Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

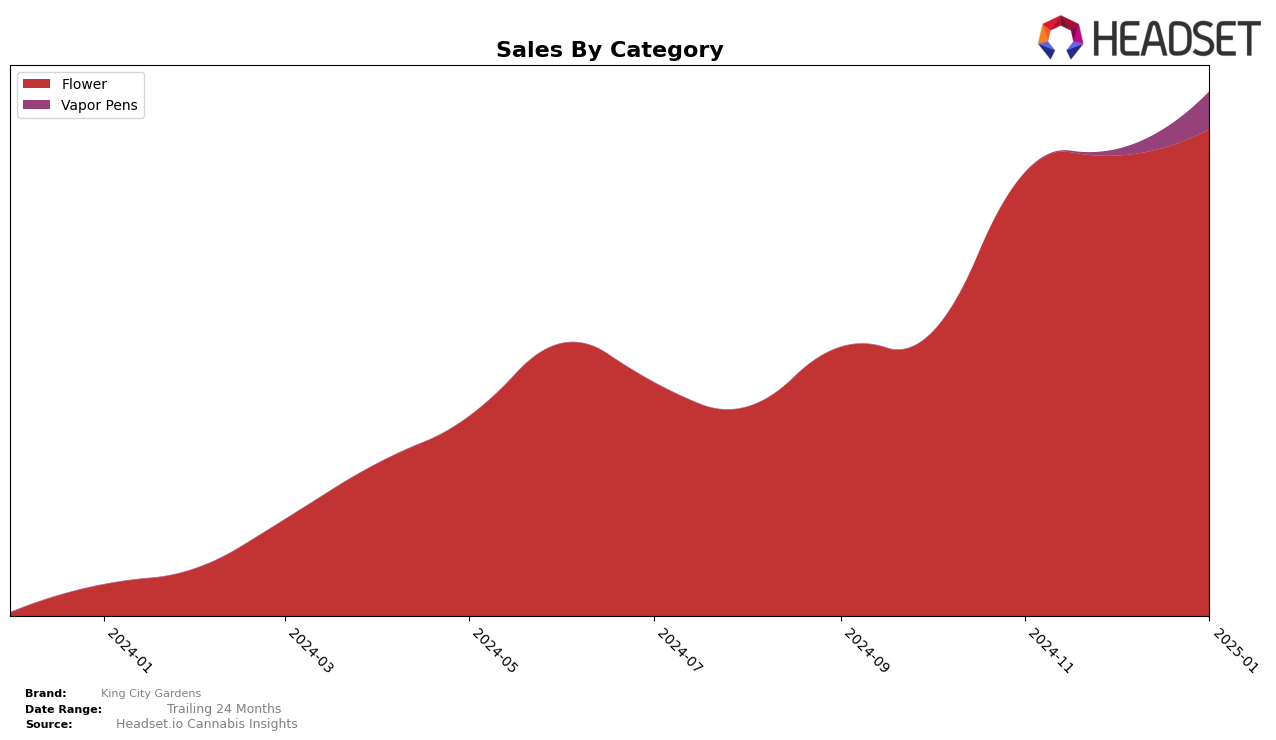

King City Gardens has shown significant movement in the Ohio market, particularly in the Flower category. Notably, the brand improved its ranking from 10th place in October 2024 to 4th place by January 2025, indicating a strong upward trajectory. This rise is accompanied by a steady increase in sales, reaching over $2.5 million by January 2025. Such performance highlights King City Gardens' growing influence and acceptance among consumers in Ohio's competitive cannabis market. However, the brand's presence in the Vapor Pens category in Ohio was less prominent, as it only appeared in the rankings by January 2025, debuting at 23rd place, which suggests potential for growth but also indicates room for improvement in this category.

In terms of category rankings across different states or provinces, King City Gardens' performance appears to be concentrated in Ohio, as there are no other states where the brand made it into the top 30 for any category within the given timeframe. This focus on a single state might be strategic, allowing the brand to consolidate its market presence and optimize operations in Ohio before expanding further. The absence of rankings in other states could be viewed as a missed opportunity or a deliberate choice to concentrate resources. This strategy might pay off if King City Gardens continues to strengthen its standing in Ohio, potentially setting a foundation for future expansion into other markets.

Competitive Landscape

In the competitive landscape of the flower category in Ohio, King City Gardens has shown a remarkable upward trajectory in its market position from October 2024 to January 2025. Initially ranked 10th in October 2024, King City Gardens made a significant leap to 4th place by November, maintaining a strong presence in the top five through January 2025. This ascent is notable when compared to competitors like Seed & Strain Cannabis Co., which fluctuated between 6th and 12th place, and Butterfly Effect - Grow Ohio, which improved from 9th to 5th place. Despite Klutch Cannabis and Riviera Creek consistently holding the top three ranks, King City Gardens' sales growth trajectory suggests a robust competitive strategy, as evidenced by its ability to surpass other brands and sustain its rank, indicating a positive trend in consumer preference and market penetration within the state.

Notable Products

In January 2025, the top-performing product for King City Gardens was Blueberry Muffin (2.83g) in the Flower category, maintaining its number one ranking from the previous two months with sales of 12,763 units. Blueberry Muffin (14.15g) rose to the second position, having previously been unranked in November and December 2024. Cake Crasher (2.83g) consistently held the third position over the past four months, demonstrating stable sales performance. Lemon Mintz (2.83g) climbed to fourth place in January, improving from its fifth-place ranking in November 2024. Aloha Lion (2.83g) entered the rankings in January at fifth place, indicating a new interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.