Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

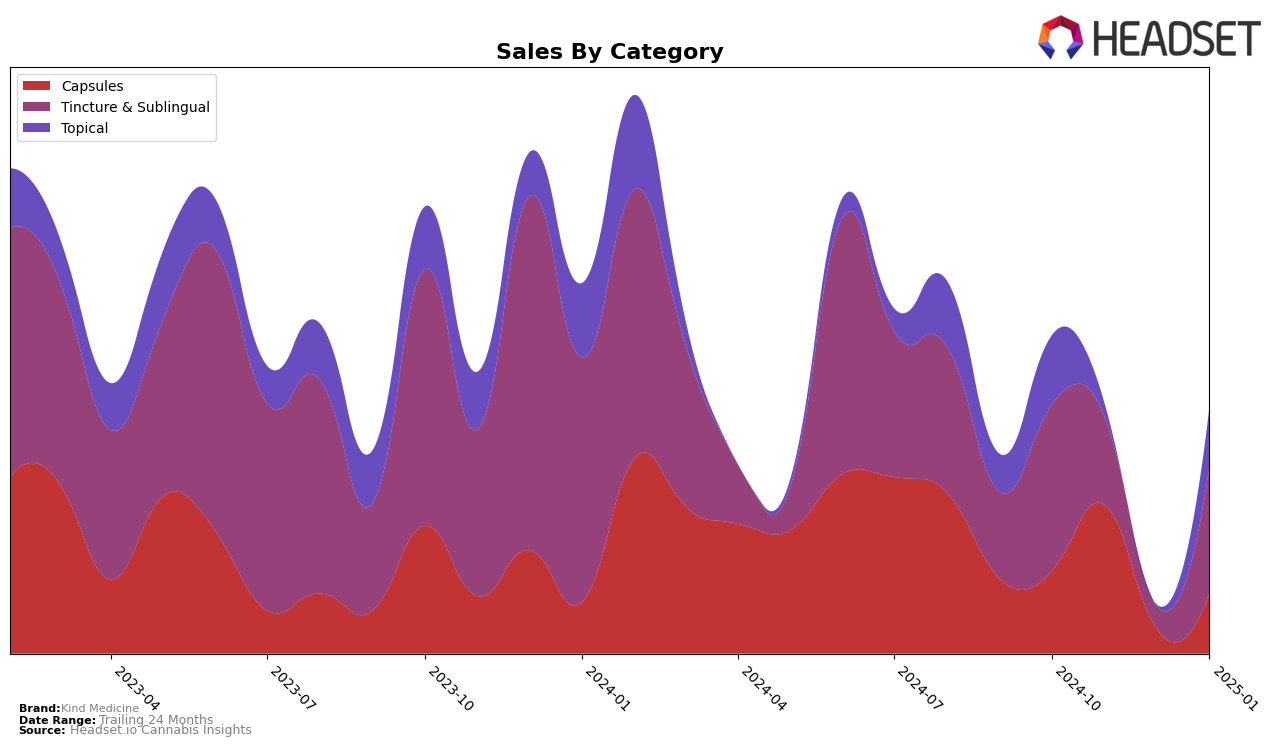

Kind Medicine has shown a notable presence in the California market, particularly within the Tincture & Sublingual category. In October 2024, the brand was ranked 22nd, which indicates a solid positioning within the top 30 brands in this category. However, it is important to note that Kind Medicine did not maintain this ranking in the subsequent months of November and December 2024, as well as January 2025, suggesting a potential decline in market presence or competition from other brands. This absence from the top 30 in later months could be a point of concern, indicating areas for improvement or strategic shifts needed to regain or enhance their market standing.

While specific sales figures for November 2024 onward are not available, the initial sales data from October 2024, totaling $10,927, provides a baseline for understanding their market entry. The lack of ranking in the following months might suggest that either sales did not keep pace with competitors, or other brands may have outperformed Kind Medicine in the Tincture & Sublingual category. This movement highlights the competitive nature of the cannabis market in California, where brands must continuously innovate and adapt to maintain or improve their rankings and market share.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, Kind Medicine has faced notable challenges in maintaining its market position. As of October 2024, Kind Medicine was ranked 22nd, indicating it was not in the top 20 brands for the subsequent months, which suggests a struggle to gain traction compared to its competitors. For instance, High Gorgeous by Yummi Karma also did not make the top 20, while Opi-Not maintained a presence, ranking 20th in November 2024. Meanwhile, Dr. May consistently held a stronger position, ranking as high as 16th in October 2024 and remaining in the top 20 through January 2025. This consistent performance by Dr. May highlights a potential gap in consumer preference or brand loyalty that Kind Medicine may need to address to improve its market rank and sales trajectory.

Notable Products

In January 2025, Kind Medicine's Indica Tincture (800mg THC, 30ml) took the top spot in sales, climbing from its previous third place in December 2024. This product outperformed others in the Tincture & Sublingual category with a notable sales figure of 82 units. Sativa Tincture (800mg THC, 30ml) followed closely in second place, maintaining a strong presence after also ranking third in December 2024. The Menthol Formula Rub (150mg THC, 50ml) secured the third rank, consistent with its performance in October 2024. Meanwhile, the CBD/THC 1:1 Rejuvenate Moisture Rub (30mg CBD, 30mg THC, 60ml) entered the rankings in fourth place, showing a promising start in the Topical category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.