Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

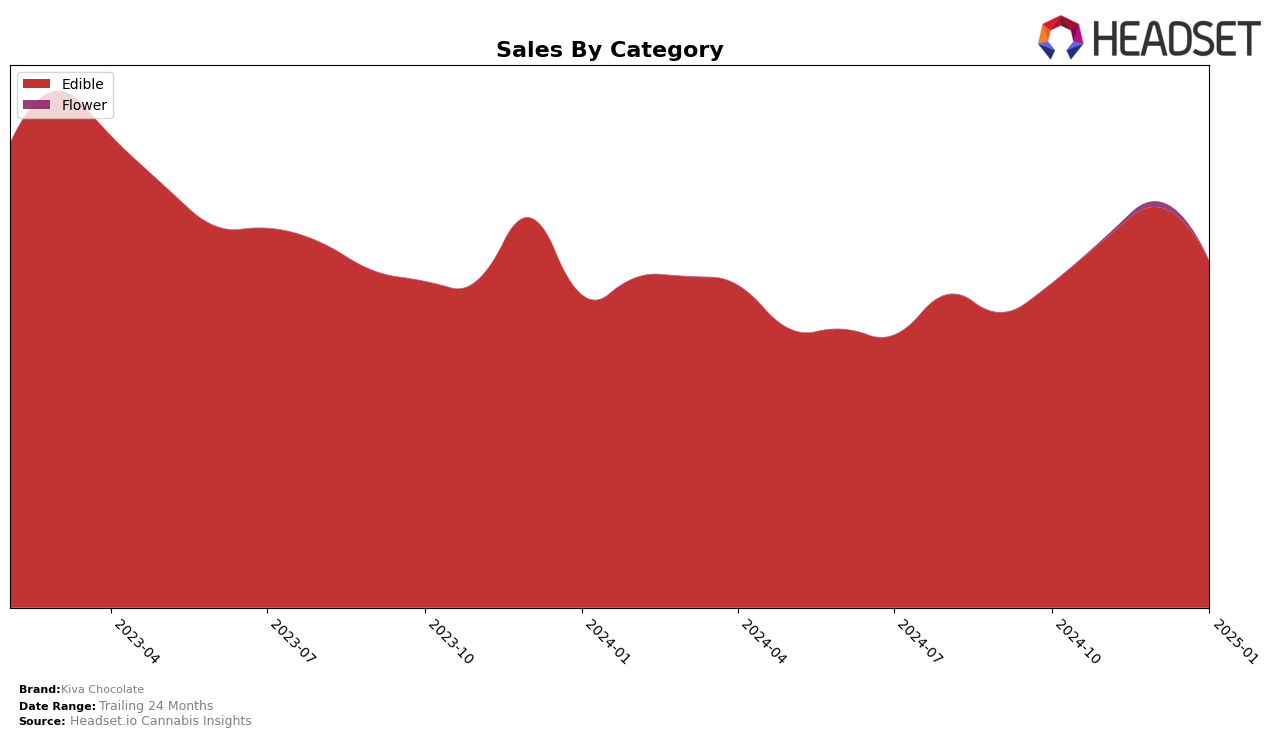

Kiva Chocolate has demonstrated varied performance across different states, with notable movements in their rankings and sales trends. In California, Kiva Chocolate has maintained a steady position in the top 15 for the edible category, holding the 14th rank consistently from November 2024 to January 2025. This stability is underscored by a significant sales peak in December 2024, followed by a slight dip in January 2025. Meanwhile, in Michigan, Kiva Chocolate showed a strong upward trajectory, climbing from the 35th rank in October 2024 to breaking into the top 25 by December. However, this momentum slightly waned in January 2025, slipping back to 27th. In contrast, Arizona presents a challenging market for Kiva, as they failed to secure a place in the top 30 by January 2025, indicating potential areas for strategic improvement.

In New York, Kiva Chocolate has consistently improved its position, moving from 18th to 16th place over the four-month period, reflecting an upward trend in consumer preference. This rise is supported by increasing sales figures, particularly a notable jump in January 2025. Conversely, in Ohio, the brand experienced a decline, dropping from 14th in October 2024 to 18th by January 2025, accompanied by a downward trend in sales. This suggests a need for Kiva Chocolate to reassess its strategy in Ohio. Meanwhile, Illinois shows a gradual improvement in rankings, moving from 45th to 43rd, which, although modest, indicates a positive trend that could be leveraged for future growth.

Competitive Landscape

In the competitive landscape of the California edible market, Kiva Chocolate has maintained a consistent rank at 14th place from November 2024 to January 2025, showing a slight improvement from 15th in October 2024. This stability in ranking suggests a steady performance amidst a dynamic market. Notably, Smokiez Edibles has seen a significant drop from 7th place in December 2024 to 12th in January 2025, which could indicate a potential opportunity for Kiva Chocolate to climb higher in the rankings if they capitalize on this shift. Meanwhile, Highatus has shown upward momentum, moving from 13th in October 2024 to 11th by January 2025, suggesting a competitive pressure that Kiva Chocolate needs to be mindful of. Additionally, Dr. Norm's and Clsics have fluctuated around the lower ranks, indicating a less stable position compared to Kiva Chocolate's consistent performance. This analysis highlights the importance for Kiva Chocolate to leverage their stable market presence while remaining agile to capitalize on competitors' fluctuations.

Notable Products

In January 2025, Kiva Chocolate's top-performing product was the Dark Chocolate Bar 20-Pack (100mg), maintaining its number one rank from December 2024 with sales of 10,117 units. The Milk Chocolate Bar 20-Pack (100mg) held the second position, consistent with its prior ranking, though its sales slightly decreased to 9,845 units. The Churro Milk Chocolate Bar 20-Pack (100mg) remained stable at the third rank, continuing its trend from the previous months. The THC/CBN 5:2 Midnight Mint Dark Chocolate Bar 20-Pack (100mg THC, 40mg CBN) also maintained its fourth position across the months. Notably, the Blackberry Dark Chocolate Bar 20-Pack (100mg) returned to the rankings at fifth place, following a temporary absence in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.