Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

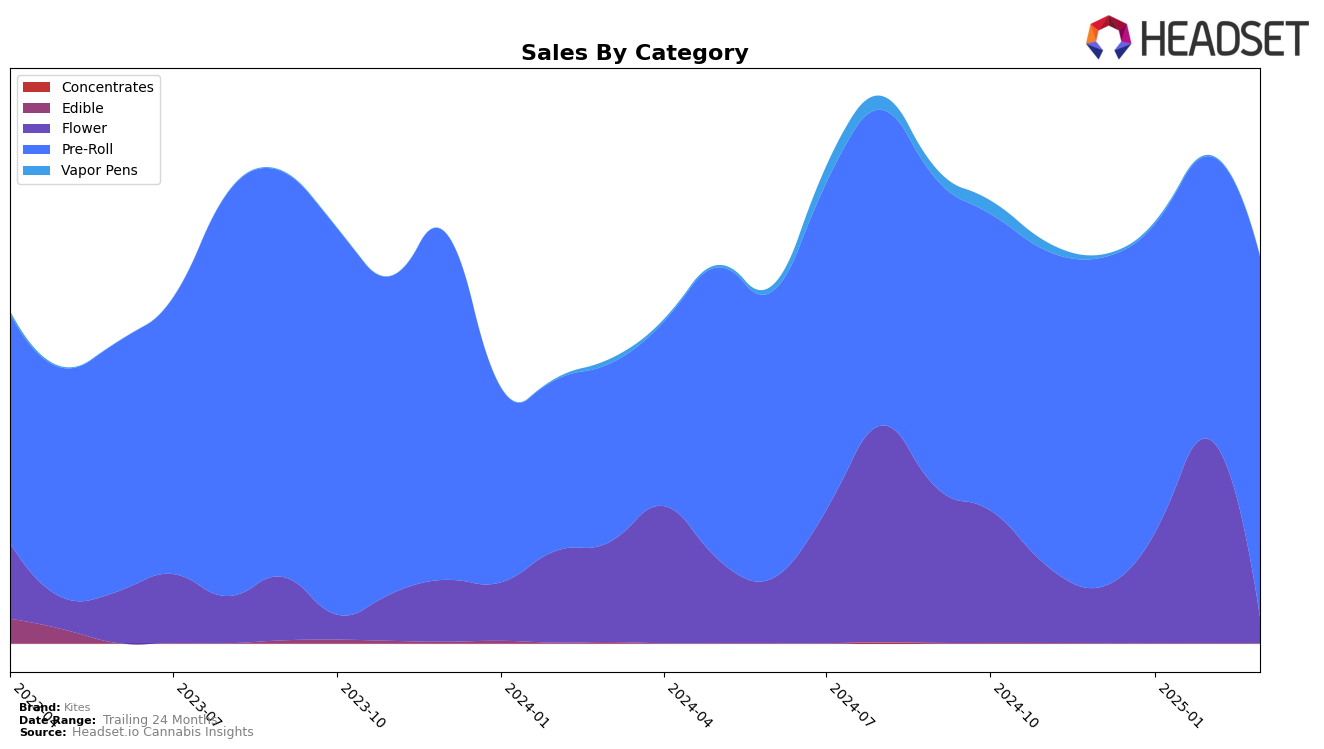

In the state of Oregon, Kites has shown a notable performance across different cannabis categories. In the Flower category, Kites was not ranked among the top 30 brands in December 2024, but made a significant leap to the 29th position by February 2025. This upward trend suggests a growing consumer interest or effective strategic changes implemented by the brand. In contrast, their performance in the Pre-Roll category has been more stable, consistently maintaining the 8th position from December 2024 through March 2025. This consistency indicates a strong foothold in the Pre-Roll market, suggesting that Kites has successfully established a loyal customer base or a well-regarded product line in this category.

While the Flower category saw Kites making strides to enter the top rankings, the absence of their position in December 2024 highlights a potential area for growth or past challenges that the brand might have faced. The steady sales figures in the Pre-Roll category, with a slight increase from February to March 2025, underscore the brand's resilience and potential to capture more market share. However, the lack of visibility in the top 30 for the Flower category in December 2024 might suggest competitive pressures or a need for further market penetration strategies. The dynamics in Oregon offer a glimpse into how Kites is navigating different product segments, with varying levels of success and opportunity.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll market, Kites has maintained a consistent rank of 8th place from December 2024 through March 2025. This stability is noteworthy given the fluctuations experienced by other brands. For instance, PRUF Cultivar saw a rise to 4th place in January 2025 but then dropped to 10th by March 2025, while Cabana improved its rank from 11th to 9th over the same period. Benson Arbor demonstrated volatility, moving from 6th to 10th and back to 7th. Despite these shifts, Kites' consistent ranking suggests a stable market position, though it trails behind Killa Beez, which maintained a higher rank, fluctuating between 4th and 6th place. Kites' sales saw a notable increase in March 2025, indicating potential growth momentum, contrasting with the declining sales trend of PRUF Cultivar during the same period.

Notable Products

In March 2025, Kites' top-performing product was Saffron Pre-Roll 10-Pack (5g) in the Pre-Roll category, securing the number one rank with notable sales of 2112 units. McClaren x Life Hack Pre-Roll 10-Pack (5g) climbed to the second position, showing an impressive increase from its fourth place in February. Sun Lounger & Member Berries Pre-Roll 10-Pack (5g) held a steady third place, marking its first appearance in the rankings this year. Guava Juice x Nascar Pretty Pre-Roll 10-Pack (5g) improved to fourth place from fifth in February. The Astronaut's Wife x Orange Push Pop Pre-Roll 10-Pack (5g) entered the rankings at fifth place, showcasing a dynamic shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.