Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

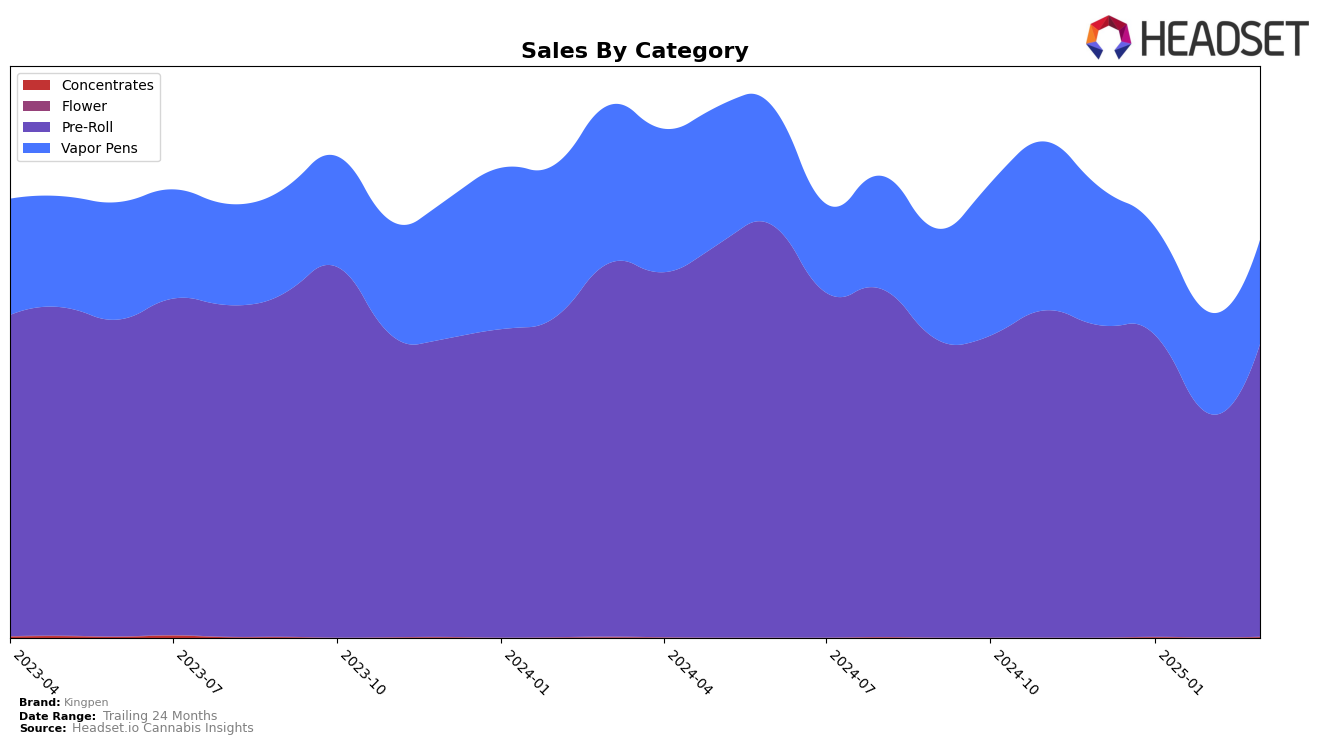

Kingpen has shown varied performance across different product categories and states. In the California market, Kingpen's Pre-Roll category has seen fluctuations but maintained a relatively strong presence. Starting from a rank of 7 in December 2024, it improved to rank 5 in January 2025, only to slip to rank 9 in February before recovering to rank 7 in March. This indicates a resilient performance despite the competitive landscape in California. However, Kingpen's Vapor Pens category tells a different story, as it was ranked 28 in December 2024 but fell out of the top 30 by January 2025 and continued to decline, reaching rank 36 by March. This downward trend in Vapor Pens suggests challenges in maintaining market share against other brands in this category.

The sales figures in California reflect these ranking movements, with Pre-Roll sales peaking in December 2024 and experiencing a dip in February 2025 before rebounding in March. This pattern suggests that while Kingpen has a strong foothold in the Pre-Roll category, there might be seasonal or competitive factors affecting its sales. On the other hand, Vapor Pens have consistently underperformed, with sales declining from December 2024 through March 2025. The absence from the top 30 brands from January onward highlights a significant concern for Kingpen in this category. These insights underscore the importance of strategic adjustments to bolster their presence in the Vapor Pens market while sustaining their Pre-Roll success in California.

Competitive Landscape

In the competitive landscape of the California pre-roll market, Kingpen has demonstrated fluctuating rank positions over the months from December 2024 to March 2025. Notably, Kingpen's rank improved from 7th in December 2024 to 5th in January 2025, before dropping to 9th in February and recovering slightly to 7th in March. This volatility suggests a competitive pressure from brands like Pure Beauty, which maintained a consistent top 5 position, and Pacific Stone, which showed a steady climb from 8th to 6th place. Meanwhile, Sluggers Hit experienced a rank drop from 5th to 8th, indicating a potential opportunity for Kingpen to capitalize on shifting consumer preferences. Despite these rank changes, Kingpen's sales figures reveal a recovery in March, suggesting resilience in the face of competition. As the market remains dynamic, Kingpen's ability to adapt and innovate will be crucial in maintaining and improving its market position.

Notable Products

In March 2025, the top-performing product for Kingpen was the Kingroll - Cannalope Ak x Cannalope Kush Oil Infused Pre-Roll (1.3g), maintaining its first-place rank from February, with notable sales of 9,525 units. The Kingroll Jr - Cannalope Ak x Cannalope Kush Infused Pre-Roll 4-Pack (3g) remained consistently in second place, showing strong performance with 8,496 units sold. The KingRoll Jr - Jack Herer x Durban Poison Infused Pre-Roll 4-Pack (3g) entered the rankings at third place, indicating a new consumer interest. Meanwhile, the Kingroll Jr - Mango Kush x Cannalope Kush Infused Pre-Roll 4-Pack (3g) slipped from third to fourth place, reflecting a decline in sales momentum. The Kingroll Jr - Blue Lobster x Apples & Bananas Infused Pre-Roll 4-Pack (3g) debuted at fifth place, showcasing potential growth in the infused pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.