Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

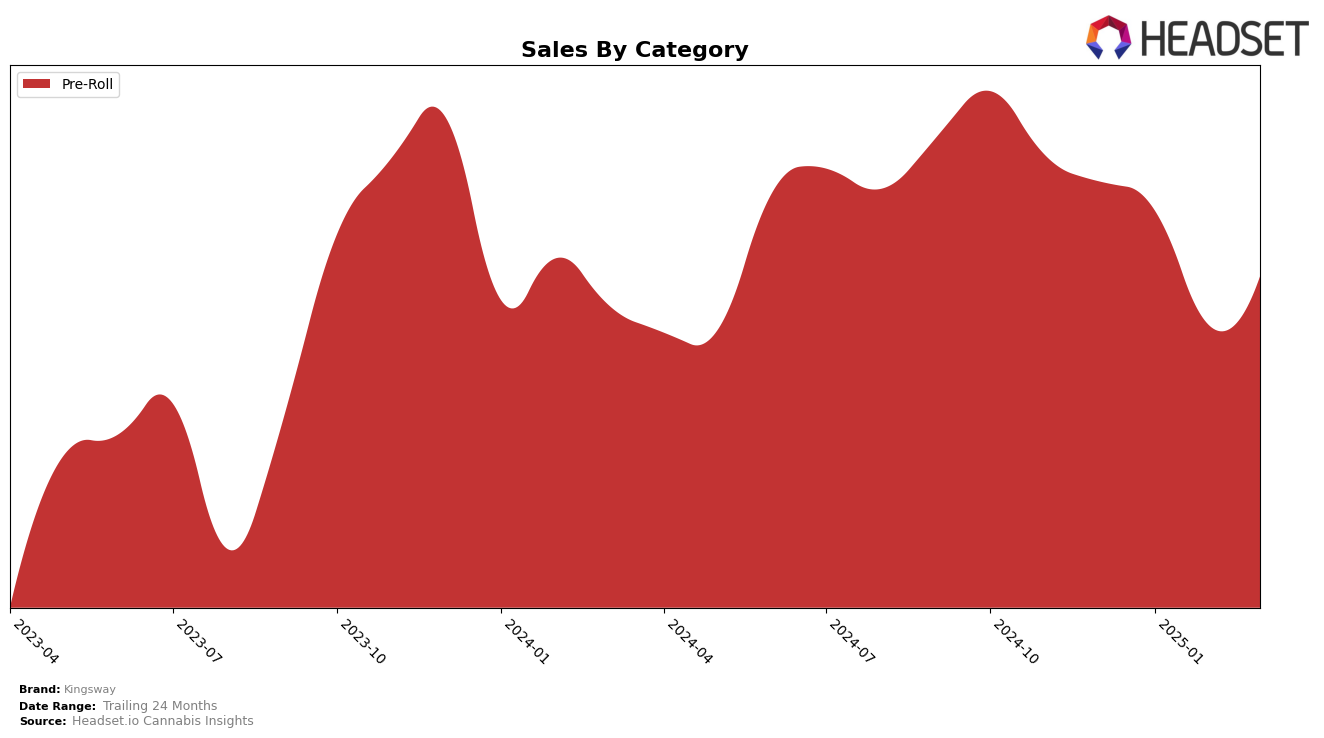

In the province of British Columbia, Kingsway's performance in the Pre-Roll category has seen a gradual decline from December 2024 through March 2025. The brand was ranked 58th in December 2024, slipping to 65th by March 2025. This downward trend is reflective of a decrease in sales over the same period, with sales figures dropping from approximately 97,000 CAD in December 2024 to around 78,000 CAD in March 2025. Such a decline suggests that Kingsway is facing increased competition or market challenges in British Columbia's Pre-Roll segment, leading to a reduction in its market presence.

Conversely, in Saskatchewan, Kingsway has shown more stability and resilience in the Pre-Roll category. The brand improved its ranking from 18th in December 2024 to 12th in January 2025, maintaining this position into March 2025. Despite a dip in sales in February 2025, Kingsway managed to recover by March, indicating a strong market presence and consumer loyalty in Saskatchewan. This performance suggests that Kingsway's strategies or product offerings resonate better with consumers in Saskatchewan compared to British Columbia, highlighting the importance of regional market dynamics in brand performance.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, Kingsway has experienced some fluctuations in its market position from December 2024 to March 2025. Initially ranked at 58th in December, Kingsway improved slightly to 56th in January, but then saw a decline to 61st in February and further to 65th in March. This downward trend contrasts with the performance of competitors like Twd., which maintained a relatively stable rank, peaking at 56th in February. Meanwhile, Carmel showed resilience by bouncing back from 59th in January to 55th in February before settling at 64th in March. Broken Coast demonstrated a strong upward trajectory, improving from 90th in December to 71st by March, suggesting a significant increase in market penetration. While QWEST was absent from the top 20 in February, it re-emerged at 68th in March, indicating potential volatility. These dynamics suggest that while Kingsway faces challenges in maintaining its rank, understanding the strategies of its competitors could provide insights for regaining market share.

Notable Products

In March 2025, the top-performing product from Kingsway was the Split Shift Pre-Roll 14-Pack (7g), maintaining its number one ranking consistently since December 2024, despite a decrease in sales to 2565 units. The Dayshift High Pre-Roll 5-Pack (2.5g) climbed to the second spot in February and held it in March, with a notable increase in sales to 2182 units. The Nightshift Pre-Roll 5-Pack (2.5g) slipped to third place in February and remained there in March, showing a steady performance. Kingsway Pre-Roll 7-Pack (3.5g) and Splitshift Pre-Roll 2-Pack (1g) held their fourth and fifth positions respectively, with minimal sales changes over the months. Overall, the rankings have been relatively stable, with only slight shifts in positions and sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.