas for potential improvement and expansion. Focusing on replicating their Colorado success in other regions could be a strategic move to bolster their national presence.

Competitive Landscape

In the competitive landscape of the Colorado flower market, Kind Love has demonstrated a notable upward trajectory in its ranking over the past few months, moving from 45th place in December 2024 to 23rd place by March 2025. This significant improvement is indicative of a strategic shift or successful marketing efforts that have bolstered its market presence. In contrast, Bonsai Cultivation and Natty Rems have seen fluctuations in their rankings, with both brands not consistently maintaining a top 20 position, suggesting potential volatility in their sales performance. Meanwhile, Host has shown a steady climb, reaching 22nd place in March 2025, which could pose a competitive threat to Kind Love if this trend continues. Interestingly, The Organic Alternative experienced a rebound to 21st place in March 2025 after a dip in the previous months, highlighting the dynamic nature of the market. These shifts underscore the importance of strategic positioning and adaptability in maintaining and improving market rank and sales.

Notable Products

In March 2025, the top-performing product for Kind Love was Garlic Juice (1g) in the Flower category, securing the number one rank with sales of 3090. Lemon Train Haze (3.5g) followed closely, climbing from fourth place in February to second place in March, with a notable increase in sales from 1746 to 3066. Crescendo (1g) made its debut in the rankings, coming in at third place. Pablo's Revenge (Bulk) also entered the top five, securing the fourth position. Lemon Train Haze (Bulk), which was the top product in February, dropped to fifth place in March, indicating a shift in consumer preference within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.