Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

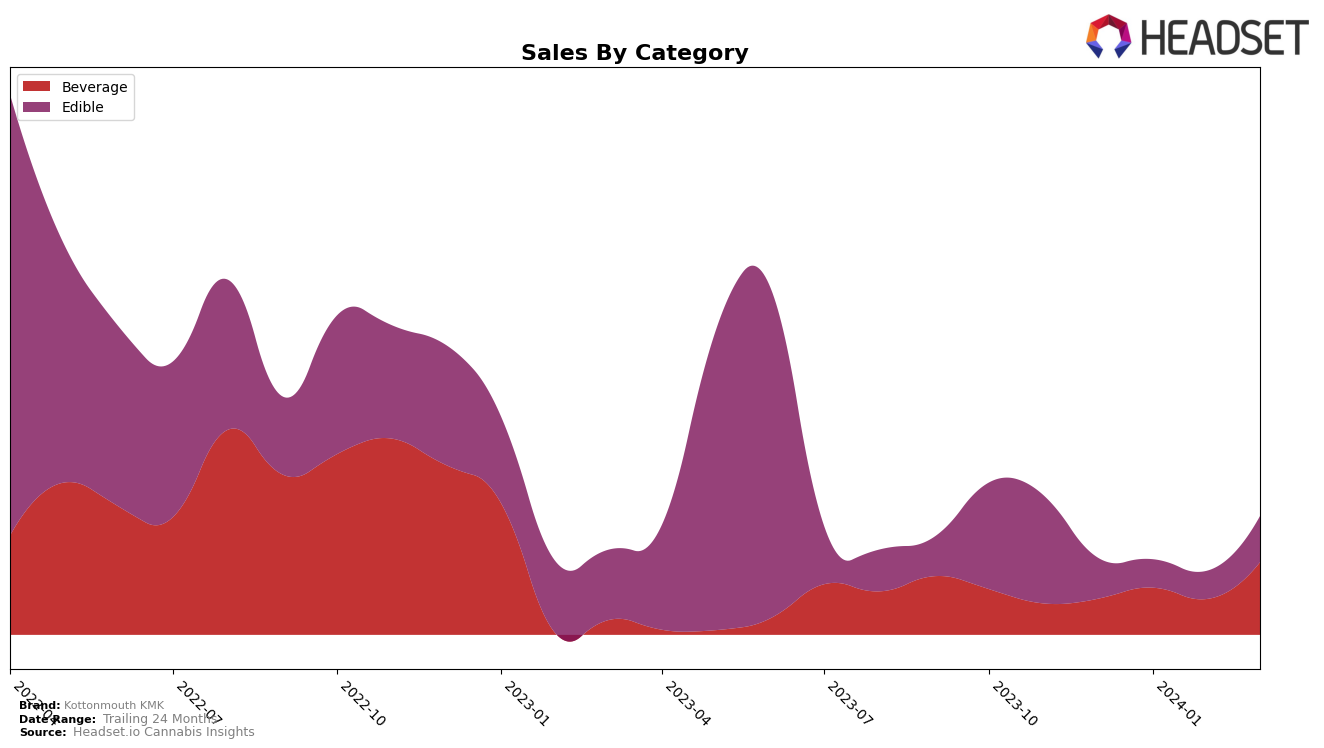

In the competitive cannabis market of Oregon, Kottonmouth KMK has shown notable performance across different product categories. Particularly in the Beverage category, the brand has demonstrated a consistent upward trajectory over the recent months, moving from a rank of 21 in December 2023 to 16 by March 2024. This improvement in ranking is indicative of a growing consumer preference and market share within Oregon's cannabis beverage sector. The sales figures further corroborate this positive trend, with a significant jump observed from December 2023's sales of $2,196 to $4,166 by March 2024. Such a movement not only highlights Kottonmouth KMK's strengthening position in the beverages category but also suggests an effective strategy in capturing the interest of cannabis consumers in Oregon.

On the other hand, the brand's performance in the Edibles category tells a different story. Initially not even making it into the top 30 brands in December 2023, Kottonmouth KMK struggled with its rank fluctuating in the lower tier, eventually reaching a rank of 45 by March 2024. While this does indicate a positive movement towards higher rankings within the category, the initial absence from the top rankings underscores a challenge the brand faces in penetrating the edibles market. Despite this, the gradual improvement in rankings from not being in the top 30 to reaching rank 45, alongside an increase in sales from $2,486 in December 2023 to $2,746 in March 2024, suggests a slow yet steady gain in consumer acceptance and market presence in the edibles sector. This contrast in performance across categories underscores the dynamic nature of consumer preferences and the competitive landscape in Oregon's cannabis market.

Competitive Landscape

In the competitive landscape of the beverage category in Oregon, Kottonmouth KMK has shown a notable trajectory in terms of rank and sales over the recent months, moving from a rank of 21 in December 2023 to 16 by March 2024. This upward movement in rank is particularly impressive, considering the fluctuating dynamics within the category. Competitors such as Hush and Happy Cabbage Farms have experienced varying degrees of rank changes, with Happy Cabbage Farms notably moving from 18th to 15th place in the same period, indicating a competitive edge in sales growth. Meanwhile, Uncle Arnie's, despite a higher rank, has seen a decrease in rank from 10th to 14th, suggesting a potential opportunity for Kottonmouth KMK to capture more market share. Additionally, Third Eye Cannabis, a lower-ranked competitor, has shown significant sales growth, moving from 28th to 17th place, highlighting the dynamic nature of the market. Kottonmouth KMK's sales growth and improved ranking amidst these fluctuations suggest a strong competitive position and potential for further growth within Oregon's beverage category.

Notable Products

In March 2024, Kottonmouth KMK's top-performing product was the Island Punch Gummy (50mg) from the Edible category, maintaining its number one rank from February with impressive sales of 234 units. Following closely, the Cherry Limeade Gummies 10-Pack (50mg), also an Edible, secured the second rank with a slight dip in position from the previous month. Notably, the Sour Watermelon KO Syrup (250mg) from the Beverage category made a significant entry into the rankings at third place without prior data for comparison. The Chorange Gummies 10-Pack (50mg) fell to the fourth rank in March, indicating a fluctuating demand within the Edibles. Lastly, the introduction of Chorange KO Syrup (250mg) in the Beverage category to the fifth rank highlights Kottonmouth KMK's expanding presence in diverse product offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.